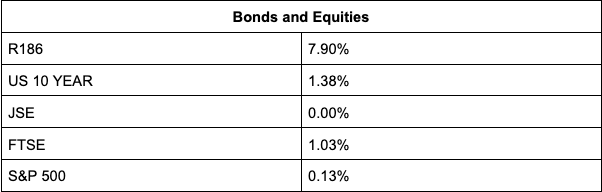

The JSE turned positive as fears of omicron’s severity receded and as the bourse received strong support from banks and heavyweight commodity counters.

News that the surge in Covid-19 cases since the emergence of omicron hasn’t overwhelmed hospitals so far, has prompted some cautious optimism that the new strain may cause mostly mild illness, reports Bloomberg. In another encouraging sign, the Steve Biko and Tshwane District Hospital Complex in Pretoria, said that most patients in the Covid wards didn’t require oxygen. That marks a departure from previous waves, according to the report.

Private hospital stocks suffered, with Netcare (-3.35%) and Life Healthcare (-1.70%) feeling the pain, while Mediclinic stood firm, gaining 0.40%. Drug stocks also bled, with Aspen Pharmacare losing 5.19%, Adcock Ingram 2.55% and Clicks 0.15%. Ascendis Health (+1.02%) and Dis-Chem (+0.03%) bucked the trend.

Banks among others boosted the bourse to end the day up 0.30% at 71,016.63 points, with Nedbank gaining 3.30% after saying it expects full-year profits to be almost double. Absa (+2.61%), Standard Bank (+1.81%), Capitec (+0.25%), Investec (+0.55%) all gained.

Heavyweight commodity counters benefited from higher commodity prices – palladium was up 0.71% at $1,828.98/oz and platinum 0.82% at $943.18/oz at last count – with Exxaro gaining 3.16%, Anglo American 3.02% and Northam 2.26%.

Sasol added 0.71% as Brent Crude surged 2.62% to last trade at $72 a barrel after Saudi Arabia boosted the prices of its crude, signaling confidence in the demand outlook.

Ecommerce counters Naspers (+0.20%) and Prosus (+0.18%) also lent support.

Meanwhile, investors were high on Labat Africa (+52%) after the industrial cannabis investment business announced that it had scored a R300m investment from US company GR Global Ventures.

On the downside, South32 dropped 10.78% after its largest shareholder Schroders reduced its shareholding in the Australian-based miner, while steelmaker ArcelorMittal lost 3.40%.

Other big losers were renewable energy company Montauk, which gave up 10.68% as investors took profit, papermaker Sappi (-4.13%) and MTN (-3.81%). Alexander Forbes lost 4.08% after announcing it is buying one of Sanlam’s (-1.20%) businesses in a transaction that will increase its client base by 40%.

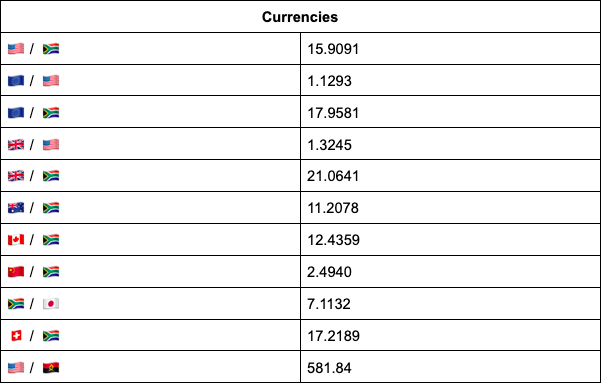

On the forex front, the rand remained stable during the major part of the day, trading between R15.94 and R16.00. “Since the open of US markets, we have broken lower and tested R15.90 as most emerging markets are ending the day stronger after the sell-off from Friday evening,” comments TreasuryONE.

The local unit was last changing hands at R15.89 against the US currency.

Indicators as at 17:00