(Bloomberg) — Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

Apple Inc. just offered a new reason to be worried about the state of the consumer.

The company is telling suppliers of waning demand for its iPhone 13. The warning suggests shoppers have either satiated their appetite for new stuff or are uneasy about extravagant purchases in a world of soaring prices and a pandemic that refuses to go away. Throw in the new omicron mutation, and it’s a heady mix for shoppers.

Whatever the reason, consumer caution leaves economies facing the new virus threat with less support from goods spending — a reversal from earlier in the pandemic.

“The story has been that we’ve seen absolutely extraordinary levels of consumer demand for goods,” UBS Group AG Chief Economist Paul Donovan wrote in a note to clients. “What we’re starting to see is the extraordinary demand levels are coming down.”

In the U.S., a key measure of prices for consumers skyrocketed to 6.2%, the highest since 1990. Across the OECD group of major economies, prices are rising at the fastest pace in almost a quarter century. For U.K. consumers, there’s an additional squeeze from tax hikes.

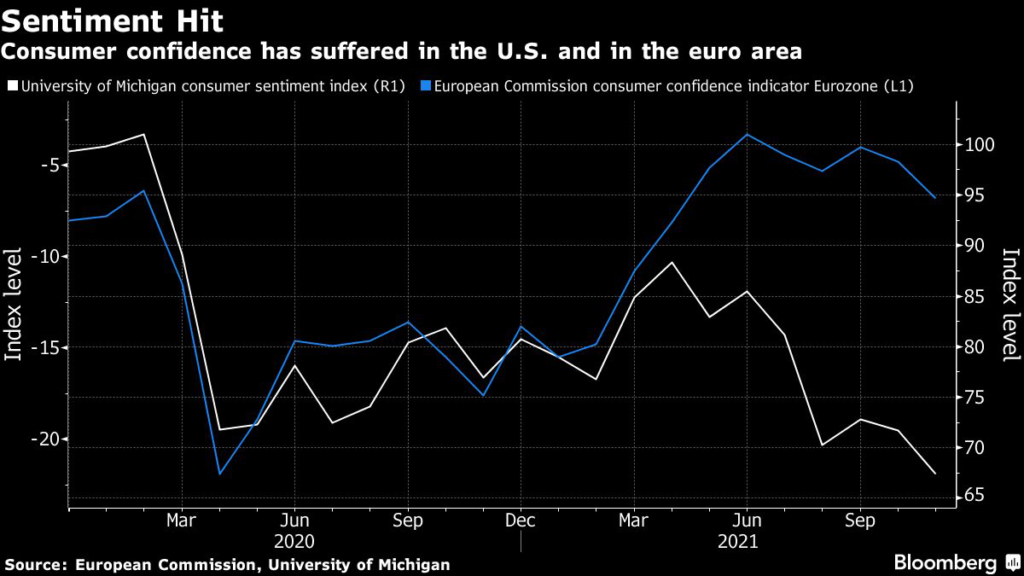

That’s taking a toll on the mood among households, and their willingness to fork out for goods, including the new iPhone that costs up to $999. While high prices didn’t dent sales at U.S. stores in October, consumer sentiment has since hit a decade-low.

Across the Atlantic, a euro-area sentiment gauge has slipped from highs in recent months, while Britons are more worried about their personal finances.

In China, retail sales are back below pre-pandemic growth rates as a property slowdown and virus-related caution weigh on sentiment. Consumer prices are starting to edge up too, eroding spending power.

Recent data shows that Americans spent less in the lead up to Black Friday. In the week between Thanksgiving and Cyber Monday, online sales were down 1.4% from the prior year, Adobe Analytics says.

Still, one key support for households remains positive. The U.S. labor market looks strong, and employment growth is projected to exceed a half million for a second month in November. The jobless rates in the euro region and the U.K. are moving back down toward pre-pandemic levels.

Any downward shift in demand is another headache for companies, which are already bedeviled by logistics logjams and struggling to keep shelves stocked for holiday shoppers.

Those supply issues may also be partly driving the spending trends, as consumers respond to headlines and decide to avoid the increased stress of trying to secure the latest must-have product.

The other factor is whether the new handset is worth it, given the scale of the upgrade is considered modest.

“There are headwinds,” said Gregory Daco, chief U.S. economist at Oxford Economics. “People are not just spending freely. They’re more cautious about how they spend and what they spend on. And that’s reflective of the supply constraints and the inflationary pressures.”

Any cooling of consumer enthusiasm could help ease price pressures and cut central banks some slack.

“It may be that a slowdown in consumption demand could give the global economy some breathing space,” said Esther Baroudy, managing director for fundamental growth and core equities at State Street Global Advisors.

The latest spending patterns may be another step in the shift from goods to services like hotels and restaurants that have reopened since lockdowns. A euro-area services gauge from IHS Markit published Friday showed an increase in November, although it was markedly weaker than the growth rates seen in the second and third quarter.

“There will be a temporary slowdown and a bit of a stop-and-go in growth, but the idea is that we go toward a normalization of activity,” said Michel Martinez, an economist at Societe Generale. “There may be a slight drop in tech products, but there will be a rebound in car sales and in services consumption.”

(Adds services PMI in penultimate paragraph.)

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.