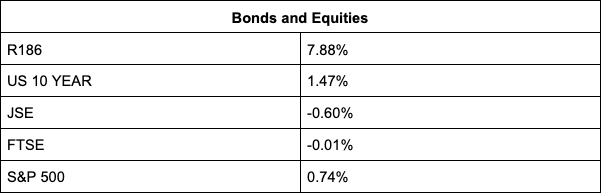

The JSE stumbled to end the week down 0.72% on 71,686.33 points as US inflation data came out in line with expectations and as investors continued to fret over the economic impact of the outdrawn Covid-19 pandemic.

The inflation print which showed CPI accelerated by 6.8% year-on-year, was largely priced into the market, reinforcing the US Federal Reserve’s determination to scale back its massive bond-buying programme it started early last year to prop up the pandemic-hit economy. More importantly, it spurred bets that the Fed won’t have to accelerate plans to tighten monetary policy and hike interest rates, reports Bloomberg.

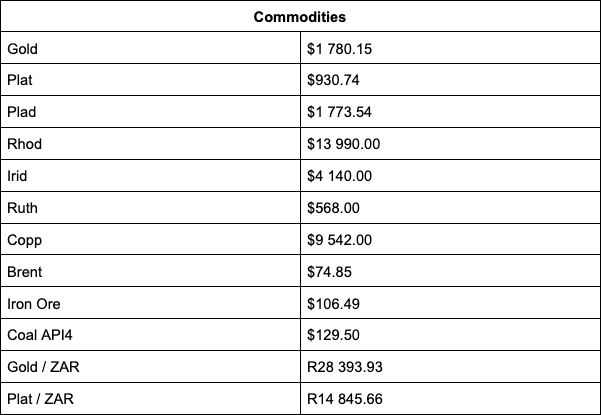

Commodities were a mixed bag with gold and platinum gaining 0.63% to $1,786.22 and 0.79% to $946.91 respectively, while palladium plunged 3.30% to last trade at $1,757.08/oz. Brent crude was selling for $74.64 a barrel.

Mining counters followed suit, with Implats losing 3.58%, Harmony 3.45%, Thungela Resources 3.50%, Kumba Iron Ore 2.94% and Gold Fields 2.83%, while ArcelorMittal (+4.02%), Glencore (+1.34%), South32 (+1.28%) and Jubilee Platinum (+1.11%) gained.

Anglo American ended the day 0.16% higher after the diversified miner said it expects its strong performance this year to gain momentum in 2022 and beyond, with an expected 35% growth over the next ten years.

Sibanye-Stillwater gave up 1.65% as the gold miner pleaded with unions to reach a sustainable wage agreement and avoid strike action that could have “significant consequences” for its operations.

The Retail index (-3.15%) saw the biggest drop, with Pepkor (-3.84%), Foschini (-3.78%), Massmart (-3.55%), Mr Price (-3.15%) and Woolies (-2.90%) leading the slide. Drug retailer Dis-Chem also got hurt, skidding 4.78%.

Ecommerce heavyweight Prosus (-1.14%), which holds a 29% stake in Tencent, tracked a similar slide in the Chinese tech behemoth. Naspers gained 0.80%. Bloomberg reports the world’s biggest equity capital markets deals of the year have almost exclusively come out of Asia, with a $14.7bn secondary share sale in Tencent in March the biggest follow-on offering in 2021 as well as the second-largest block trade on record. In the last three weeks Tencent also invested $48m in Cape Town-based digital-payment gateway Ozow and $180m in Patrice Motsepe’s TymeBank.

Stemming the losses were rand-hedges Anheuser-Busch Inbev (+0.18%), British American Tobacco (+1.99%) and BHP (0.70%). Richemont was down 0.46%.

Diversified, global engineering project delivery and operations management group DRA Global, which listed on the JSE and Australian Securities Exchange in July this year, also added some green, jumping 11.43% on its continued daily share buy-back programme.

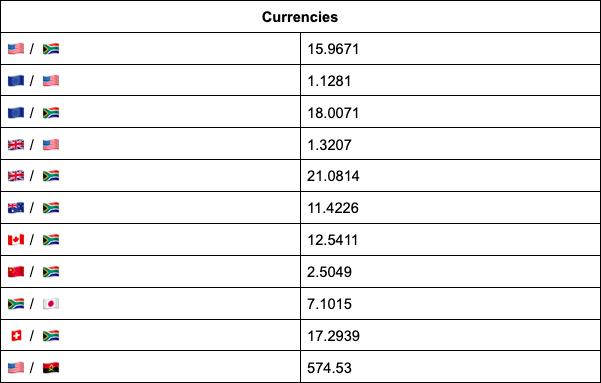

On the forex front, the rand ended the local trading session flat after a fairly volatile day. “Today the rand made some significant moves ahead of the US CPI figures. The unit weakened to R16.08 at one point, from its R15.92 opening. After the release of the US CPI figures, which were in line with estimates, it firmed to as low as R15.88 but has given back some ground and is currently trading relatively flat at R15.94,” comments TreasuryONE.

The market will now look to the outcome of next week’s FOMC meeting for any changes to the pace of taper and timing of interest rate hikes, said the forex trading house.

Indicators as at 17:00, brought to you by TreasuryONE.