(Bloomberg) — Investors are shifting their focus from supply chain concerns to whether consumer strength can continue to sustain the economy. You can see it in the movement of Nike Inc.’s stock.

Nike’s stock, however, is a different story. It has been far more sensitive to revenue growth than anything happening with margins. That may mean investors considered the supply chain concerns from earlier this year, which weighed on margins, as temporary and were more focused on continued spending from consumers.

From a macro perspective, it signals the reliance on the strength of the consumer, particularly in economies like the U.S. that are driven by spending ability. There was a lot of momentum in 2020, but it has since decelerated. The most recent leg lower is most likely a function of stalled revisions starting in October. For a global economy that has largely been powered by American consumers flush with fiscal and monetary stimulus, this plateauing could be cause for concern in 2022.

The purchasing power of U.S. consumers is crucial to the global recovery, but the asymmetrical regional progress is also something to keep an eye on. Nike, for example, beat its overall earnings estimates for its most recent quarter, although its sales in China plummeted due to production delays in its Vietnam factories and reduced consumer activity due to the country’s zero-Covid policy. Year-over-year sales are up 12% in North America but down 20% in Greater China. Meanwhile, European revenues proved resilient, gaining 6% on an annual basis and sparking rallies in other athletic wear stocks.

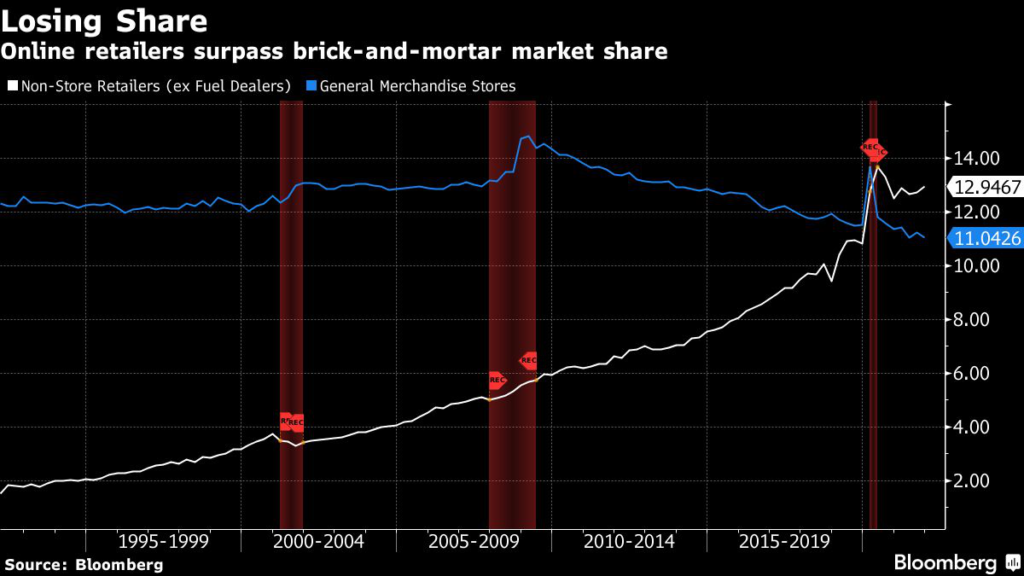

The other piece of the equation is the whether sales are coming from online or retail stores, which has implications for inventory. For example, in-store merchandise returns can be immediately added back to store stock rather than dealing with shipping lags. In 2020, Nike’s sales from e-commerce surpassed those from bricks-and-mortar retail. It’s a broad trend that’s only likely to continue globally as the recovery faces threats from Covid variants like omicron.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.