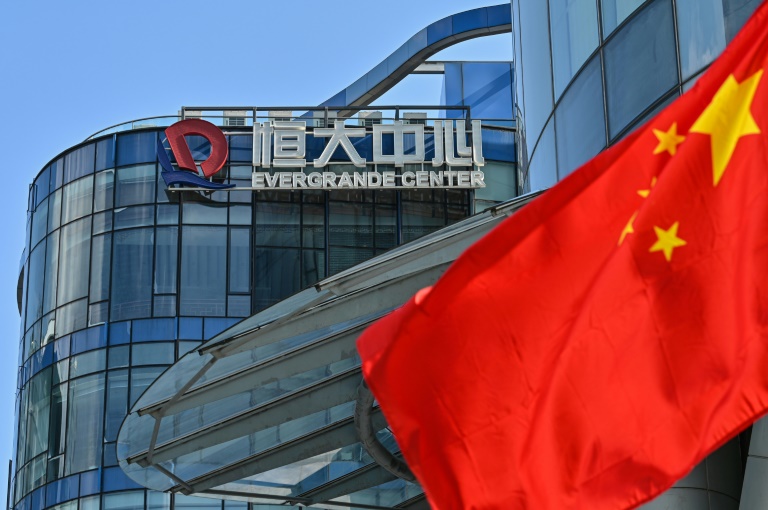

Chinese property giant Evergrande’s shares plunged Thursday after resuming trading in Hong Kong, with the failure of a unit sale deal deepening fears the indebted firm will collapse and send shockwaves through the world’s second-largest economy.

Evergrande had suspended trading on October 4 pending an announcement on a “major transaction” as it struggled with some $300 billion of debt — with investors worried about the potential fallout from its predicament.

On Thursday, shares dropped more than 10 percent as it ended its two-week halt.

A deal worth HK$20.04 billion (US$2.58 billion) to sell a 50.1 percent stake in its property services arm had fallen through, it said in a statement Wednesday, when it announced it would resume trading.

The buyer in talks with Evergrande was a unit under Hong Kong real estate firm Hopson Development Holdings, which said in a stock market filing it “regrets to announce that the vendor has failed to complete the sale”.

Hopson shares rose five percent on Thursday as Evergrande Property Services stock tumbled.

Evergrande said it would continue to implement measures to ease its liquidity issues, cautioning that “there is no guarantee that the group will be able to meet its financial obligations”.

In a stark assessment of its current state of trading, Evergrande said it had sold only 405,000 square metres of real estate throughout September and October so far — normally a peak period for sales.

Contracted property sales totalled just 3.65 billion yuan ($571 million) — a near collapse on the 142 billion yuan it recorded in a similar period last year.

There has been no further progress on asset disposals, said the group, following the sale of a $1.5 billion stake in a regional Chinese bank in September.

The Shenzhen-based company has missed several payments on dollar-denominated bonds, and a 30-day grace period on an offshore note is up on Saturday.

– ‘Contagion’ –

Fears that Evergrande could collapse and send shockwaves through the Chinese economy have rattled buyers and markets — even though Beijing has insisted any fallout would be containable.

“I don’t think it will be a surprise to see a default (on the offshore note),” said Chen Long, partner at research firm Plenum.

“Actually, it’s the other way around. It would be a surprise to see Evergrande not default.”

Data this week showed China’s economic growth slowed more than expected in the third quarter as the crackdown on the property sector and an energy crisis began to bite.

In a sign of the ongoing weakness, home sales by value slumped 16.9 percent year-on-year in September, following a 19.7 percent fall in August, AFP calculations based on official data showed.

China’s new-home prices also fell for the first time in six years last month.

Several domestic property rivals have in recent weeks already defaulted on debts and have seen their ratings downgraded.

Hong Kong-listed Sinic Holdings became the latest to miss a payment, while mid-sized competitor Fantasia also failed to meet obligations in recent weeks.

Evergrande first listed in Hong Kong in 2009, raising HK$70.5 billion in its initial public offering — making it China’s largest private real estate company and founder Xu Jiayin the mainland’s richest man at the time.

In an expansion spree, Xu — also known as Hui Ka Yan in Cantonese — bought the then-embattled Guangzhou football team in 2010, renaming it Guangzhou Evergrande and pouring money into world-class players and coaches.

The group diversified into various sectors, including bottled water and electric vehicles.

But Evergrande started to falter under the new “three red lines” imposed on developers in a state crackdown in August 2020 — forcing the group to offload properties at increasingly steep discounts.

Chen said Evergrande did not start the contagion, noting that many developers had borrowed too much money and found themselves in trouble with tighter restrictions and a cooling housing market.

“Evergrande was not the first, and it’s not going to be the last,” he told AFP. “It just turned out to be the largest.”