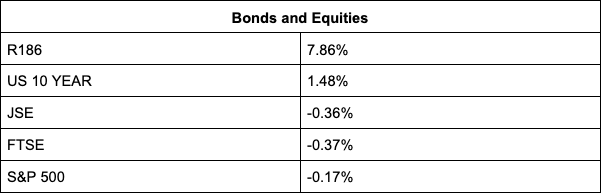

The JSE tracked global markets lower as risk-off sentiment returned, weighing on commodity prices and commodity currencies.

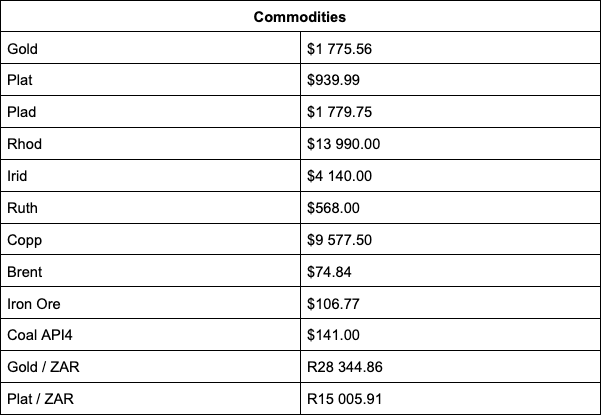

All metals were down for the day, with palladium the most volatile, losing close to 5% to last trade at $1,774.50/oz. Gold staged a comeback but was still down 0.36% at $,776.68, while platinum dropped almost 2% to $941.50. Iron Ore was also softer, selling for $106.77 a dry metric ton, while Brent crude sagged 1.20% to change hands at $75.02 a barrel.

Northam (-5.05%), Exarro (-3.34%), Kumba Iron Ore (-3.13%), Sasol (-2.56%) and DRDGold (-2.60%) were among the hardest hit. Northam also got punished for turning up the heat in the bidding war with Implats (-0.35%) by making an unsolicited offer to acquire all, or a portion of RBPlats’ voting securities. RBPlats gained 1.66%.

Also among the losers was Tongaat Hulett, slumping 8.62% after posting bitter half-year results in which the sugar producer revealed it took a R158m hit on profits from the July unrest.

Standard Bank ended the day 0.08% firmer in a volatile trading session after a more than five-hour outage. Banking peers were mixed with Nedbank and Capitec gaining 0.32% and 0.15%, and Absa and FirstRand losing 0.04% and 0.09% respectively.

Adding to the JSE 0.27% drop were heavyweight rand-hedges Naspers (-1.07%), Anglo American (-0.24%) and Richemont (-0.20%). BAT bucked the trend, gaining 2.06% after a report pointed out that British American Tobacco’s exposure to reduce the risk of non-combustible products provides a path to growth for the business.

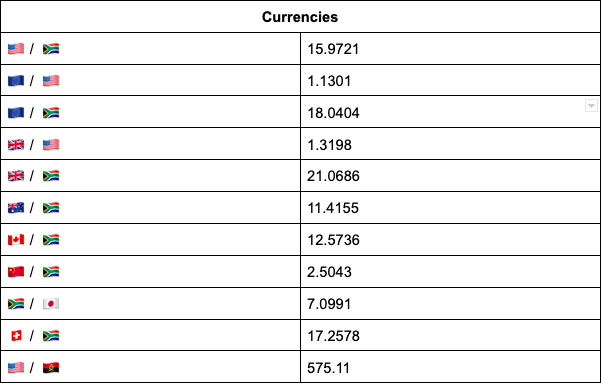

On the forex front, it has been a day of risk-off, with the rand trading in a wide 20c range, according to forex trading house TreasuryONE.

“Starting off in the low R15.70s, the rand lost ground continuously during the course of the day,” remarks TreasuryONE, adding that EM currencies across the board followed similar paths, most likely over concerns of the impact of the omicron variant on the global economy.

The local currency was last trading 1.6% weaker than its overnight close at R15.96 against the safe-haven dollar.

“This risk-off mood has halted a good run of form for the rand in the short term and could look to trade back into the R16/R16.20 range if sentiment continues,” says TreasuryONE.

Indicators as at 17:00, brought to you by TreasuryONE.