(Bloomberg) — Bitcoin tumbled below a closely watched price level as the slide in the largest cryptocurrency from its all-time high extended into a fifth week.

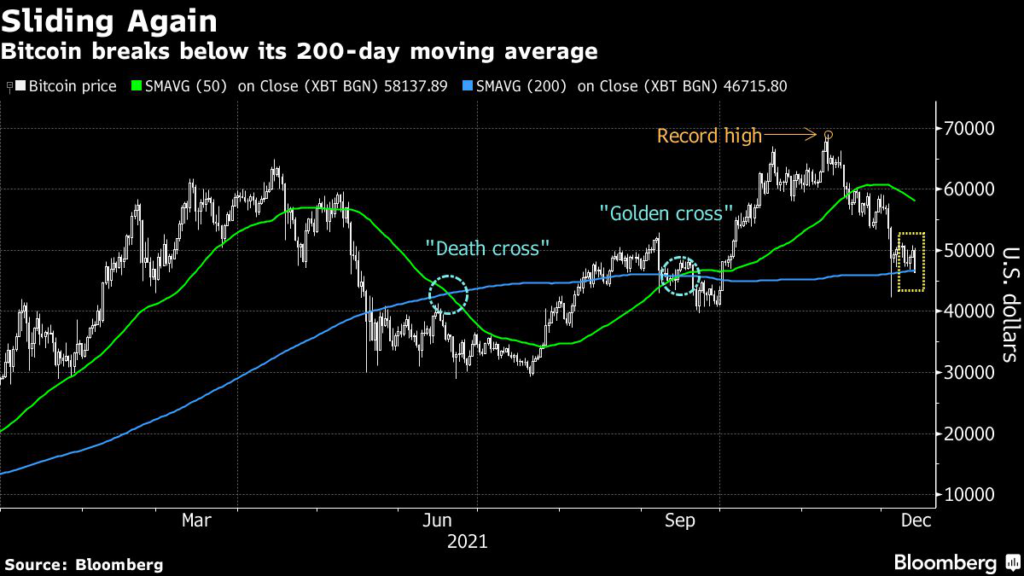

The digital asset dropped as much as 8.4% to $45,773 on Monday in New York trading. The decline pushed it below its average price over the last 200 days, which currently stands around $46,720.

The Bloomberg Galaxy Crypto Index slumped as much as 7.4% to its lowest since early October, while popular DeFi tokens such as Solana, Cardano and Polkadot fell even more.

“The idea that as it matured, the volatility would ease has not really materialized,” said Marc Chandler, chief market strategist at Bannockburn Global Forex. “The volatility is deadly and its other supposed attributes, like a hedge against inflation, seems spurious.”

Bitcoin has dropped for four consecutive weeks as measured by the seven days ended Friday. Unlike most traditional asset classes and securities, digital tokens trade around the clock, often on lightly regulated online exchanges worldwide.

Bitcoin got a brief boost Friday after a report showed U.S. consumer prices accelerated, supporting the argument that the coin is a hedge against the erosive impact of inflation. On Dec. 4, the token tumbled as much as 21% before recouping around half the loss hours later. It’s still down about 30% from its record high of almost $69,000 reached Nov. 10.

Proponents have long argued that Bitcoin and other digital assets, on account of their being an idiosyncratic asset class, could act as hedges against swings in other areas of the financial market. Only 21 million Bitcoin will be put into circulation under the computer protocol that governs issuance, though that figure isn’t expected to be reached for another 100 years.

“These types of moves are expected — I think it’s pretty standard,” Dan Gunsberg, co-founder of Hxro Network, said by phone. “It’s very healthy — you get a lot of froth and a lot of projects that maybe their reason for being here were a little more short-term motivated, those end up getting flushed out.”

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.