(Bloomberg) — Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

The global economy is still feeling the weight of Covid-19, which is complicating recovery efforts and sparking inflation.

Retail sales in the U.K. and China continued a stretch of weakness, while those in the U.S. unexpectedly rose. Inflation remains elevated in most parts of the world, and soaring food prices are especially hurting populations in emerging markets.

Here are some of the charts that appeared on Bloomberg this week on the latest developments in the global economy:

World

Covid-19 still isn’t done hobbling the global economy. From the U.S. to China and Germany, the latest data are flagging an economic slowdown as the new form of the coronavirus hits spending just as supply chain snarl ups threaten to keep inflation elevated. Both the world’s two largest economies are feeling a squeeze.

Companies around the world from noodle makers to semiconductor giants are spending on new plants and machinery in ways they haven’t done for years. Globally, corporate capital expenditure, or capex, will jump by 13% this year, according to S&P Global Ratings, with growth in all regions and broad sectors — especially in semiconductors, retail, software and transportation.

The global economy is expected to undergo its fastest recovery in almost five decades this year, but deepening inequities between advanced and developing countries threaten to undermine this, the United Nations warned.

U.S.

Prices paid by U.S. consumers rose in August by less than forecast, snapping a string of hefty gains. The data offered some comfort for “team transitory” –- those at the Federal Reserve and elsewhere who say price spikes caused by the economy’s reopening will soon abate.

Retail sales rose unexpectedly in August as a pickup in purchases across most categories more than offset weakness at auto dealers, showing resilient consumer demand for merchandise. The report showed firmer receipts at online retailers, general merchandise stores, furniture outlets and grocery stores.

Europe

U.K. retail sales fell unexpectedly for a fourth month in August, the longest stretch of declines in at least 25 years, raising concerns about the economic recovery as a resurgence of coronavirus cases and supply shortages take a toll.

U.K. inflation surged more than expected to the strongest pace in more than nine years, prompting investors to anticipate a sharper increase in interest rates in 2022. Consumer prices jumped 3.2% in August from a year ago, the most since March 2012, the Office for National Statistics said on Wednesday.

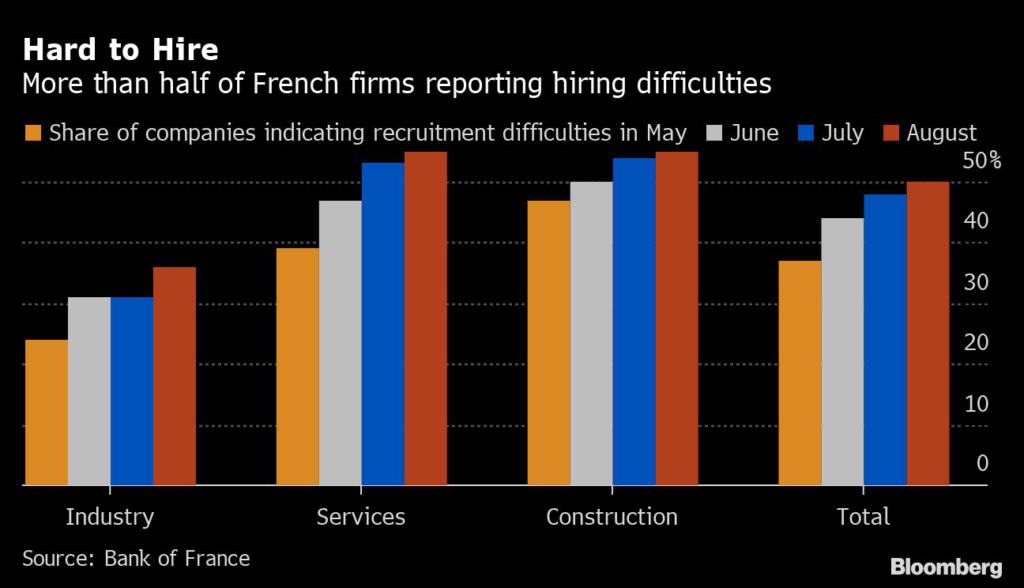

France’s sooner-than-expected economic recovery from the slump during the Covid-19 pandemic is reviving deep problems in the labor market that have long hobbled growth, the country’s central bank said.

Asia

China’s economy took a knock in August from stringent virus controls and tight curbs on property, fueling concerns about the global recovery as countries battle to get delta outbreaks under control. Retail sales growth slowed to 2.5% from a year ago.

Australia’s fiscal coffers are under assault on two fronts as its largest export goes into free-fall while the nation’s biggest cities and swathes of the east coast are under virus lockdown, driving up emergency spending.

Emerging Markets

Global food prices were up 33% in August from a year earlier with vegetable oil, grains and meat on the rise, data from the United Nations Food and Agriculture Organization show. It’s unlikely to get better as extreme weather, soaring freight and fertilizer costs, shipping bottlenecks and labor shortages compound the problem.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.