(Bloomberg) — Emerging market and developing nations will continue to struggle with the Covid-19 pandemic and its aftermath even as a few major economies spur the strongest post-recession global growth in 80 years, the World Bank said.

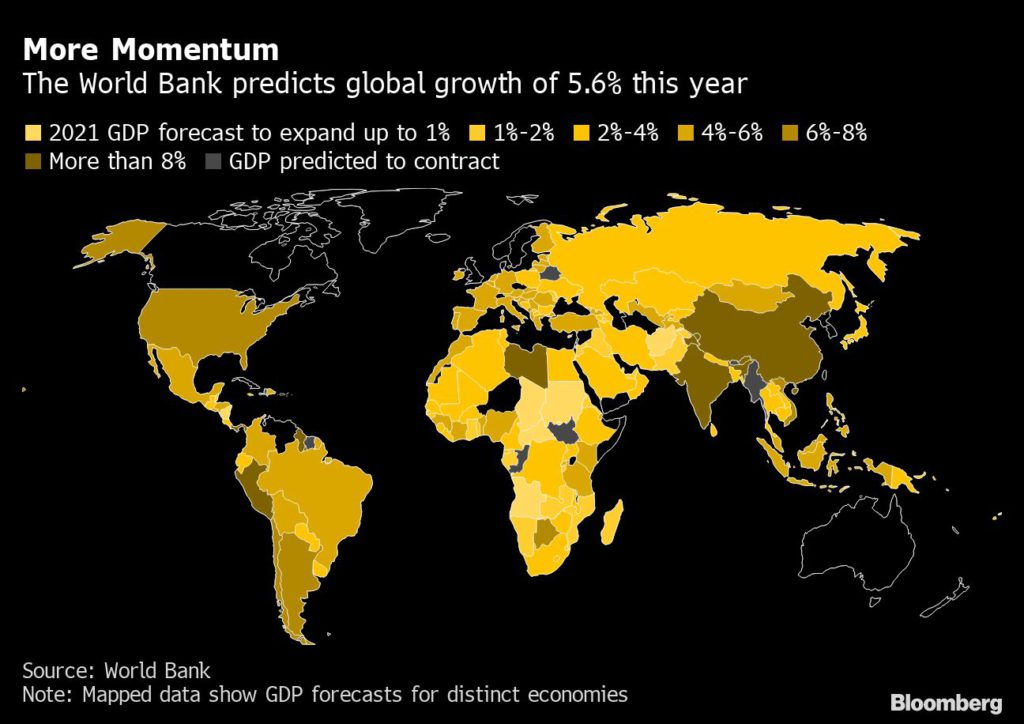

Global gross domestic product will expand 5.6% this year, up from 4.1% forecast in January, the Washington-based development organization said in its semi-annual Global Economic Prospects report. That will be fueled largely by a 6.8% expansion in the U.S. and 8.5% in China. The World Bank revised its historical data to reflect updated GDP weights.

Though most advanced nations are projected to return to their pre-pandemic per-capita income levels in 2022, two-thirds of emerging and developing nations are projected to remain below it. Growth in low-income countries is expected to be the second-slowest of the past 20 years at 2.9% — down from the 3.4% forecast in January, held back by lack of access to vaccines.

“It’s the tale of two recoveries,” Ayhan Kose, director of the World Bank group that produced the report, said in an interview. “On the one hand, advanced economies, big countries, are delivering fast growth, record growth. On the other hand, you have these low-income countries struggling to generate growth.”

The World Bank warned of substantial uncertainty beyond 2021.

The global recovery could falter once policy support is withdrawn and pent-up demand runs out, particularly if the pandemic lingers, according to the report. Sustained inflation pressures could cause a tight sharpening in financial conditions, adding to high debt vulnerabilities.

Under these circumstances, activity in both advanced and emerging and developing economies could slow global growth to 2.7% in 2022 and 2.1% in 2023. That would leave the recovery on par with the anemic one that followed the global financial crisis of 2008-2009.

On the other hand, the global rebound could prove stronger than expected if the surge in growth in 2021, together with faster and more equitable distribution of vaccinations worldwide, spur expansion in the private sector.

To help ensure the best outcome, policy makers should seize the moment of benign global conditions to implement overhauls that increase the resilience of financial systems, improve fiscal sustainability and create the foundations for a green, resilient and inclusive recovery, the World Bank said.

Other highlights from the report:

While global inflation is likely to keep rising this year after a rebound in the first half of 2021, it probably will remain within target bands in most countries

While half of inflation-targeting emerging market and developing economies could see inflation above target ranges, it may be temporary and not warrant a policy response if expectations remain well-anchored

Due to record-high debt, emerging and developing countries remain vulnerable to financial market stress, if investor risk sentiment worsens due to actual or perceive inflation pressures in advanced economies

Higher global agricultural prices are likely to present inflation pressures for low-income countries in the near term, worsening food insecurity and threatening to increase poverty

Attempts to lower food prices through subsidies or export controls risk driving global food prices higher

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.