(Bloomberg) — Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

A week after U.S. Federal Reserve Chair Jerome Powell said there’s still some way to go before stimulus can be reduced, a similar message may come from the Bank of England this Thursday.

The rise in coronavirus infections in the wake of the European soccer championship has heightened uncertainty about Britain’s economic recovery — at least in the short term.

The U.K. central bank’s rate-setting panel — down a member after the departure of chief economist Andy Haldane in June — is forecast to see the doves prevail when policy-makers meet.

Before taking their foot off the stimulus pedal, they’re likely to want to know how the U.K. jobs market fares when the government’s wage-support program ends in September, and whether the success of the vaccine rollout can tame the delta variant ahead of the start of the school year.

The BOE also plans to formally adopt negative rates as a policy tool, but Governor Andrew Bailey has been at pains to emphasize that operational readiness doesn’t imply that sub-zero territory is a desirable destination.

What Bloomberg Economics Says:

“We expect policy makers to vote unanimously in favor of keeping rates at 0.1%. Our base is that the first rate hike comes at the end of 2022.”

–Dan Hanson, senior U.K. economist. For full preview, click here

Elsewhere, central bankers in Brazil and the Czech Republic are predicted to hike interest rates yet again, while policy makers in Australia, India, Thailand and Egypt are set to hold.

Click here for what happened last week and below is our wrap of what is coming up in the global economy.

U.S.

The monthly employment report for July will be released Friday. Economists expect a robust reading of about 900,000 jobs added to payrolls. The release will shed more light on the strength of the U.S. recovery as well as challenges to hiring, and will inform the outlook for policy makers at the Federal Reserve. Data on manufacturing, factory orders and weekly jobless claims are also due.

Fed Vice Chair Richard Clarida and Fed Governor Christopher Waller are scheduled to speak, which should give investors more insight into the central bank’s thinking on inflation and the potential for tapering its bond-buying purchases.

- For more, read Bloomberg Economics’ full Week Ahead for the U.S.

Europe, Middle East, Africa

Central bankers in the region are set for a busy week.

In addition to the BOE, Czech policy makers gather on Thursday and are expected to raise rates for a second consecutive meeting. Later that day, Egypt is predicted to keep its benchmark on hold amid accelerating inflation.

On Friday, Romania will likely maintain policy as officials continue to assess the current price surge. Central bankers in Mauritius, Armenia and Georgia also have scheduled meetings.

Turkey reports consumer-price inflation for July on Tuesday, days after the central bank raised its year-end forecasts but predicted a “significant” drop in price growth in the fourth quarter — which may open the window for a rate cut sought by the president.

Meanwhile, Russia will be watching for further confirmation that surging inflation is near its peak as some produce prices decline with the arrival of this year’s harvest.

- For more, read Bloomberg Economics’ full Week Ahead for EMEA

Asia

Reserve Bank of Australia chief Philip Lowe faces a big call on Tuesday over whether to push back the planned tapering of the central bank’s bond buying.

The optimism of early July has faded in a wave of delta variant infections that’s plunged key parts of Australia back into lockdown. Lowe will also be grilled in parliament later in the week and may have to acknowledge that the economy’s enviable recovery is heading back into reverse.

Following the latest inflation data on Tuesday, minutes from the Bank of Korea’s recent policy meeting will shed light on how aggressive the board’s dissenters were on the need for rate hikes. That comes after data published Sunday showed South Korea’s exports of chips, computers and other technology products helped boost overseas sales to a record in July, even as the pace of growth in overall shipments slowed.

Tokyo inflation figures also out Tuesday will point to the likely direction of the national trend ahead of a re-weighting of Japan’s CPI basket. Thailand sets rates on Wednesday against a backdrop of surging virus cases and a flagging growth outlook. Indonesia, itself facing one of the world’s worst virus outbreaks, reports GDP on Thursday.

India’s central bank sets policy on Friday, with investors closely watching for commentary on rising inflation pressure. And China releases trade data for July on Saturday.

- For more, read Bloomberg Economics’ full Week Ahead for Asia

Latin America

Chile’s economic activity figures for June, to be posted Monday, look set to hit double-digits for a third straight month after beating forecasts in March, April and May.

On Tuesday, June data on Brazil’s industrial production will likely show a 10th straight positive year-on-year reading. And Colombia’s central bank posts the minutes of its July 30 meeting, where it held the key rate at a record-low 1.75%. Local observers see a hike — the first since 2016 — as soon as October.

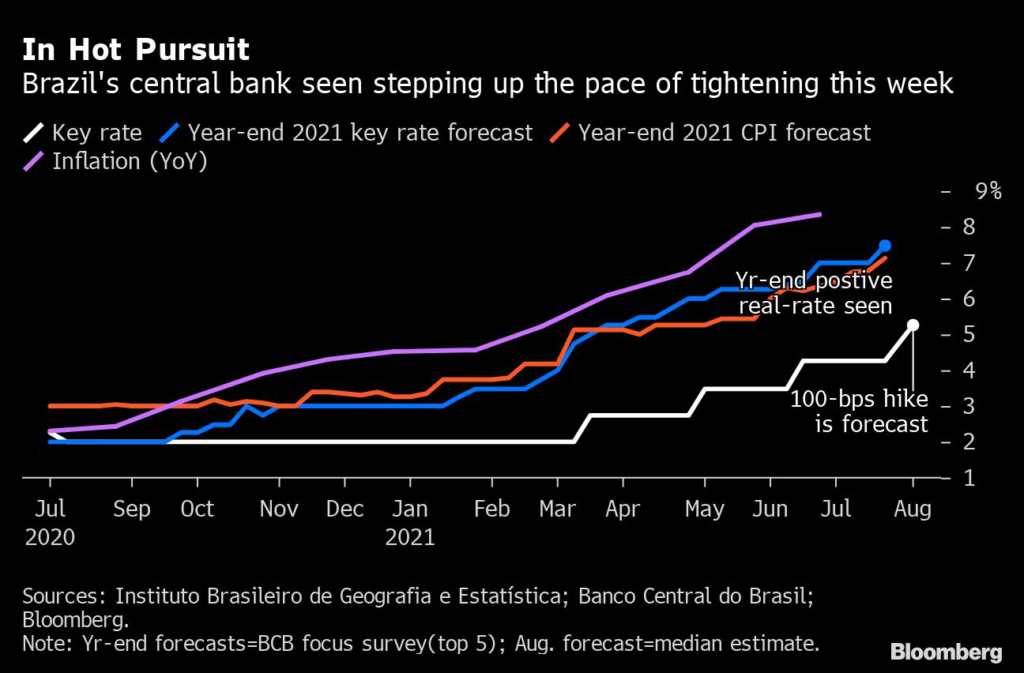

On Wednesday, Brazil’s central bank has been clear that it will raise its key rate for a fourth straight meeting, with most analysts expecting a full-point hike to 5.25%. The consensus is for 200-to-225 bps of additional tightening in this cycle.

Colombia inflation for July, out Thursday, may show a slight pick-up although the headline figure is seen remaining well within the target range. In Chile, where the central bank has begun to tighten, the July consumer price data out Friday becomes somewhat less critical for now.

- For more, read Bloomberg Economics’ full Week Ahead for Latin America

(Updates with South Korea trade data in Asia section)

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.