(Bloomberg) — The slump in U.S.-listed Chinese shares accelerated Tuesday, wrapping up another day of heavy losses, as investors shunned the assets amid a broad-based crackdown by regulators in Beijing.

In the span of three trading days, the Nasdaq Golden Dragon China Index — which tracks 98 of China’s biggest firms listed in the U.S. — has plunged more than 19%, its biggest such drop on record. Stocks included in the index have seen $829 billion in value erased since hitting a record high in February with the benchmark being nearly halved.

The gauge was already under pressure after China unveiled sweeping policy changes to the technology sector but the rout deepened as regulators pivoted to also target other industries like online education and property management.

“We do not see a buy-the-dip opportunity. China’s recent regulatory crackdowns are the beginning, not the end, of increased control and command by Chinese leaders,” said David Trainer, chief executive officer of New Constructs, an investment research firm, based in Nashville.

Markets across China slumped on Tuesday as rumors circulated that U.S. funds were dumping Chinese and Hong Kong assets, with analysts warning that gains may be short-lived. Meanwhile, tech-giants including Alibaba Group Holding Ltd., JD.com Inc., NIO Inc. and Baidu Inc. were among the biggest decliners in New York, all slumping by 2% or more.

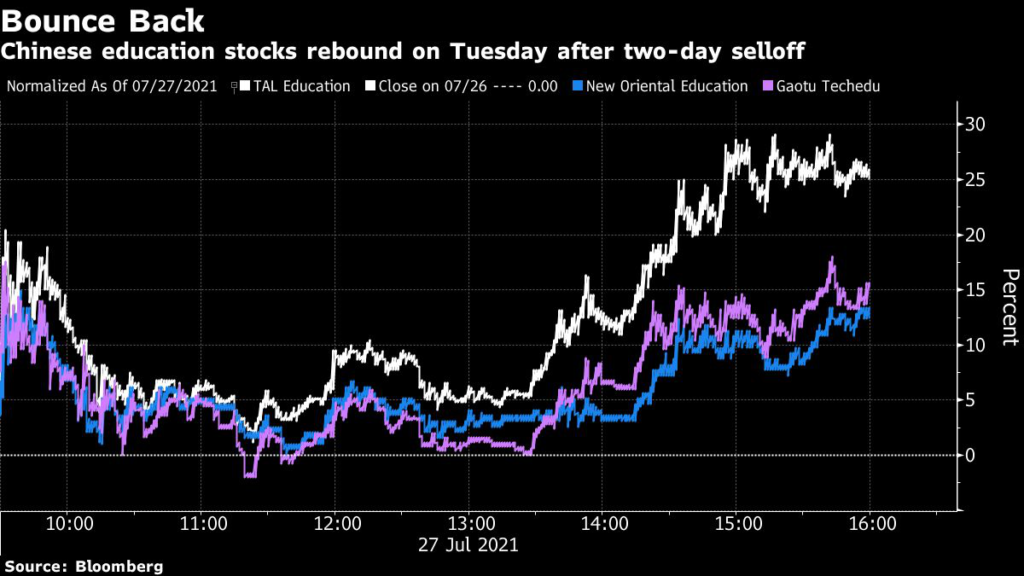

Still, shares of education stocks like TAL Education Group, Gaotu Techedu Inc. and New Oriental Education & Technology Group managed to stage a rebound on Tuesday. All three gained by at least 12%, though they remain lower by an average of 91% on the year. Other companies, including Meten EdtechX Education Group Ltd. and 17 Education & Technology Group Inc. also closed higher.

Read more: Beijing Crackdown Breathes New Life Into ‘America First’ Trade

Despite the rebound in some education firms, not everyone’s convinced the selling pressure has abated. “I think it’s kinda of a dead cat bounce,” said Matt Maley, chief market strategist for Miller Tabak + Co. “It’s way too early to be catching the falling knife,” he added.

(Updates pricing throughout.)

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.