The JSE raced to a new record within a whisker of 73,000 points amid a global tech and commodities rally, while optimism that omicron won’t dampen growth also buoyed the bourse.

Commodity prices glittered, with platinum the biggest gainer, adding 2.18% to $962.00 at last count, while gold gained 0.43% to trade for $1,785.95 an ounce, palladium 0.40% to $1,861.00/oz and iron ore 2.17% to $103.74 per dry metric ton. Brent Crude surged, gaining a massive 3.32% to sell for more than $76 a barrel in a relief rally that omicron may not be as severe as feared.

Initial data indicates that the surge in omicron cases hasn’t overwhelmed hospitals so far, and mobility statistics show little evidence of a significant hit to global oil consumption so far, reports Bloomberg.

Bloomberg also reports researchers in Hong Kong said they have developed the world’s first stainless steel that kills the Covid-19 virus within hours, adding to the arsenal of products being created globally to curb the pathogen that triggered the worst pandemic of the past century.

Steelmaker ArcelorMittal gained 4.26%.

Mining counters benefited from the rise in prices with Anglo American and Kumba Iron Ore both gaining more than 6%. South32 recouped all its losses and then some from the previous session, gaining a massive 11.02% after it won the backing for its $671m expansion of its coking coal mine in Australia’s New South Wales. Cash-flush Thungela Resources gained 7.41%, while BHP jumped 5.13%, Glencore 4.05% and African Rainbow Minerals 3.79%.

Sasol added 4.47%.

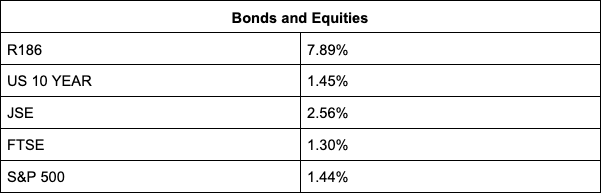

Naspers (+3.25%) and Prosus (+4.65%), which together account for a 12% weighting in the All Share index, along with heavyweight mining and industrial counters helped the JSE to end the day 2.71% higher on 72,939.25.

Investors cheered the end of the strike at Massmart, sending the stock price up 6.51%.

Other big counters supporting the JSE’s rally were renewables unit Montauk (+7.94%), luxury goods group Richemont (+4.73%) and container leasing firm Textainer (+5.42%).

Among the few losers were Gold Fields (-2.29%) and Anglogold (-2.22%). Santam lost 3.17% .

On the economic front, South Africa’s third-quarter GDP (measured by production) contracted by 1.5% following a 1.2% expansion in the second quarter and 1.0% growth in the first quarter of 2021, underlining the damage Covid-19 restrictions and the riots in July had done the economy.

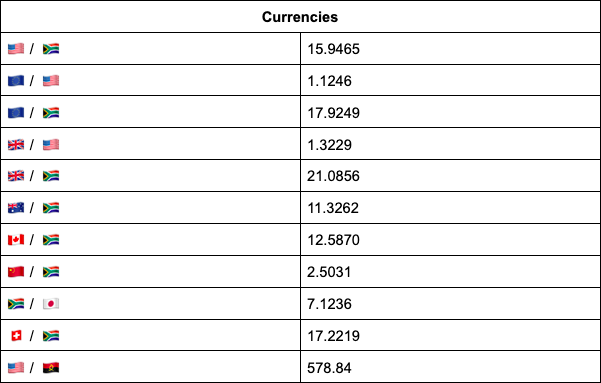

The rand, which tested R16 against the US dollar following the GDP print, has since pulled back and was last trading 0.18% firmer than its overnight close in New York at R15.89/$.

Indicators as at 17:00

Indicators brought to you by TreasuryONE