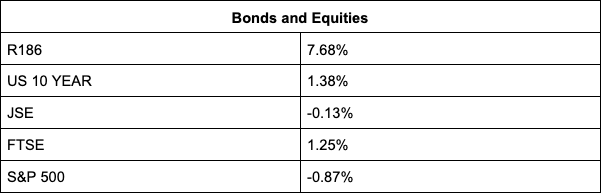

The JSE resumed where it left off on Wednesday, extending losses by 0.37% to end the week on 71,203.13 points amid a selloff in heavyweight rand-hedges and tech counters, ongoing omicron concerns and as hawkish signals from the US Federal Reserve and other central banks on interest rates hit growth stocks around the world.

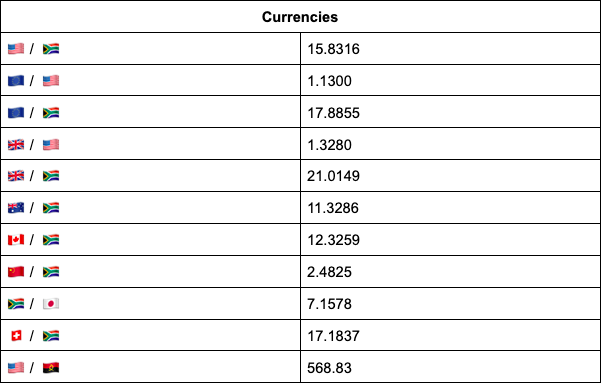

The rand, defying all odds to test R15.80 against the US dollar in intraday trade, added to the selloff in All Share index heavyweights Naspers (-4.26%), Prosus (-3.55%) and Richemont (-5.04%).

“The big EM story at the moment is the fact that Turkey has halted all trading on its equity and derivative markets after sustaining massive losses in early trade.

The Turkish lira is in free fall and has been trading at around 16.80 against the US dollar. However, we haven’t seen any contagion effect from the lira rout in the EM space,” comments TreasuryONE.

The rand is now stronger than the lira bearing in mind that the local unit was trading at R2/lira at the start of the year, adds the forex trading house.

At last count the rand was changing hands at R15.85/$, with a move stronger in the US dollar against the euro hampering further rand strength.

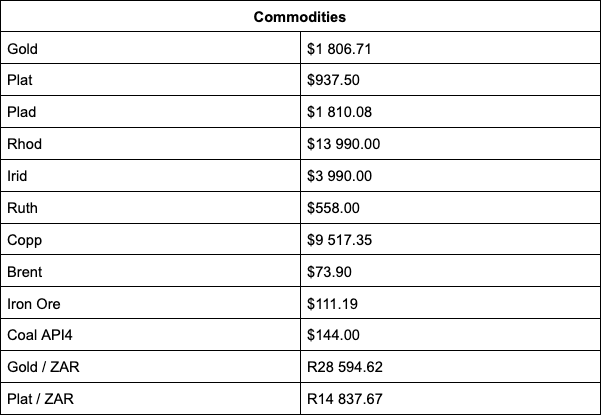

A strong run in commodity prices – palladium up 3.26% at $1,791.00, platinum 0.32% at $944.50 and gold up 0.26% at $1,804.10 in trading after the local market close – buoyed mining counters, stemming a bigger drop in the JSE.

Harmony (+5.34%), Anglogold Ashanti (+5.08%) and Gold Fields (+4.88%) led the gains with Angloplat (+3.18%), Implats (+3.94%) and Anglo American (+0.75%) lending support.

Sasol (+1.53%) ignored an almost 2% slump in Brent Crude, which was last trading at $73.68 a barrel.

Kumba Iron Ore was 0.82% firmer after the Anglo subsidiary announced a R1.6 billion mining contract to a black-owned, community-based joint venture at its Kolomela Mine.

Steinhoff surged another 10.79% following yet another big settlement, this time with Mauritius-based company Trevo Capital, paving the way to complete settlement of global claims.

This follows the deal Steinhoff reached at the end of the previous trading session with the former owners of footwear retail chain Tekkie Town.

Among the other big losers weighing the bourse down were Textainer (-8.29%), Montauk (-5.59%) and Multichoice (-5.05%).

Source: TreasuryONE