(Bloomberg) — Chinese tech stocks’ best weekly rally since January may not be enough to persuade some investors to return to a market still reeling from an unprecedented private-industry assault.

JPMorgan Asset Management is waiting for clearer policy signals, while Amundi SA believes Beijing’s new focus on data protection means uncertainty will remain high for internet companies. Martin Currie Investment Management, which overseas more than $22 billion in assets, is now allocating new money to tech stocks in markets away from China.

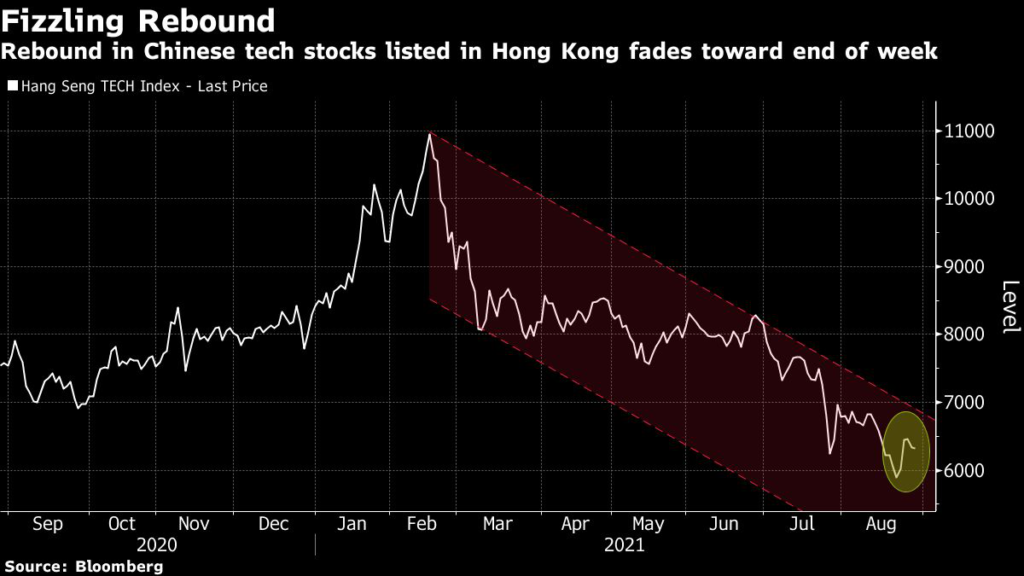

The rally in the Hang Seng Tech Index, which tracks Chinese tech stocks listed in Hong Kong, fizzled out toward the end of this week amid headlines of fresh crackdowns, trimming its weekly gain to 7.3%. Members of the gauge have seen more than $1.3 trillion of value wiped out since a February peak as the index remains 42% lower.

“Regulatory reforms are still on the cards for some of the ‘new economy’ industries where the Chinese authorities see the need to achieve better social outcomes,” said Marcella Chow, global market strategist at JPMorgan Asset Management. “We remain cautious on earnings growth of these sectors until there is a clear signal for the establishment of a stable regulatory regime.”

Xi Jinping’s “common prosperity” campaign to reduce the wealth gap in the country kicked into a high gear this week. The flurry of activity included a regulatory vow to step up tax enforcement, a top court ruling against labor abuses in the private sector and a government denouncement of excesses in “fan culture.” A Dow Jones report about China’s plans to ban U.S. IPOs for data-heavy tech firms further spooked investors Friday.

“Many investors are asking us whether it is time to buy Chinese technology stocks. The short answer is no,” Peter Garnry, head of equity strategy at Saxo Bank wrote in a note on Wednesday. “Before ploughing into Chinese technology stocks investors should recognize that China’s next Party Congress is set for October 2022 and thus the political sphere could continue to cast a shadow over the Chinese equity market.”

Mixed tech earnings this week also failed to give investors confidence. Live streaming giant Kuaishou Technology and electronics component maker AAC Technologies Holdings Inc. both missed profit estimates and saw their shares plunge. JD.com Inc., on the other hand, surged after the e-commerce giant reported revenue that beat forecasts, defying the crackdown on the internet sector.

To be sure, some investors have already returned to the sector, including Cathie Wood, whose Ark Investment Management picked up some JD.com shares this week after its results. The purchases by the thematic tech-focused global investment firm came after it had earlier this year reduced its China holdings to a negligible amount.

That shows some investors disagree with the “uninvestable” tag, but until the regulatory fog that’s enveloped the country’s technology firms clears, money managers are finding it very difficult to justify stepping off the sidelines.

“As the regulation has built over the last few months we have opted not to add anymore” in Chinese online platform stocks, said Alastair Reynolds, a portfolio manager at Martin Currie Investment.

The asset manager is now allocating money to tech stocks in markets such as Singapore and Korea, instead of those in China.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.