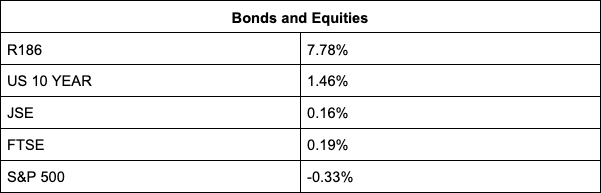

The JSE nearly lost its footing just before the close after the release of the biggest-ever annual jump in US producer prices.

Bloomberg reports the spike in inflation, which follows Friday’s jump in consumer prices at the fastest pace in nearly 40 years, is putting pressure on policy makers to act.

The Federal Reserve is on Wednesday expected to accelerate tapering of its bond-buying programme – an action that would allow officials to begin increasing interest rates next year. Other central banks, including the European Central Bank, Bank of England and Bank of Japan are due to announce their policy decisions this week.

Significant gains in MTN, Kumba Iron Ore, Implats, African Rainbow Minerals and health stocks kept the bourse afloat, with the All Share index closing up 0.16% at 71,544.82 points after a brief visit in the red.

MTN moved 5.64% higher after its Nigerian unit was awarded a 5G licence, paving the way for the continent’s largest wireless carrier to supply faster internet to consumers and businesses.

Peer Telkom gained 1.58% after the telecoms provider announced that outgoing CEO Sipho Maseko will step down earlier than planned at the end of December after eight years at the helm.

Adcock Ingram, which counts Panado painkillers and the cold and flu product Corenza C among its brands, added 3.70% after the drugmaker said it expects half-year profits to rise by at least a fifth amid improving demand and an absence of retrenchment costs.

Hospital group LIfe Healthcare gained 5.01%.

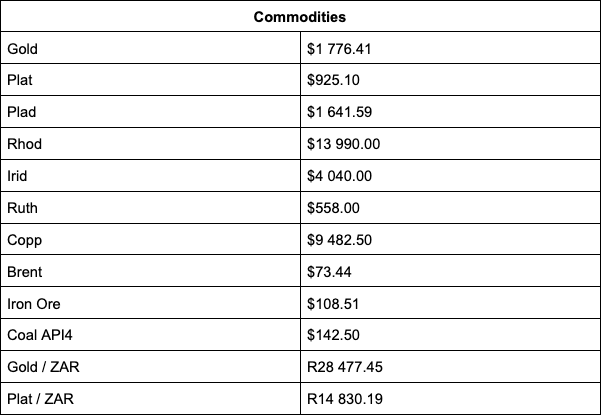

Kumba Iron Ore gained 4.47% and African Rainbow Minerals, which among other industrial metals mines and beneficiates iron ore, added 3.42% as the price of iron ore continues to gain amid demand optimism on expectations that China will move to increase stimulus next year to bolster the economy.

Precious metals fell on a busy trading day, with palladium – down 4% at the local market close – the biggest loser.

Precious metals have since changed course, with palladium trading flat at $1,681.56 and gold just 0.17% down at $1,783.57/oz. A late 0.38% rally in the platinum price to $937.09 supported heavyweight platinum counters, with Implats adding 3.76% and Angloplat 1.74%.

However, Northam (-0.13%), Implats’ rival for smaller platinum producer RBPlats (-0.12%), gave up earlier gains. Meanwhile, Simply Wall Street reports that an intrinsic calculation for Northam suggests that the miner is 47% undervalued.

Eastplats dipped 3.56% after the dual-listed platinum producer said it’s in the process of arranging an updated compliant independent technical report on the Crocodile River Mine which will be the basis for fundraising efforts to restart underground operations.

Sasol slumped 6.00% after the producer of synthetic fuels said it has reduced production at its Secunda Operations as a result of a significant coal supply shortfall.

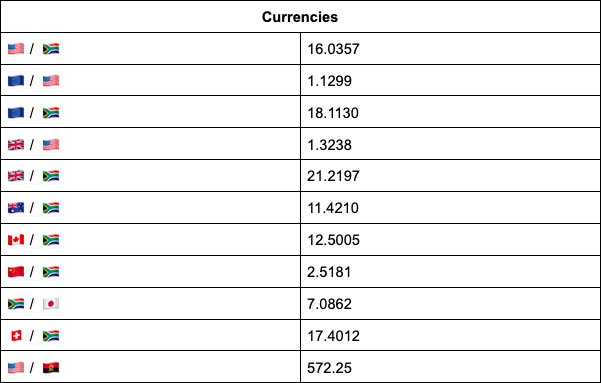

On the forex front, the rand lost ground following the US inflation print and amid new contagion from Turkey.

Emerging market currencies stayed vulnerable despite central banks in Pakistan and Hungary raising interest rates. Bloomberg reports Pakistan raised its key rate for a third consecutive meeting, the most aggressive tightening in Asia to combat the region’s fastest inflation, while Hungary raised the required reserve rate less than expected in a move signaling further monetary tightening for one of the most hawkish central banks in Europe.

The rand was last changing hands 0.52% weaker than its overnight US close at R16.10 against the greenback.

Source: TreasuryONE