(Bloomberg) —

Transnet SOC Ltd., South Africa’s state-owned ports and freight-rail company, declared force majeure at the country’s key container terminals due to disruptions caused by a July 22 cyberattack.

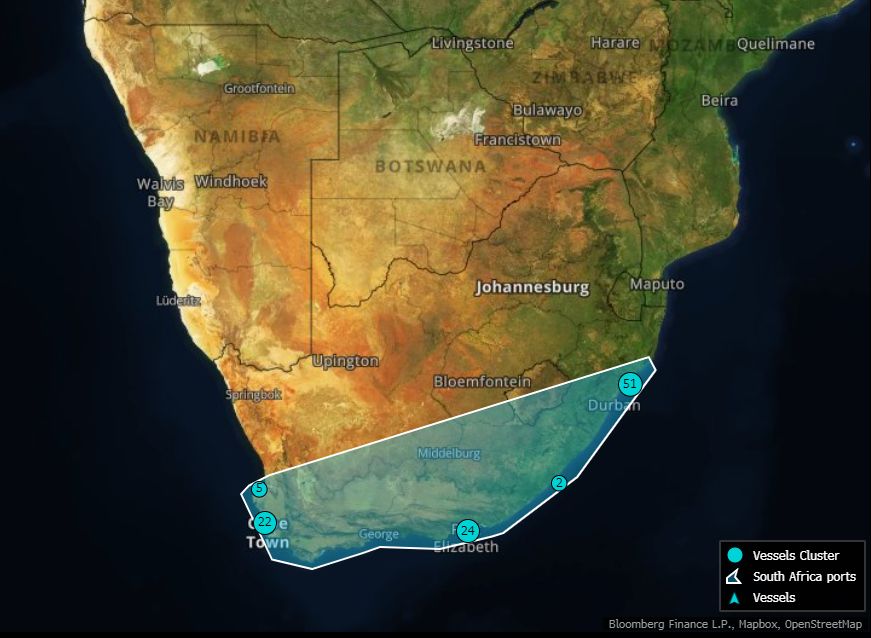

The measure covers the Durban, Ngqura, Port Elizabeth and Cape Town harbors, according to a notice Transnet sent to customers on Monday and seen by Bloomberg News.

“Transnet, including Transnet Port Terminals, experienced an act of cyberattack, security intrusion and sabotage,” it said. “Investigators are currently determining the exact source of the cause of compromise and extent of the ICT data security breach or sabotage.”

In a statement issued on Tuesday, the company said it has made significant progress in restoring its computer systems, most of which were up and running by Monday, and that the force majeure will be lifted soon.

“It is expected that some applications may continue to run slowly over the next few days, while monitoring continues. All operating systems will be brought back in a staggered manner to minimize further risks and interruptions,” the company said. “The terminals are berthing vessels as planned and facilitating loading and discharge operations with the shipping lines.”

Force majeure is an unanticipated or uncontrollable event that releases a company from fulfilling contractual obligations.

With Transnet’s Durban port handling 60% of the nation’s shipments, a prolonged disruption will deal a further blow to an economy that was already reeling from the coronavirus pandemic and deadly protests that shuttered businesses in two provinces earlier this month. The ports are also key to shippers from landlocked African countries including the Democratic Republic of Congo, Zambia and Zimbabwe.

While the Durban port was the most severely affected, it is fully operational again and fruit exports have resumed, while a recovery process is underway in Cape Town, Minister of Public Enterprises Pravin Gordhan said by phone from Pretoria, the capital, on Tuesday. The bulk-handling ports of Richards Bay and Saldanha were unaffected, and there was little impact on the Koega and Gqeberha trans-shipment hubs or on the East London harbor, which had been shut down for a week, he said.

A probe into the motive for the attack is still underway, the minister said.

The knock-on effect of the port closures and unrest has been clearly evident, with manganese producer Assmang Pty. Ltd. declaring a force majeure of its own because it was unable to access raw materials and ship finished alloys.

“We have some orders in place, in the queue, to be exported but we expect two to three weeks of delays,” Rorie Wilson, an alternate director at the company, said by phone. “Something that must go this week will probably go in three weeks. Our force majeure is still in place off the back of the unrest” and will remain in place until the one declared by Transnet is lifted, he said.

The auto industry has also been affected and some component manufacturers were battling to move their products, Renai Moothilal, executive director of the National Association of Automotive Component and Allied Manufacturers and the chairman of the Automotive Industry Export Council, said last week. The country’s long-term attractiveness as an investment destination could also be adversely affected, he said.

READ: Crippled African Port Goes Manual as PE-Backed Software Is Shut

Mike Schussler, chief economist at Economists.co.za, said Transnet’s problems are unlikely to affect most commodity shipments, but importers and exporters of manufactured and agricultural goods will be hard hit, with a domino effect on the rest of the economy.

“The impact over the whole region will shave quite a few percentage points off the gross domestic product now,” he said in a text message. “We can make most of it up but in another week or so that becomes more difficult.”

(Updates with public enterprises minister’s comment in two paragraphs after chart.)

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.