(Bloomberg) — Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

The Bank of England said the case to tighten U.K. monetary policy is building and inflation may breach 4%, prompting investors to bring forward bets on an interest-rate hike.

While the BOE kept its ultra-loose monetary policy settings in place as forecast by economists, officials shifted tone on the outlook, and Deputy Governor Dave Ramsden joined Michael Saunders in pushing to end bond purchases as soon as possible.

Noting the “modest tightening” in policy foreseen over their horizon in August, “some developments during the intervening period appear to have strengthened that case, although considerable uncertainties remain,” the Monetary Policy Committee said in a statement.

Financial markets advanced bets for an interest-rate increase to February, while the pound strengthened as investors reacted to a decision that puts the BOE in the more hawkish camp of advanced-world central banks in a pivotal week. On Wednesday, the U.S. Federal Reserve announced that officials may taper bond buying soon, and Norway raised its interest rate on Thursday.

The U.K. central bank is trying to tame inflation that accelerated well beyond its forecasts over the summer, reaching 3.2% last month. Its new focus is enabled by stronger-than-expected jobs data that show unemployment will peak well below worst-case scenarios predicted at the onset of the pandemic.

“The looming end of furlough is a major source of uncertainty facing the economy, but for now the bank appears relatively confident that the economy can deal with this shock without a large increase in unemployment,” according to Luke Bartholomew, economist at Aberdeen Standard Investments.

What Bloomberg Economics Says…

“We still expect the labor market and a softer growth outlook to stay the BOE’s hand for longer than financial markets expect. But it now looks like a first hike will come in May, six months earlier than we forecast prior to the decision.”

— Dan Hanson, senior U.K. economist. Click here for full REACT.

Traders now are pricing a 15-basis-point rate increase in February, compared with May previously. The pound rallied as much as 0.6%, while 10-year gilt yields rose by the most in a week.

The BOE kept its own benchmark unchanged at a record-low 0.1%, while its stock of asset purchases is set to total 895 billion pounds ($1.2 trillion) by the end of this year. Policy makers led by Governor Andrew Bailey unanimously agreed that any future tightening should start with an interest-rate increase.

Ramsden joined Saunders in pushing to end bond-buying early, a surprise switch that will add to the perception of the BOE shifting its view.

“There was increasing evidence from a range of global and domestic cost and price indicators that inflationary pressures were likely to persist,” the minutes said. “These members judged that, with the existing policy stance, inflation was likely to remain above the 2% target in the medium term.”

The decision was also notable for the participation of the MPC’s two newest members: Huw Pill, the former Goldman Sachs Group Inc. analyst who replaced Andy Haldane as chief economist, and Catherine Mann, a one-time chief economist of the OECD who replaced Gertjan Vlieghe. Both of them voted with the majority on this occasion.

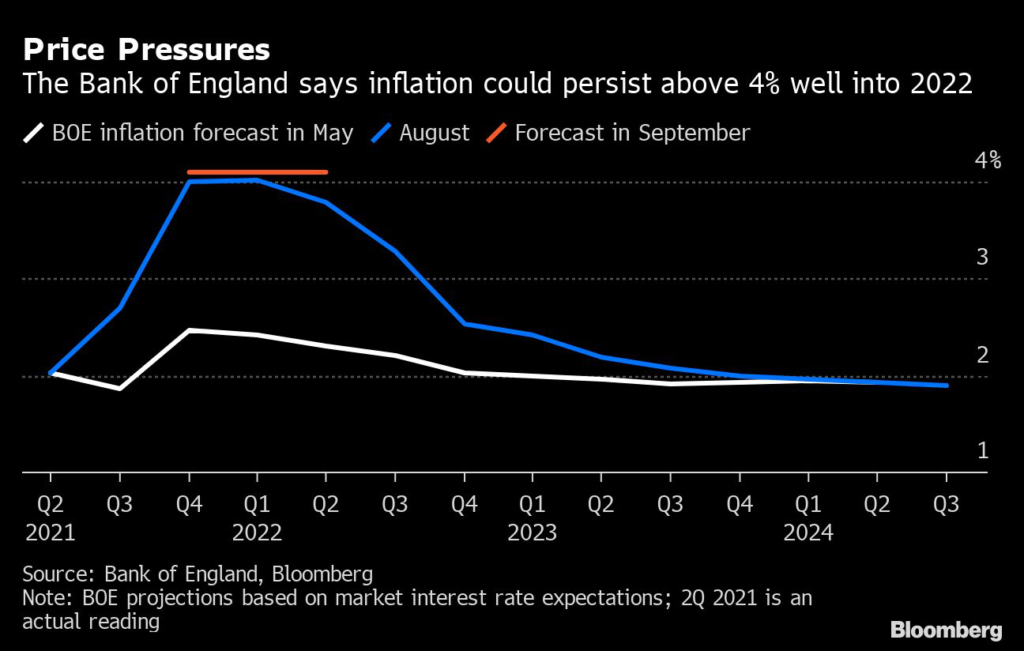

While the BOE targets inflation of 2%, the rate may temporarily exceed double that level in the final three months of the year, slightly more than predicted in August, officials said. Spiking gas costs that have caused turmoil in U.K. energy markets “could represent a significant upside risk,” and also mean that consumer-price increases could remain above 4% until the second quarter of 2022, the MPC added.

Alongside the outcome, the BOE released an exchange of letters between Bailey and Chancellor of the Exchequer Rishi Sunak to mark the spike in inflation above the institution’s tolerance level of 3%.

“Most indicators of cost pressures have remained elevated,” Bailey wrote. “That said, it appears that supply conditions in the global semiconductors sector have improved slightly, although it will take some time for previous order backlogs to clear.”

While the BOE’s more hawkish rhetoric follows a noticeable spike in inflation, it also comes against the backdrop of an economic recovery that has shown signs of losing steam amid supply bottlenecks and labor shortages.

Data released on Thursday showed the U.K. had about 5.8% of its workforce on furlough at the start of this month even though that support program is set to expire Sept. 30. September is also shaping up to be the weakest month for private-sector activity since the height of the winter lockdown, IHS Markit said on Thursday.

(Updates with economist comment in sixth paragraph)

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.