(Bloomberg) — Supply Lines is a daily newsletter that tracks Covid-19’s impact on trade. Sign up here.

A line of more than 80 container ships waiting to dock at the ports of Los Angeles and Long Beach, California, was cut in half in late November — or so it seemed. Turns out the vessels disappearing from the queue were merely hiding from it, loitering in the Pacific out of reach of the official count.

The actual bottleneck at midweek stood at 96 ships. In a recurring theme in economies from Germany to the U.S., progress repairing this supply snarl proved to be a mirage.

As the year supply chains went haywire winds down, logistics experts are struggling to distinguish between the rays of real improvement and the false dawns. Even if the optimists are proved correct in detecting a peak in the gridlock, the fragile global trading system faces months of additional pain and remains at risk of collapsing again from even one unforeseen shock.

“I wouldn’t necessary call this a bottom,” said Jennifer Bisceglie, the CEO of Arlington, Virginia-based Interos, a supply-chain risk management company. She sees any return to normal as an 18- to 24-month transition, partly because companies are grappling with pandemic challenges alongside efforts to fortify supplier networks with digitization.

Among the signs of a nascent turnaround is an Oxford Economics report released this week that showed an easing of U.S. supply-chain stress in November. But the fallout from the new coronavirus variant, which triggered another round of restrictions ahead of the Christmas travel season, “risks slowing the pace at which supply-chain problems are resolved, and could unwind the progress achieved thus far,” it said.

“It’s far too early to say we’ve seen the peak of supply-chain disruptions,” said Oren Klachkin, lead U.S. economist at Oxford Economics. “The situation is very fluid and the omicron variant could make the situation worse.”

No Relief in Sight

The monthly U.S. Logistics Managers’ Index released this week hardly showed a lurch toward normal, either. The main gauge climbed for a second month in November, reflecting warehouse costs that jumped to a record, as well as rising inventory and transportation expenses.

Respondents to the LMI’s survey don’t anticipate any significant relief over the next 12 months.

Zac Rogers, who helps compile the LMI as an assistant professor at Colorado State University’s College of Business, said the worst is probably over in the mismatch between logistics capacity and demand.

Still, he cautions that passing the bottom doesn’t mean supply chains are in the clear or can’t return there. Rogers points to the ongoing semiconductor shortage as the heart of the problems because it means, for instance, a new class-8 truck ordered today won’t be finished until February 2023.

“We still have a long way to go until things are back to normal,” he said. “We aren’t going to wake up on Jan. 1 and suddenly have all of the trucks and storage that we need to get costs to go down in any meaningful way.”

Ocean Shipping

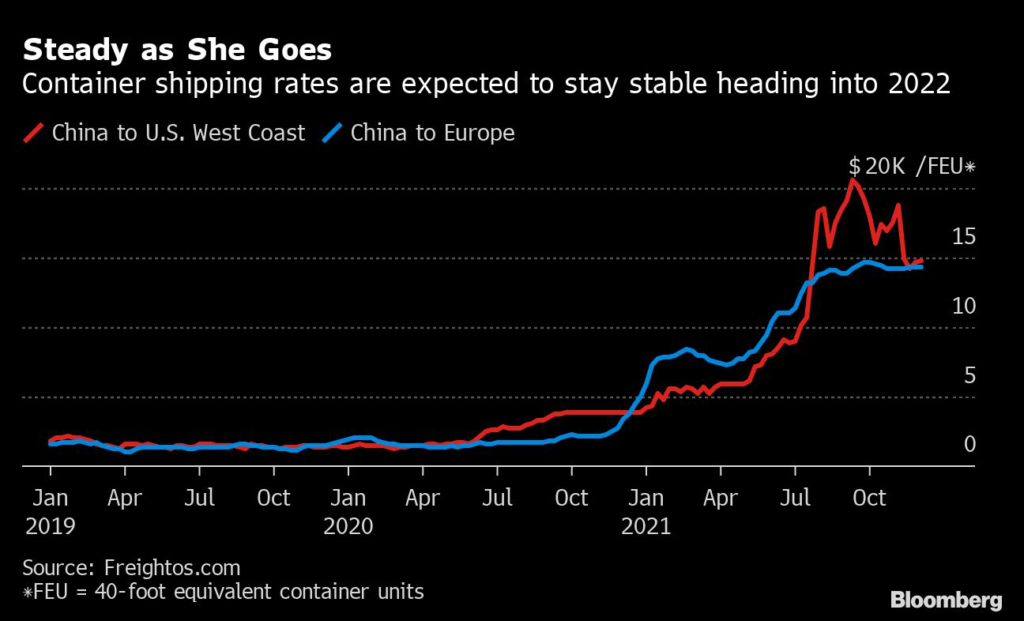

Capacity constraints continue to keep ocean shipping rates at high levels.

The price for a 40-foot container to the U.S. West Coast from China inched back up during the past two weeks, to $14,825, according to Freightos data that includes surcharges and premiums. While that’s down 28% from a record of $20,586 reached in September, it’s still more than 10 times higher than it cost in December 2019.

Many observers note that those headline-grabbing rates reflect the spot market, and most big retailers and manufacturers pay lower rates spelled out in annual contracts typically renewed with the carriers around April each year.

Now long-term contract rates for containers are heating up, with a 16% jump in November leading to a 121% surge year over year, according to Xeneta, an ocean- and air-freight market-analytics platform.

“It’s difficult to see a change of course ahead, with the fundamentals stacked very much in favor of the carrier community,” Patrik Berglund, CEO of Oslo-based Xeneta, said in a online post. “In short, they’ve never had it so good, while many shippers, unfortunately, are well and truly on the ropes.”

Air Freight

Pressure is also unrelenting in the air-cargo market, where rates are still climbing amid demand fueled partly by the delays and soaring costs for ocean freight. As the Federal Reserve’s most receive Beige Book noted, the cost of transporting goods on ships recently exceeded the cost on airplanes.

So analysts say there’s little to reason to expect air freight rates will go down in the short run. Camille Carenton, a senior air cargo manager with Flexport Inc., said on a webinar this week that “really strong” and is leading to backlogs at U.S. and European airports, with delays ranging from two to seven days.

“The past few months have seen a rare convergence of limited capacity, higher demand, and a peakier peak season but the elevated prices so far are still likely more seasonal than anything,” said Eytan Buchman, chief marketing officer at Hong Kong-based Freightos, an online cargo marketplace. “That doesn’t mean the worst isn’t over though.”

Europe’s Struggles

In the euro area, a Bloomberg Economics gauge shows supply conditions cooling down from heighten levels. Whether that trajectory lasts gets depends on whether the virus can be controlled. In Germany, a survey released Tuesday showed investor confidence about the current environment dropped to a six-month low as the country reintroduces restrictions to curb virus outbreaks.

German manufacturers have been held back for months by global supply problems. Underscoring their challenge, data on factory orders released Monday showed a slump that was far worse than any analyst predicted. On top of that, consumers are being squeezed by the fastest inflation since the early 1990s.

“Persisting supply bottlenecks are weighing on production and retail trade,” ZEW President Achim Wambach said in a statement. “The decline in economic expectations shows that hopes for much stronger growth in the next six months are fading.”

U.K. Trucker Shortages

In the U.K., the economy is still grappling with strains ranging from crammed ports to truck driver shortages. A.P. Moller-Maersk A/S recently said it’s omitting until March some container services through the congested Port of Felixstowe, Britain’s busiest container gateway, and routing U.K. cargo on shuttles from mainland Europe.

A lack of lorry drivers is still perhaps the biggest cause of British cargo backlogs. Logistics UK said in a report this week that the number of heavy goods vehicle, or HGV, drivers dropped by 72,000 — or 24% — between the second quarters of 2019 and 2021.

British logistics companies are taking steps to boost training, recruitment and pay, “yet there remains concern that some supply-chain disruption will continue in 2022 until these crucial roles are filled across the industry,” the report warned.

After falling in October and November, the Transport Exchange Group’s index for courier and haulage prices may jump this month if spikes in the past two Decembers are any guide.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.