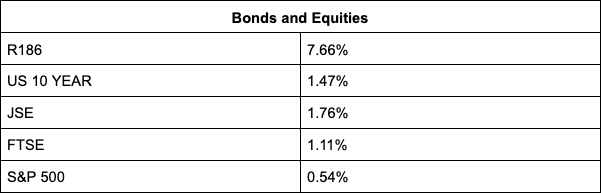

The JSE reversed almost all its losses of the previous session in line with global peers as investor appetite for risk returned after yesterday’s global selloff, with the FTSE/JSE All Share index ending the day 1.47% higher at 71,119.36 points.

Bloomberg reports as the bourse closes in on its best year since 2012, the benchmark index is set for more gains on the back of a weakening rand, attractive valuations and supportive monetary policy.

“We have a positive outlook for South African equities in 2022, expecting double-digit returns,” Jonathan Kennedy-Good, a Johannesburg-based analyst at JPMorgan Chase & Co told the news service provider.

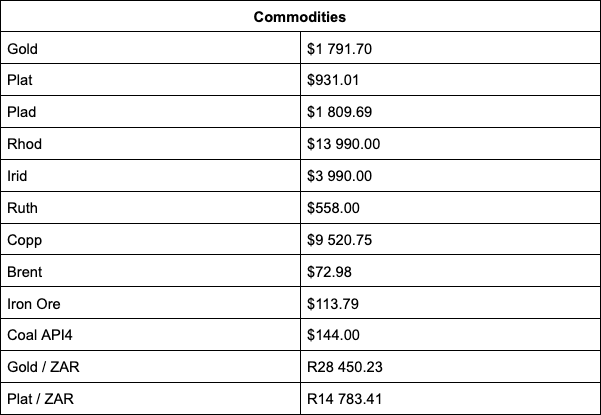

Sasol surged 3.60% after the multinational investment bank said it favours the chemicals sector, where the fuel-from-coal producer is seen benefiting from higher oil prices, despite coal production issues. An almost 1.5% rise in Brent crude to $73.13 a barrel also supported the stock.

Platinum-linked stocks also gained on JPMorgan’s optimism in platinum-group miners on expected gains in PGM metal prices amid rising demand from carmakers. Implats added 4.40%, and Northam gained 3.31% despite platinum closing flat at the end of local trade. The metal was however slightly up in after-close trading, with platinum last changing hands at $938.35/oz.

African Rainbow Minerals extended its gains with 3.16% as investors continue to cheer the R3.5bn Bokoni platinum mine acquisition.

Sibanye-Stillwater (+4.73%) and Harmony (4.35%) looked the other way as gold lagged, trading 0.25% lower at $1,786.10/oz, despite the “US dollar trading sideways and the seemingly risk-off surrounding the omicron variant still firmly dominating news headlines”, comments TreasuryONE.

JPMorgan is also overweight telecoms, with MTN (+0.03%) expected to benefit from a growing fintech business in Africa as well as increasing demand for data, according to the Bloomberg report. Telkom added 3.36% and Vodacom 0.87%.

Furniture retailer Steinhoff jumped 11.14% on bargain-hunting, with peer Lewis (1.50%) also gaining. Massmart weakened 3.91% after the consumer goods distributor flagged a wider annual loss due to store damages and lost trading income suffered due to looting in July. Retailers Shoprite (-1.03%), Pick n Pay (-0.37%) and Pepkor (-1.06%) all lost.

Other heavyweight counters were mixed, with Montauk (+5.69%), Textainer (+5.45%) and Bytes Technology (+3.56%) gaining and Naspers (-0.63%) and Barloworld (-1.63%) losing.

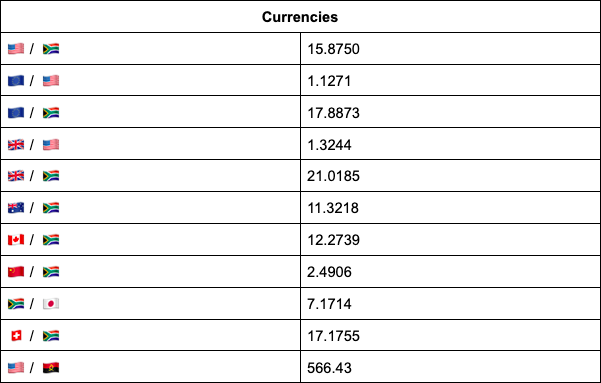

In the forex market, the rand drifted weaker to last trade at R15.87 against the dollar as the US unit lingered around its recent highs on the back of the US Federal Reserve’s hawkish stance and after Goldman Sachs trimmed its US economic growth forecast for 2022.

The big emerging market news is from Turkey, where the Turkish president unveiled a plan to guarantee local currency deposits against market fluctuation, comments TreasuryONE. “The Turkish lira strengthened almost 17% against the USD at one stage today but has since lost some of the gains, trading 6% stronger on the day. The rand is trading very comfortably within the R15.75 to R16.10 range for now,” TreasuryONE adds.

Indicators as at 17:00

Source: TreasuryONE