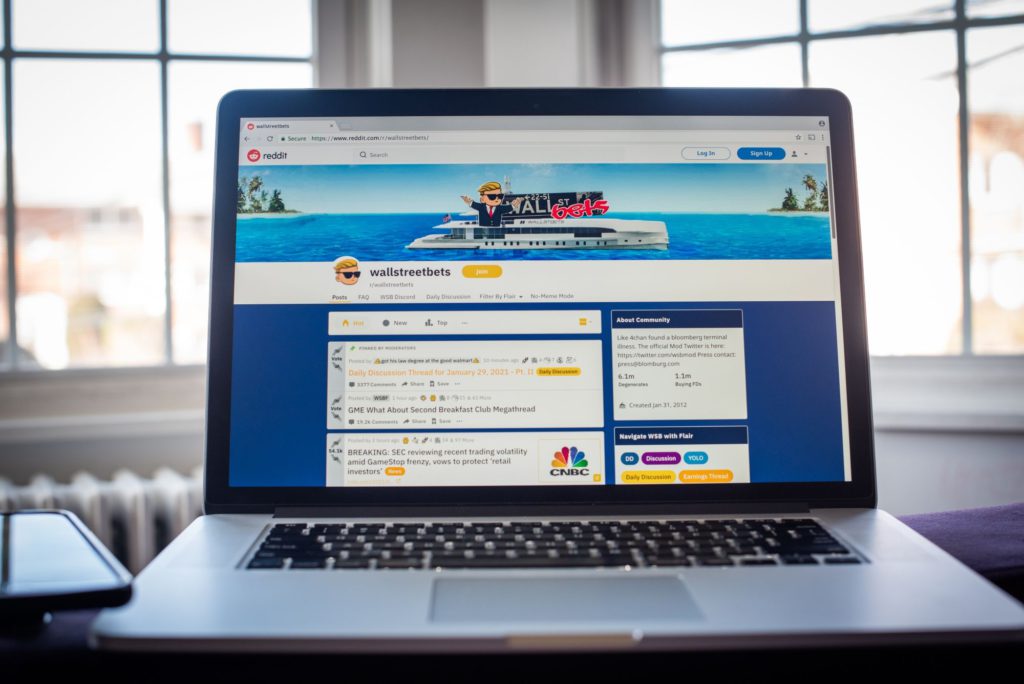

(Bloomberg) — Investors looking to capitalize on this year’s meme-stock mania without having to scour Reddit message boards may soon be able to through an exchange-traded fund.

The Roundhill MEME ETF (ticker MEME) will screen stocks based on their social media activity and levels of short interest, according to a Securities and Exchange Commission filing Thursday. The ETF will rebalance every two weeks based on the holdings’ “social media score” over a trailing 14-day period.

MEME is the latest attempt in the $6.8 trillion U.S. ETF universe to directly tap online retail-investor sentiment. Most recently, the VanEck Vectors Social Sentiment ETF (BUZZ) launched with the backing of Dave Portnoy, the founder of Barstool Sports Inc. It started with a boom, quickly gathering assets of about $500 million, however it has struggled to maintain momentum and now has around $220 million.

The new fund will be passively managed, following the Solactive Roundhill Meme Stock Index, and if approved will trade on the New York Stock Exchange.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.