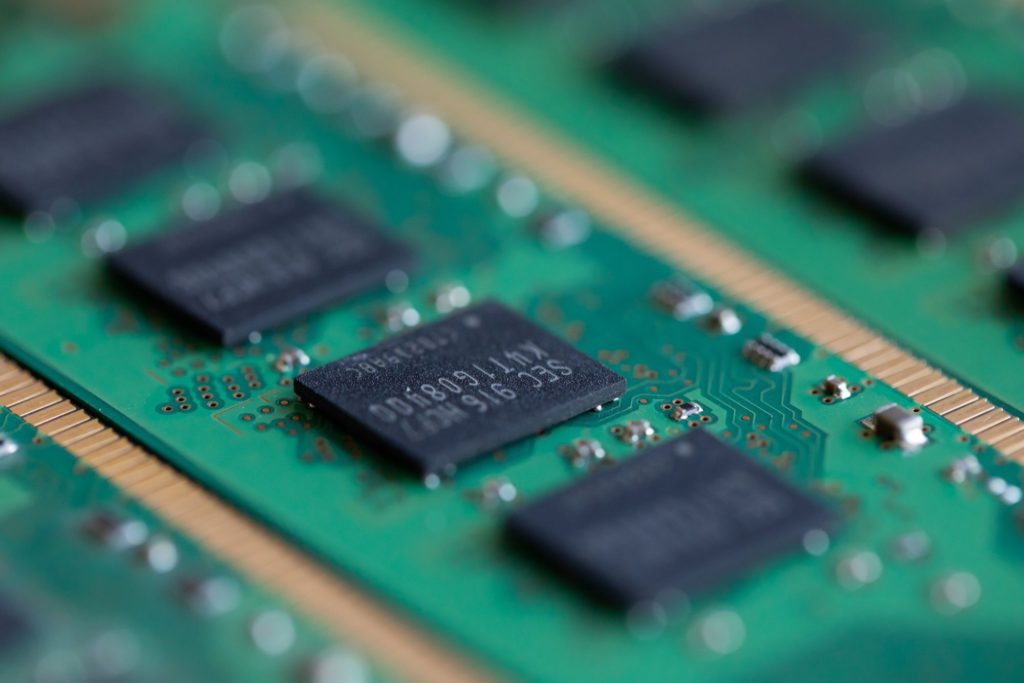

(Bloomberg) — Samsung Electronics Co. predicted the strong memory demand that helped its second-quarter profit beat estimates will continue for the rest of the year, while the recovery of its Austin chip plant drove record sales at its foundry unit.

The adoption of 5G smartphones and consoles as well as new server processors should drive memory demand and lift shipments at Samsung’s largest division this year, it said. Chip inventory have fallen “substantially” low level and should continue to do so, the Suwon-based company projected.

Samsung’s forecast comes after crosstown rival SK Hynix Inc. reported strong earnings for the second quarter earlier this week and projected that favorable market conditions will continue beyond the second half of this year. Data center operators and PC makers have pushed memory prices up as they rush to secure inventories in the wake of a chip shortage and growing demand for services and hardware at home.

“There is an ongoing trend of higher content on server, especially with the adoption of new CPUs,” Jin Man Han, senior vice president of semiconductor business, said during an earnings call Thursday. “Server demand will remain sold in the remainder of the year.”

South Korea’s largest company posted net income of 9.45 trillion won ($8.2 billion) for the three months ended June, beating an 8.7 trillion won average of estimates compiled by Bloomberg. Samsung disclosed preliminary numbers earlier this month that showed operating profit rose more than 50%. The results included a one-time gain in its display business.

Samsung projected DRAM market bit growth — a measure of unit demand for memory chips — to be at mid-20% and increased its estimate for NAND market bit growth to 40%, adding that the company’s bit growth will be similar to the market.

Operating profit in the Samsung’s semiconductor business rose 28% from a year earlier to 6.93 trillion won. Samsung said its memory chip shipments exceeded bit growth guidance even as average selling prices rose. It’s also preparing to start mass production of 14-nm DRAM and 176-layer V-NAND in the second half.

Despite a slump in phone shipments partly due to supply chain disruptions in Vietnam, Samsung’s mobile business managed to remain profitable with more frugal digital marketing and robust sales of tablets and wearable gadgets. Samsung said its Indian mobile production line wasn’t directly affected by the recent spread of Covid-19, while it managed to minimize the impact on its Vietnam plant during a nationwide lockdown. Operations in the Southeast Asian nation will normalize this month, the company predicted.

“Although smartphone demand contracted globally due to chip shortages and the spread of Covid-19 in India, memory shipments and prices rapidly increased from server clients that helped improve earnings,” said Greg Roh, a senior vice president at HMC Securities. “A one-time gain from a North America-based client in display and a price increase in mobile OLED products were also positive factors.”

Samsung’s betting on new technology such as foldable phones and flexible OLED displays to expand its market leadership in the sectors and improve profitabilities. The company, which is set to unveil the Galaxy Z Fold 3 and Galaxy Z Flip 3 along with wearable devices on Aug. 11, said it’s going all-in on marketing this year’s new foldable phones. The company is aiming to sell more foldable phones to boost adoption, which could see it lower prices.

Samsung Makes Foldable Phones a Key Priority for Mobile Business

As for its display business, the company is seeking to “aggressively” introduce under-display cameras, while seeking to expand the supply of flexible OLED displays for EV clients as well as portable game devices. Nintendo Co. recently adopted Samsung OLED displays for its newest Switch gaming console.

“Samsung expects demand to recover for mobile displays as major customers are planning to launch new flagship models, including high-value products such as foldable phones,” the company said in a statement. “However, there are concerns that a supply crunch of certain components such as DDIs may affect shipments for some customers.”

Samsung’s foundry business reported record sales in the second quarter after its Austin fab rebounded faster than expected, said Senior Vice President Shawn Han. Overall foundry demand will exceed supply in the second half and the company’s boosting capacity for 5-nanometer and 4-nanometer process-based products, he added. The company is in the product-designing phase with clients for first generation 3-nm GAA technology, an advanced node that is set to start mass production in 2022.

It reiterated plans to seek “meaningful” mergers and acquisitions within three years, Ben Suh, executive vice president of investor relations, said during the call. Though he declined to specify timing or targets, the company’s considering potential deals in various fields such as artificial intelligence, 5G and automotive, he said.

Samsung shares were little changed on Thursday. They had dropped a little more than 2% this year through Wednesday. Semiconductor shares have underperformed the Kospi index as expectations about a “supercycle” turned to disappointment, said MS Hwang, analyst at Samsung Securities, citing a rise in chip production and concern over the sustainability of pandemic-induced demand.

“In the near term, chip prices may lose some momentum and even trend lower but such concerns are already reflected in the market,” Hwang said. “We believe buying pressure will build in the not-too-distant future.”

Meanwhile, there is growing speculation that Vice Chairman Jay Y. Lee could be freed from prison, perhaps on Aug. 15, South Korea’s Liberation Day. Local media outlets reported President Moon Jae-in is considering granting a special pardon for Lee, while the Ministry of Justice is reviewing the possibility of parole. Lee is currently serving a prison term after being convicted in a corruption case.

Samsung Boss Could Be Set Free by One of His Biggest Critics

(Updates with executives’ comments from earnings call from second paragraph.)

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.