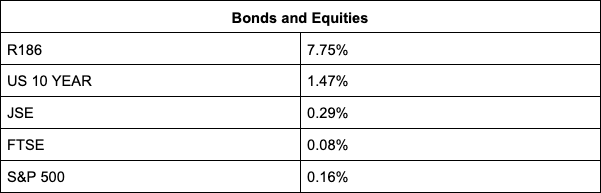

The JSE ended in the green for a second consecutive session after recent global selloffs due to omicron, with the All Share Index ending the day 0.34% higher on 71,359 points.

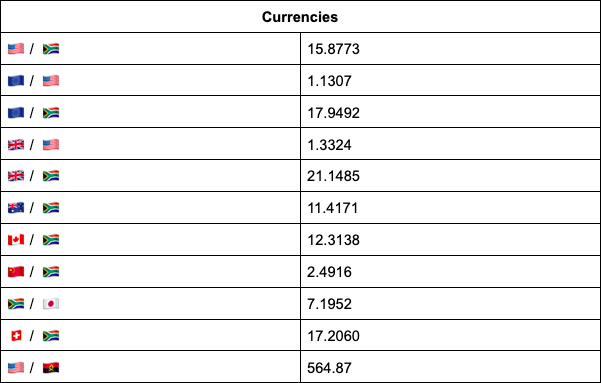

On the currency front, the rand spent most of the day below the R15.90-level against the US dollar and was last trading 0.23% firmer from its overnight close at R15.81/$, as risk appetite continued to improve on expectations that the impact of the omicron variant on the global economy will be limited based on early data, reports Reuters.

Since the outbreak of the omicron variant in late-November, investors heading into the holidays have been trying to avoid risk, with knee-jerk reactions being the order of the day every time there is some development on the virus, according to Reuters.

TreasuryONE, however, expects markets to stay flat as the holiday season approaches. “We could continue to see subdued movement in the currency space as we head further into the December holidays,” says the forex trading house.

Back on the JSE, Steinhoff was one of the biggest winners, continuing its run from the previous session to end the day 9.49% firmer. Retail peers Massmart (+0.81%), Lewis (+3.31%), Pick n Pay (+0.08%), Shoprite (+0.47%), Pepkor (+1.22%) and Woolworths (+1.77%) all ended in the green.

Healthcare providers had a good day of trading, with Netcare gaining 3.2%, Mediclinic 1.61% and Life Healthcare 0.32%, while pharmacies Dis-Chem and Clicks added 2.51% and 0.48% respectively. Aspen Pharmacare added 3.52%.

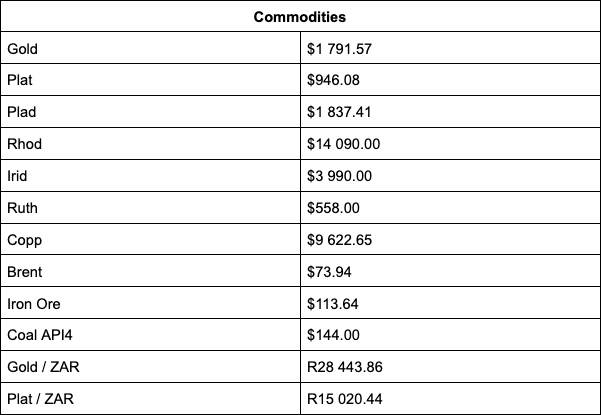

On the commodities front, palladium was the best performer ending the day at $1,835, a 2.5% gain on the previous close. Platinum and copper both added 1% while gold was flat, trading at $1,793. Platinum is currently trading at $946/oz, while Brent crude was selling for just under $74 a barrel.

Anglo American was flat despite subsidiary De Beers’ provisional sales for its tenth sales cycle of 2021 coming in at $332 million (R5.27 billion), down from $438 million in its ninth cycle.

“Despite the ongoing challenges of Covid-19, our rough diamond sales for the year are higher than what we saw in 2019 before the onset of the pandemic, and much higher than our sales in 2020,” said De Beers CEO Bruce Cleaver.

Mining counters were mixed with DRDgold (+0.99%), African Rainbow Minerals (+1.36%), Angloplats (+0.59%) and Glencore (+0.92%) gaining, while Implats (-0.21%), Gold Fields (-0.06%) and Sibanye-Stillwater (-0.27%) clocked losses.

Naspers (+1.01%) and Prosus (+1.08%), which together have a 12% weighting in the All Share index, were the main drivers of the bourse’s gain amid big announcements in ventures in which they have a shareholding. In Germany, Delivery Hero announced it would exit its food delivery business in that country and divest its Japanese operations, while Prosus participated in a further funding round into an Indian tech-based seafood market place, Captain Fish. Prosus jointly led the funding round with US investment firm, Tiger Global to the tune of R635 million.

Other heavyweight counters were mixed, with Montauk (-0,23%) and Textainer (-0.67%) losing and Bytes Technology (0.31%) and Barloworld (1.09%) gaining.

Insurer Sanlam added 2% following an announcement that it is in talks with Europe’s largest insurer, Allianz, over the exploration of various strategic alternatives to their respective African business operations, excluding South Africa. In September, Sanlam said it was exiting several of its UK-based businesses to free up capital for expansion into Africa and India. Subsidiary Santam gained 0.01% on the back of the Allianze news.

Indicators as at 17:00