(Bloomberg) — Kaisa Group Holdings Ltd. is planning to sell property projects valued at almost $13 billion to raise capital, the South China Morning Post reported after the debt-laden Chinese developer suspended trading of its shares in Hong Kong.

Kaisa and its three units listed in the city were halted on Friday pending an announcement containing inside information, the companies said, a day after the real estate firm flagged liquidity pressure and overdue payments on wealth products.

The developer has put 18 projects covering 1.45 million square meters (15.6 million square feet) in Shenzhen up for sale, with a total value estimated at 81.82 billion yuan ($12.8 billion), the SCMP reported, citing a catalog. China Resources Land Ltd. and other state firms are in talks to buy the projects, Chinese media outlet Cailian reported.

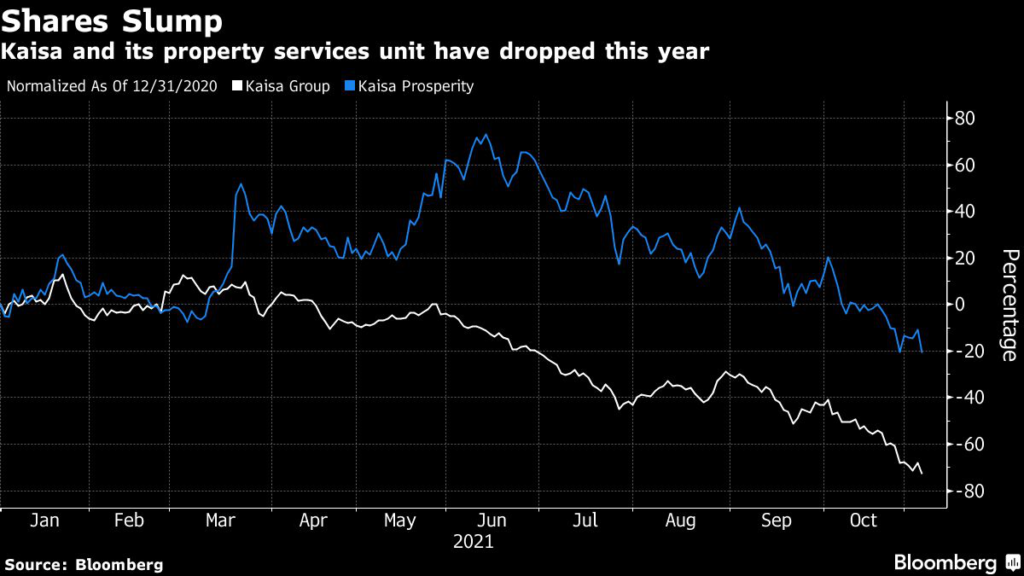

Kaisa’s shares and bonds tumbled Thursday after the company said it has faced “unprecedented pressure on its liquidity” due to unfavorable factors such as credit rating downgrades and a challenging property market environment. The missed payments on wealth management products come about two months after industry giant China Evergrande Group faced protests from investors demanding money on similar overdue offerings.

Chinese developers are facing an intensifying cash crunch following a government campaign to reduce leverage in the industry. That’s been made worse by a slump in home sales and prices as sentiment among homebuyers weakens. A bond sell-off is making it prohibitively expensive for the nation’s builders to refinance maturing debt.

“Kaisa’s non-payment of a guaranteed wealth management product may exacerbate the sector’s crisis,” Andrew Chan, a Bloomberg Intelligence analyst, wrote in a note. It “suggests investors need to be aware not only of upcoming public debt payments but of obligations such as WMPs which may not be widely known.”

Kaisa’s dollar bonds rallied on Friday after the previous day’s plunge. Its 6.5% note due Dec. 7 rose 4.4 cents to 49.7 cents, according to Bloomberg-compiled data. Its shares dropped 15% on Thursday to the lowest price since its 2009 listing.

The developer plans to start selling assets as soon as next month through to the end of next year, the SCMP said, citing people familiar with the program.

Kaisa didn’t immediately respond to a request for comment on the media reports.

Its property management arm Kaisa Prosperity Holdings Ltd., health operation Kaisa Health Group Holdings Ltd. and construction equipment provider Kaisa Capital Investment Holdings Ltd. were also suspended, pending inside information of their controlling shareholder, according to filings.

‘All Efforts’

Kaisa is “making all efforts” to resolve its liquidity problem such as by speeding up asset sales, it said in the statement Thursday. The company is seeking buyers for assets including Kaisa Prosperity, but no clear candidates had emerged, Reuters reported last week.

Yet whether the company can pull off disposals of the scale reported remains to be seen. Property developers in China looking to raise badly needed funds by offloading assets are finding it hard to strike deals because many of their peers are hoarding much-needed cash.

Read more on how Kaisa is alarming bondholders again

The wealth products have 12.8 billion yuan outstanding in principal and interest, according to China’s Economic Observer. Kaisa offered a plan to repay in cash installments, paying 10% of principal and then 25% of interest every quarter, the Hong Kong Economic Journal reported.

Authorities in Shenzhen will hold a meeting Friday to discuss liquidity issues of the company and industry peer Fantasia Holdings Group Co., Cailian reported earlier.

Kaisa became a focus of investor concern after it canceled meetings with investors in October, triggering doubts about its liquidity and sending its dollar bonds lower. Downgrades by both S&P Global Ratings and Fitch Ratings a few days later caused a fresh sell-off in the developer’s shares, which have tumbled more than 70% this year.

The first Chinese builder to default on dollar bonds, Kaisa completed a debt restructuring in 2016. Since then, it has grown to become China’s third-largest dollar debt borrower among developers with more than $11 billion of bonds outstanding in the currency. It ranked as China’s 27th-biggest property developer by sales last month.

In addition to Kaisa’s $400 million note due next month, it has $2.8 billion of dollar bonds maturing in 2022, according to Bloomberg data. It’s scheduled to pay an interim dividend of 4 Hong Kong cents per share on Dec. 17, which would cost the company about HK$281 million.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.