(Bloomberg) — A spike in shares of Chinese real estate developers helped contain a downward spiral of Hong Kong stocks on Friday that was fueled by worries over tech firms’ earnings.

The Hang Seng Index pared an earlier loss by nearly half to end 1.1% lower.

China Resources Land Ltd. and Country Garden Holdings Co. were the biggest point contributors to the gauge, each gaining at least 5.5%. The nation’s e-commerce giant Alibaba Group Holding Ltd. was the largest drag with a record 11% slump, after reporting disappointing quarterly results.

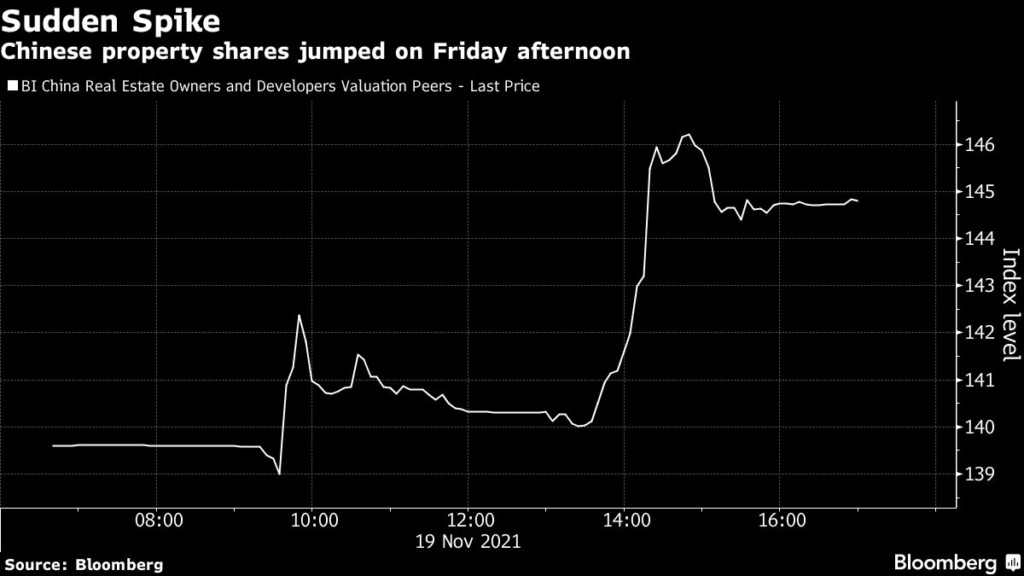

Speculation circulated after the mid-day break about lenders being asked to increase developer loans, driving traders to take the opportunity to bargain hunt despite skepticism.

A Bloomberg Intelligence gauge of Chinese developers jumped 3.7%. The gains offset a selloff of tech shares as Alibaba joined Tencent Holdings Ltd. to become the latest online giant that missed estimates in this earnings season.

The rumor appeared to be “too vague to have any significance without a numerical figure,” said Zhang Chuanxu, a fund manager at Hexi Capital in Shanghai.

“It is unclear if top-level polices are shifting too, or if it’s a very incremental window guidance that will never be seen in readouts. I still believe that any loosening will come with clear ceilings.”

China’s benchmark CSI 300 Index rose 1.1%, as builders also rallied on the mainland.

Yet concerns over the earnings outlook for Chinese tech firms remain an overhang in the market.

Among the 16 companies that have reported quarterly results on the Hang Seng Tech Index, seven were behind market expectations, Bloomberg-compiled data show.

Alibaba’s results “reminded investors that the golden time of Chinese technology companies is likely behind,” said Castor Pang, head of research at Core Pacific-Yamaichi International Hong Kong Ltd.

“Now they have to deal with longer-than-expected earnings impact from tightened regulations and a slowing Chinese economy.”

READ: Alibaba Shares Slump After ‘Underwhelming’ Results: Street Wrap

Still, investors are rewarding firms that could deliver positive earnings surprises amid a challenging macro environment.

JD.com Inc., a major rival of Alibaba, saw its shares surge 9.1% in Hong Kong to the highest in eight months, after announcing third-quarter revenue that beat analyst forecasts.

The Hang Seng Tech Index, which tracks mostly Chinese online titans, dropped for the third straight day, finishing 0.3% lower.

READ: China Stocks in U.S.

Slide as Alibaba Adds to Earnings Woes (1)

Morgan Stanley strategist Laura Wang warned on Thursday that Chinese companies are facing the worst earnings season since 2018, while downward revisions by analysts to profit views will likely extend through the end of this year.

Also weighing on the Hang Seng Index on Friday was property management firm Country Garden Services Holdings Co.

It plunged 8.9% to be the second-worst performer after Alibaba following a $1 billion share placement.

(Updates throughout.)

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.