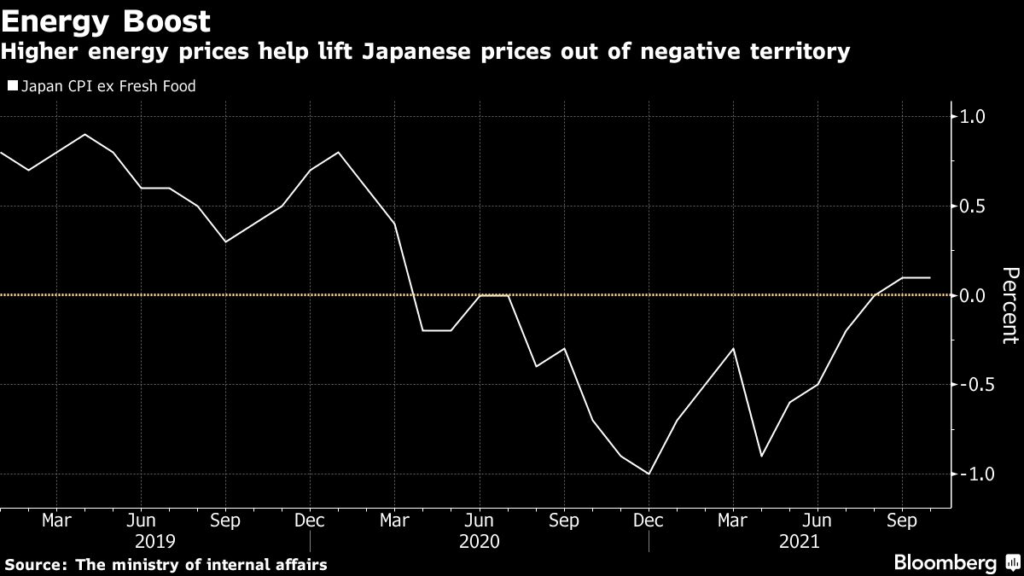

(Bloomberg) — Higher energy costs caused Japanese consumer prices to edge up for a second month in October, with Prime Minister Fumio Kishida expected later Friday to deliver a stimulus package that includes countermeasures to ease the pain from more expensive fuel.

Consumer prices, excluding those for fresh food, increased 0.1% compared with a year earlier, the ministry of internal affairs reported. The result matched the median forecast from analysts.

Overall gains were limited by plunging mobile phone fees, even as gas prices at the pump surged 21%.

While Japanese inflation is far less dramatic than that confronting consumers and central banks elsewhere, surging oil costs are becoming an issue. Chief Cabinet Secretary Hirokazu Matsuno last week signaled the country’s new government would offer support to fishing and transport businesses coping with higher fuel bills as part of its first economic package. The overall size of the package will total about $690 billion, according to a draft of the plan seen by Bloomberg.

“We are not at a stage yet where inflation is going to affect the course of Japan’s monetary policy,” said economist Takeshi Minami at Norinchukin Research Institute. “We’re not seeing people taking advantage of lower mobile phone fees to spend more and, without stronger demand, inflation won’t be sustainable.”

Read more: Japan’s Kishida Eyes Record Fiscal Firepower to Aid Recovery

Lower fees for phone services, which have dropped this year under government pressure, continue to weigh on prices, sliding 54% from 2020’s level in October. Stripping out the phone factor, core inflation is closer to 1.7%, according to a Bloomberg calculation.

Meanwhile, gasoline prices have climbed in recent weeks to the highest level in seven years. That adds a burden on households especially outside Japan’s big cities, who tend to drive more and are an important constituency of the ruling party.

More details:

- Overall, consumer prices rose 0.1%. Analysts had expected an increase of 0.2%.

- Prices, excluding those for both fresh food and energy, declined 0.7%, matching the estimate

- Energy prices rose 11%, boosting the overall price index by 0.8 percentage point.

Soaring commodity prices amid supply chain bottlenecks and a weaker yen are also squeezing many Japanese businesses, which are facing the strongest cost pressure in four decades.

While most firms remain reluctant to pass their costs on to the country’s shoppers, who are known for being extremely sensitive to price increases after years of deflation and stagnant wages, there are some exceptions. Soy sauce maker Kikkoman Corp. last week announced a 10% hike on some products, citing higher costs for materials and logistics.

What Bloomberg Economics Says…

“The prospect of steps by the government to contain the surge in domestic gasoline prices could damp the CPI. This would be supportive for consumption but would put another hurdle in front of the central bank’s 2% inflation target.”

–Yuki Masujima, economist

To read the full report, click here.

Kishida’s aid package is aimed at putting the economy back on track after it shrank last quarter on a resurgence of Covid and a shortage of semiconductors. Measures are expected to include tax breaks for companies raising pay, key to driving a sustained resurgence in consumer spending.

The stimulus is also expected to include a resumption of the government’s Go-To travel subsidies to help the ailing tourism industry, a move made possible now that the virus is under better control. The discount plan will boost business at hotels and restaurants, but will also add downward pressure on inflation, as it did last year.

Bank of Japan Governor Haruhiko Kuroda this week told local business leaders he sees core inflation increasing gradually to about 1% around the middle of next year. With no immediate prospect of reaching the bank’s 2% inflation target, though, he said the BOJ needs to stick with its easing, even as other central banks change direction.

(Adds economist’s comments.)

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.