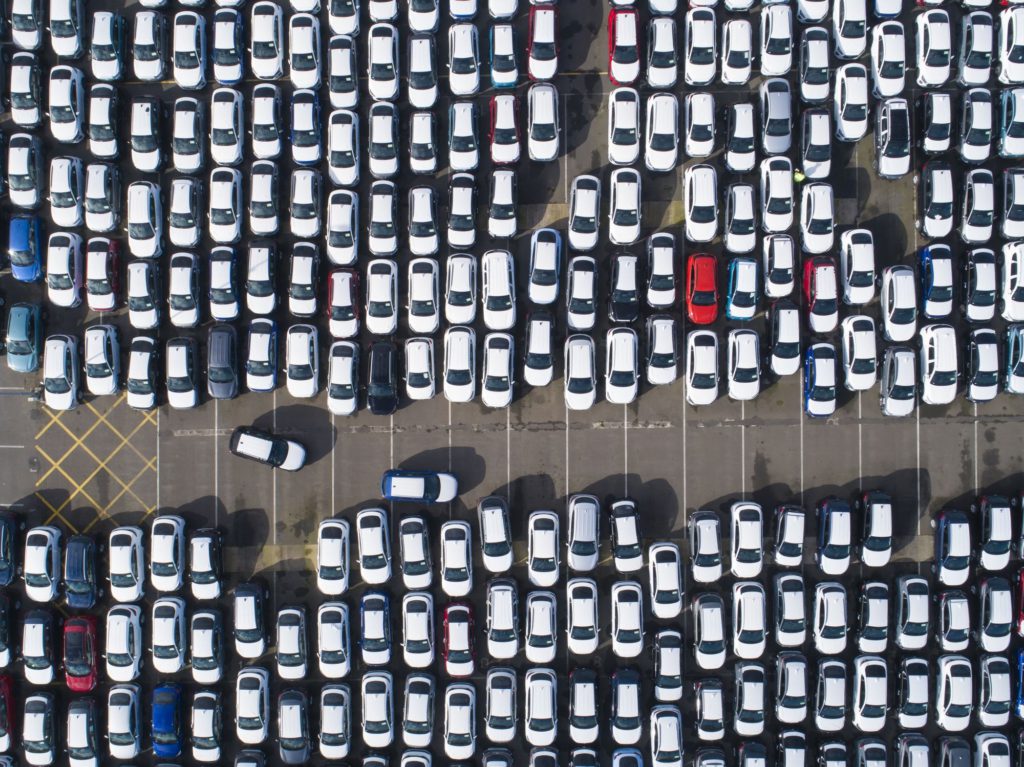

(Bloomberg) — Auto sales are deteriorating in Europe, with months of meek recovery giving way to deliveries that no longer even measure up to last year’s pandemic-depressed results.

New-car registrations fell 18% in August and 24% in July from year-ago levels, the European Automobile Manufacturers’ Association said Thursday.

Sales are now up just 13% for the year, less than half the percentage increase posted at the year’s halfway point.

Auto production is being suppressed by the global semiconductor shortage that the chief executives of Volkswagen AG, Daimler AG and BMW AG have warned will linger well into next year.

And if scarce inventory weren’t enough to drive up prices, carmakers also are prioritizing their most lucrative models as the number of vehicles they can produce is constrained.

“The chip shortage is causing production losses, and demand that’s actually high can’t be met,” EY said in a note.

“Traditional combustion vehicles have been hit the most, while the boom for plug-in hybrids and electric cars continues.”

The July and August figures are the worst for the two months since the tail end of the Eurozone economic crisis in 2013.

The declines were broad-based, with Europe’s biggest car markets — Germany, France, the U.K., Italy and Spain — all seeing double-digit drops each month.

So far, automakers have been holding up just fine.

First-half earnings, margins and cash flows were the highest in the industry’s history, Bernstein analyst Arndt Ellinghorst said in a report Wednesday.

“Isn’t autos a funny industry,” he wrote.

“The fewer cars OEMs sell, the more money they make.”

Europe’s biggest economies may be having a harder time. Supply crunches are hitting Germany beyond just the automotive sector and threatening to derail its recovery.

Of Europe’s five big markets, Spain performed worst in August with sales plunging 29%, followed by Italy with a 27% drop.

Uncertainty related to the ongoing pandemic likely added to problems caused by the chip shortage, Joe Spak, an analyst at RBC Capital Markets, wrote in a report earlier this month.

Among the largest automakers, European sales fell 14% for VW Group, 29% for Stellantis NV and 23% for Renault SA last month.

Registrations dropped 38% for Daimler AG and 18% for BMW AG.

“While the pandemic is not over in the region, the single biggest challenge facing the industry is now the auto chip shortage,” LMC Automotive analysts wrote in a report last week.

“Any meaningful recovery in demand, following the improved economic backdrop in the region, is now being held back.”

(Updates with comments from EY in the fourth paragraph.)

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.