(Bloomberg) — Turkey’s wealth fund is considering acquiring a majority stake in the country’s second-biggest telephone company, in a potential deal that would make it the largest shareholder in two of the top telecom operators, according to people with knowledge of the matter.

Creditors seized a 55% stake in Turk Telekomunikasyon AS almost three years ago after its previous owner defaulted on a multi-billion-dollar loan. The sovereign fund, known by its Turkish initials TVF, has approached the lenders about acquiring the holding, said the people, who asked not to be named because the matter isn’t public.

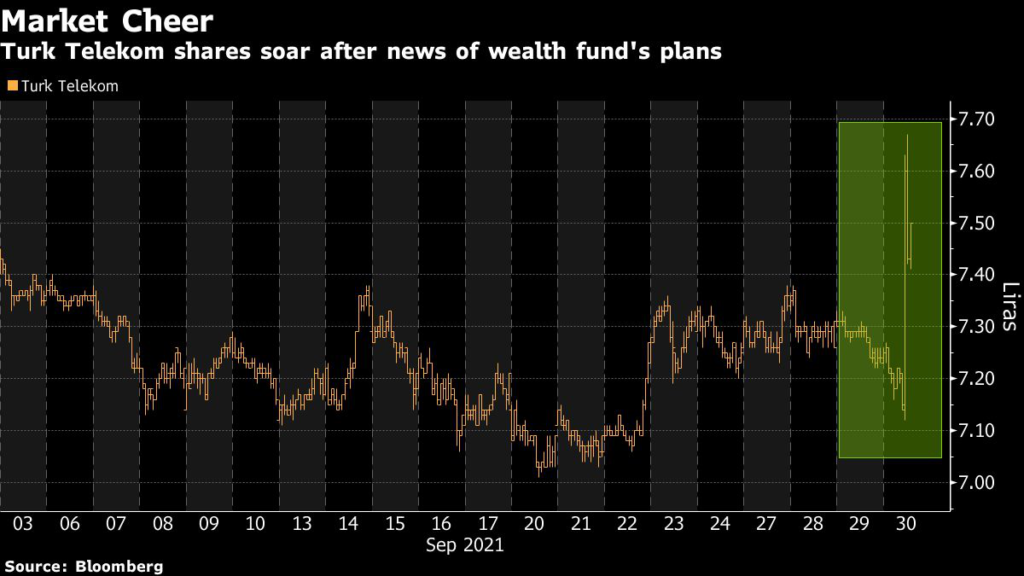

Turk Telekom’s shares surged on the news, erasing losses in Istanbul and rising as much as 5.9% — the most in 10 months. The stake in the company could be worth around $1.6 billion based on its current market price, data compiled by Bloomberg show.

The two sides differ over the price and the fund has yet to make a formal offer, they said. The group of mainly local banks previously hired Morgan Stanley to advise on finding a strategic buyer.

A deal would mark the biggest step yet in the creeping re-nationalization of Turkey’s telecommunications industry after the wealth fund last year took a majority stake in the country’s biggest mobile phone operator, Turkcell Iletisim Hizmetleri AS.

Although dogged by allegations of corruption, the privatization of Turk Telekom in 2005 represented the largest government asset sale in Turkish history after fetching $6.55 billion in proceeds. The company’s $1.9 billion initial public offering three years later also raised a record amount at the time.

New Era

In pursuing the takeover, the wealth fund is looking to clinch its biggest deal since President Recep Tayyip Erdogan replaced TVF’s chief executive officer half a year ago during a shakeup of Turkey’s key economic institutions.

Turkey established its sovereign fund in 2016 and mandated it to take a lead role in making investments deemed too big for the private sector. It’s amassed assets valued at $39 billion, building a portfolio that now consists of nearly two dozen companies across eight industries.

Chaired by Erdogan, the sovereign investor already merged state-owned insurance companies and injected cash into state banks to boost their lending power during the pandemic.

In an interview in February, the wealth fund’s then-CEO urged the banks to change Turk Telekom’s ownership structure to enable it to invest in large infrastructure projects, saying they shouldn’t be long-term investors in companies outside their core business.

Apart from the shares held by the banks through special purpose vehicle LYY Telekomunikasyon AS, the Treasury and Finance Ministry owns 25%, TVF has 6.7% and the remainder is publicly traded. The government also retains a so-called golden share that entitles it to make certain management decisions.

Record Default

Failure to pay an installment on a $4.75 billion loan by the Ankara-based operator’s former owners, the Lebanese Hariri family’s Oger Telecom Ltd., led to one of the biggest ever defaults in Turkey.

About 20 lenders then took over the holding in Turk Telekom in 2018, and some of them said they’d already written off a significant part of their exposure to the original loan. Akbank TAS is the biggest shareholder in the SPV with 35.6%, giving it more say over decisions.

TVF and Turkey’s Treasury and Finance Ministry declined to comment. Akbank and LYY didn’t reply to questions seeking comment.

All previous attempts by the group of banks to sell the stake have failed because the time remaining before Turk Telekom’s fixed-line license expires in 2026 deterred investors concerned it wouldn’t be long enough to recoup their investment through dividend payouts.

Strategic international investors, including those from the Gulf region and China, had shown interest but later balked.

The effort by the wealth fund to break the impasse around the company echoes a deal last year that saw it take control of Turkcell, ending decades of shareholder disputes. It now owns 26.2% of Turkcell, including a 15% privileged stake.

(Updates with Turk Telekom share price in third paragraph.)

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.