(Bloomberg) — Microsoft Corp. reported sales and profit that exceeded analysts’ estimates for a 10th straight quarter, sending shares higher after some investors were initially spooked by signs of slowing growth in the software giant’s Azure cloud-computing business.

Sales in the fourth quarter, which ended June 30, climbed 21% to $46.2 billion, the Redmond, Washington-based company said Tuesday in a statement. That compared with the $44.3 billion average estimate of analysts polled by Bloomberg. Net income rose to $16.5 billion, or $2.17 a share, while analysts had predicted $1.92.

Microsoft’s market value now tops $2 trillion, and the high-flying shares have led investors to expect results to outdistance projections by a wide margin. After years of investments to make Azure a strong No. 2 in cloud services behind Amazon.com Inc., investors no longer question Chief Executive Officer Satya Nadella’s corporate transformation, but some become skittish at any indication that momentum is fading. Microsoft’s sales and margin forecasts on a conference call reassured investors about its prospects, and shares gained 1.2% in extended trading after first dropping about 2.5% following the report.

“People are not happy if Azure decelerates — they’re worried the good days are over,” said Mark Moerdler, an analyst at Sanford C. Bernstein. “People seem to worry Azure will never be as big as Amazon.” Moerdler had previously written that he thinks concerns about both Azure growth and margins were overblown.

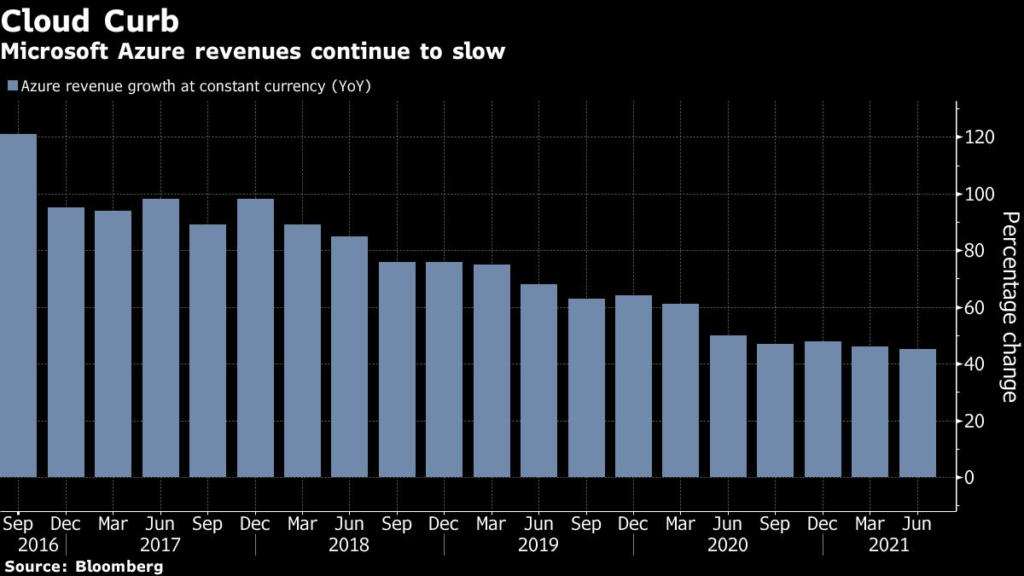

Azure’s sales increase of 51% in the period disappointed some investors because it was partially fueled by currency fluctuations — the number drops to 45% without that boost, representing a slowdown from the prior period. Azure revenue had gained 50% from a year earlier for the two prior quarters, not taking into account currency fluctuations. In constant currency, Azure posted a 46% sales gain in the March quarter.

On the company’s call with analysts, Chief Financial Officer Amy Hood said that Azure growth rates, including currency impacts, should “remain relatively stable.” Her fiscal first-quarter forecasts for the company’s two biggest units — Intelligent Cloud and Productivity — exceeded the estimates of analysts polled by Bloomberg.

Before the earnings release, Microsoft shares had declined to $286.54 in regular New York trading Tuesday. The stock rose 15% in the fiscal fourth quarter, compared with an 8.2% gain for the S&P 500 Index, reflecting investor ebullience about growth prospects for Azure, Office, artificial intelligence and gaming. The recent period marked the second quarter in a row that initial analysts’ notes highlighted Microsoft’s better-than-expected performance in sales and profit, while shareholders were less pleased with specific details.

Hood hailed the Azure performance as better than she had forecast and said demand remains strong across all of Microsoft’s cloud businesses, including Azure, Office and Dynamics software services.

“Forty-five percent was both better than we expected and driven by consumption growth, which is very good,” Hood said in an interview. “Demand is healthy. The overall execution was better than I expected.”

Commercial cloud sales in the fiscal third quarter rose 36% to $19.5 billion, Microsoft said. Gross margin, or the percentage of sales left after subtracting production costs, in that business widened 4 percentage points to 70%, the company said in a slide posted on its website. Total company gross margins have been benefiting from an accounting change that’s related to current and future server and network equipment, and this may be the last quarter where that leads to an improved margin, according to Bloomberg Intelligence analyst Anurag Rana.

“This year has been great because of the accounting change, but that particular boost is hiding the fact that gross margin is being hurt by the faster-growing Azure business,” Rana said before the results.

Hood may have assuaged concerns about profitability on the conference call by noting that excluding the impact of the accounting change, margins will be wider in the current fiscal year.

In the Productivity unit, mostly made up of Office software, fourth-quarter sales were $14.7 billion, compared with an average analysts’ estimate of $14 billion. LinkedIn, which Microsoft acquired in 2016, became the third business in three years to top $10 billion in annual revenue, Hood said, and Teams, the Microsoft product that competes with Slack Technologies Inc., reached 250 million monthly active users, a huge jump from the 145 million the company reported in April.

Sales of Intelligent Cloud products, made up of Azure and server software, rose to $17.4 billion, above analysts’ expectations for revenue of $16.4 billion.

In the More Personal Computing unit, which includes products like Windows, Surface and Xbox, sales were $14.1 billion. Analysts had expected $13.9 billion. Sales of Windows software sold to PC manufacturers declined 3%, a drop that reflects the surge in laptop buying in the same quarter a year earlier, when Covid-19 lockdowns were forcing many workers to do their jobs remotely.

Overall gaming revenue jumped 11% in the recent period, Microsoft said, with Xbox hardware sales more than doubling. A global semiconductor shortage has constrained sales of Xbox consoles following the release of a new machine late last year, and growth in video-game and gaming services fell 4% in the quarter compared with the pandemic-boosted year-ago period.

Component shortages are also hurting PC and Surface availability, Hood said. Surface sales dropped 20% in the quarter. Hood expects some impact from chip and part shortages to persist into the new fiscal year, which began July 1.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.