(Bloomberg) — Bitcoin fluctuated in a fairly narrow range of less than 5% with risk sentiment across global financial markets dwindling.

The largest cryptocurrency by market value was little changed after declining as much as 2.5% to $45,583 on Monday in New York.

It has slumped about 30% since setting a record high in early November. Ethereum edged higher, while popular DeFi tokens such as Solana, Cardano, Polkadot and Polygon also swung between gains and losses.

“The macro talking points around Bitcoin as a store value, as an inflationary hedge, has definitely gained a ton of traction,” said Chris Matta, president of 3iQ Digital Assets. “And so what that means now in a risk-off environment is you’re starting to see Bitcoin maybe get a little more correlated to traditional assets.”

Central banks globally are prioritizing the fight against elevated inflation by tightening monetary settings, while also keeping a wary eye on the impact of omicron.

That backdrop has investors questioning whether so-called risk assets such as cryptocurrencies and technology shares are due for a rougher patch after surging from pandemic lows.

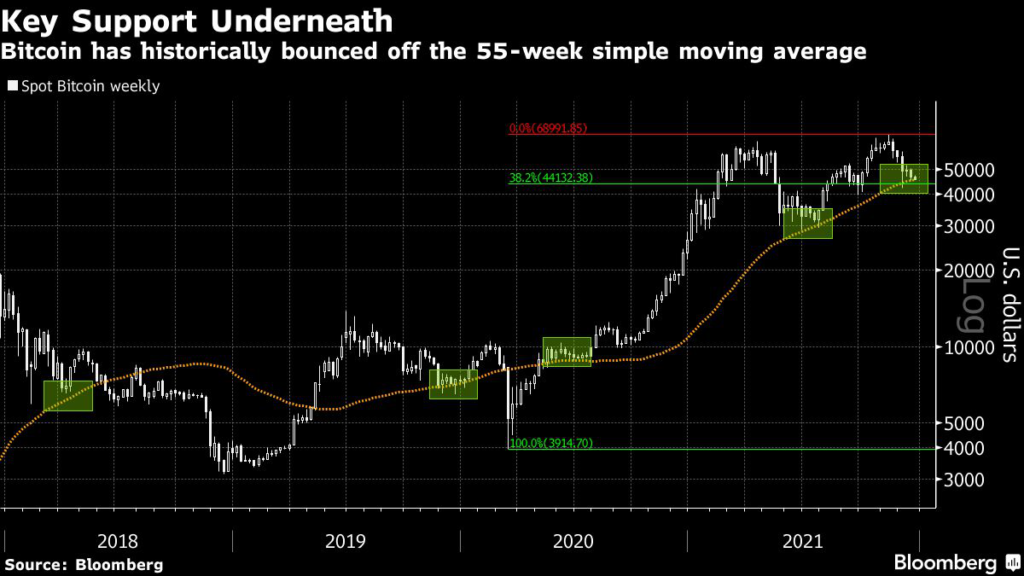

Bitcoin is also facing some price levels that technical analysis watch for signs of future direction.

The digital currency is sitting at its 55-week simple moving average. The token has typically bounced higher the past several times it reached the level.

Katie Stockton, founder of Fairlead Strategies, is eyeing $44,200 as a support level for the cryptocurrency.

If that level is broken, “important long-term support at the bottom boundary of the weekly cloud will likely be tested, near $37K,” she said.

Bitcoin dropped for five consecutive weeks as measured by the seven days ended Friday.

Unlike most traditional asset classes and securities, digital tokens trade around the clock, often on lightly regulated online exchanges worldwide.

The risk of an “imminent reduction in liquidity” as the Federal Reserve pares back its asset-purchasing program will weigh on risky assets, particularly those that don’t generate cash flow, including Bitcoin, according to Jay Hatfield, chief executive and founder of Infrastructure Capital Management.

“When there’s a lack of liquidity, the riskiest” assets get hit the most, he said.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.