(Bloomberg) — If there’s a single word that captures how Americans feel about their economy as the second pandemic summer draws to a close, it could conceivably be: “meh.”In the two years before Covid-19 struck, U.S. consumers reckoned they had things pretty good. For about a year starting from March 2020, they knew a bad economy when they saw one.

But for several months now, polling data suggest the public isn’t quite sure what to make of the recovery -– with a roughly even split between positive and negative views.

By global standards, the U.S. has bounced back fast. But as data on the recovery continue to pour in, there’s plenty to support the suspicion that the glass is still half-empty.

Consumer sentiment fell in early August to the lowest level in nearly a decade by one measure and U.S. retail sales fell in July by more than forecast.

The following charts help explain why Americans still aren’t clear how impressed they should be.

Jobs Are Coming Back…

The economy has been creating jobs at a rapid clip. Employment has risen by an average of about 617,000 people per month so far this year.

While the total number of Americans who are working is still more than 5 million short of 2019 levels, there is work available. The number of open positions surged to a record 10 million-plus in June.

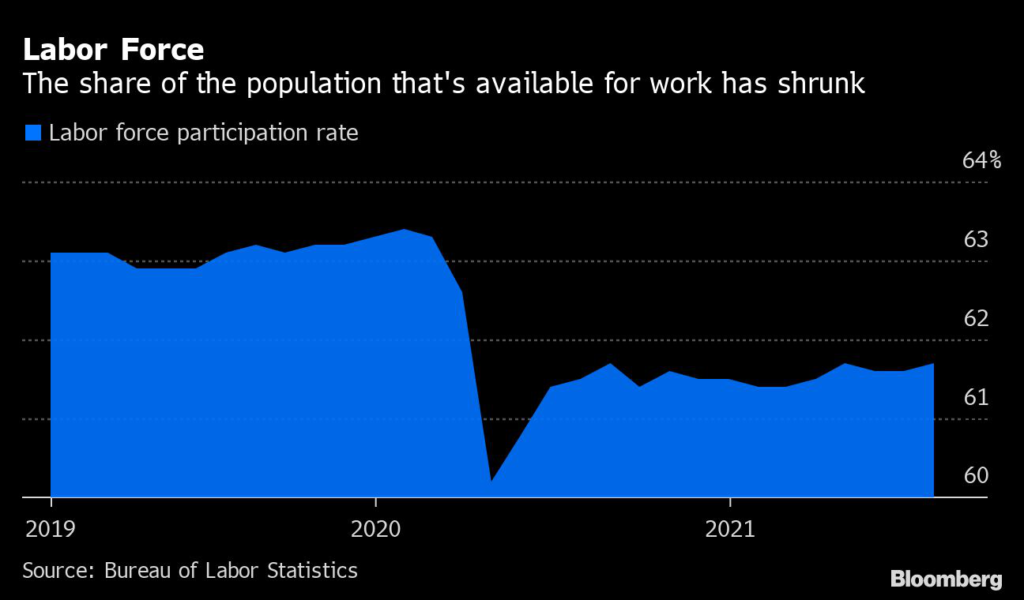

…But the Labor Force Has Shrunk

Many employers say they’re having trouble filling those jobs, even with the unemployment rate still relatively high.

That points to one big question-mark around the recovery. Whether it’s because of early retirements, difficulties finding child care or mental-health problems, many Americans have dropped out of the labor force.

Geography may be adding to the mismatch because many Americans relocated in the pandemic — so workers may not be in the places where jobs are available.

More than half of the unemployed have been out of work for 15 weeks or longer and, on average, it’s taking people 29.5 weeks to find a job — even with all those openings.

Prices Are Up…

Inflation has been above 5% for the past two months, the highest in more than a decade — and a debate is raging about whether that’s a “transitory” problem.

Much of the increase has been driven by supply-chain bottlenecks caused by the rapid reopening of the economy — like the semiconductor shortage that’s sent vehicle prices skyrocketing. Those influences should fade in time.

Still, rising prices for staples such as food and gasoline are eating into household budgets — and the squeeze could get worse if there’s a sharp increase in housing rentals, as some indicators suggest.

Incomes Have Kept Pace…

Even after adjusting for that higher inflation rate, household incomes have remained above their pre-pandemic levels ever since Covid-19 first hit the U.S. — one of the most striking economic statistics of the period.

That’s due to government’s unprecedented stimulus payments, including one-time checks to households (responsible for the biggest spikes in the chart above) and enhanced unemployment benefits.

The latter are due to expire next month, and other pandemic support programs are being phased out too — which will leave Americans more dependent on their earnings from work.

…But Wages Mostly Haven’t

Millions of Americans, especially at the low end of the pay scale, have received a raise as a result of the pandemic. In their rush to reopen, businesses have been offering higher wages, one-time bonuses, or both.

The problem is that, in the aggregate and in most industries, wages haven’t risen as much as consumer prices — meaning that even if pay-packets look bigger, they buy less stuff. The leisure and hospitality industry, a major employer of lower-paid workers, is an important exception.

The coming months could be a key test of whether workers have enough leverage to secure pay raises that outpace increases in the cost of living.

The Outlook Is Mixed…

With new variants of the Covid-19 virus spreading, consumer sentiment deteriorated in August along with expectations for the near future. Measured over a three-month period to smooth out the volatility, the index suggests Americans are far from recapturing their pre-pandemic optimism about the economy.

…But It Could Be Much Worse

Even a “meh” economy looks pretty good when viewed from the outside.

Gross domestic product has already returned to pre-pandemic levels. And in its latest set of forecasts, the International Monetary Fund revised its growth outlook sharply higher for the U.S. — illustrating how the world’s biggest economy has out-recovered its developed-nation peers (emerging-market countries have mostly fallen even further behind.)

(Updates with retail sales)

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.