(Bloomberg) — Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

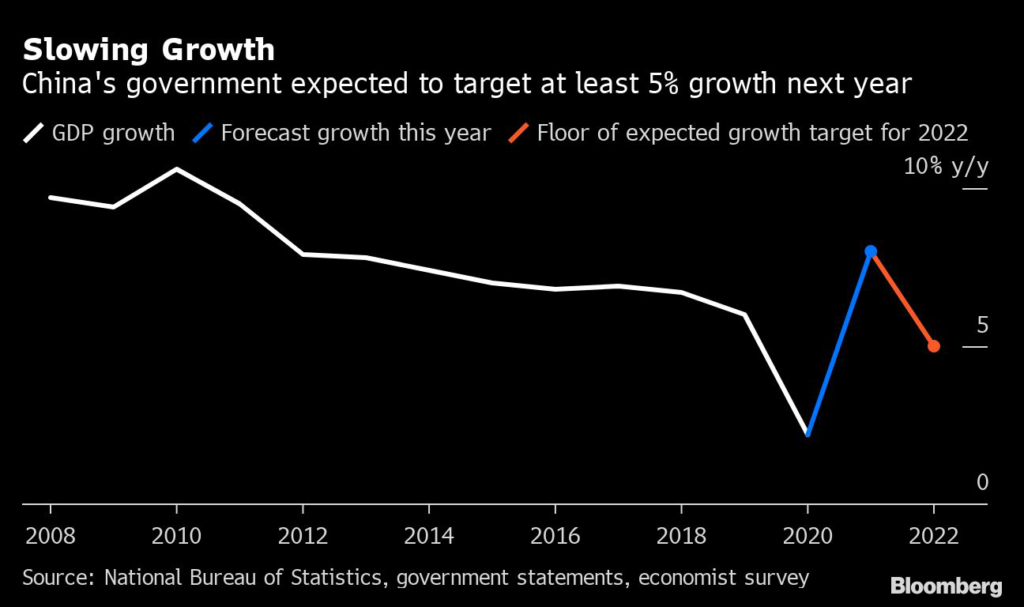

China is seen adding stimulus to stabilize growth next year, with various ministries vowing more proactive measures to reverse the slowdown caused by a worsening property slump, weak consumption and the coronavirus.

As downward pressure on the economy increases, China’s top leaders made ensuring stability their top priority for next year, telling all regions and ministries to share responsibility in achieving that goal.

Heeding the call, the central bank pledged to pro-actively introduce monetary policies that are conducive to economic stability.

The People’s Bank of China will use a variety of monetary policy tools to keep liquidity “reasonable and ample” and ensure credit growth is stable, according to a statement Monday evening after the bank’s planning conference for 2022.

On the same day, the finance ministry said it would proactively roll-out fiscal policies to stabilize growth, with greater cuts in taxes and fees planned for 2022.

China’s economy has slowed in recent months, with the property market slump hitting debt-laden developers and also undercutting industrial output, home prices falling, and investment and private consumption weak.

The emergence of the omicron variant is an added threat to the economy as it could hit demand for exports and tighter restrictions at home could further damage spending.

Last month, residential property sales and the area of new housing started by developers both dropped about 20% from a year earlier, pulling down the pace of overall investment spending.

Retail sales growth slowed to 3.9% in November from a year earlier as people stayed home amid renewed virus outbreaks, while industrial output rose 3.8%.

Earlier this month the PBOC allowed banks to lower the benchmark lending rate by five basis points after unleashing 1.2 trillion yuan ($188 billion) of money by cutting the amount of funds banks are required to keep in reserve.

It also reduced the interest rate for the re-lending program for small businesses. Credit growth picked up in November after slowing for almost a year.

The PBOC has so far taken a restrained approach to monetary stimulus but expectations are growing that it will do more in the new year, especially if property market problems continue and private consumption doesn’t recover.

Monday’s statement from the central bank comes after it pledged last week to be more proactive in using policy tools to provide greater support for the real economy in 2022.

The central bank will focus on making finance better serve the real economy in 2022, PBOC Governor Yi Gang said in an interview with Xinhua published Tuesday.

According to Yi, that means keeping credit growth stable so that money supply and total social financing increase at the same pace as nominal gross domestic product; optimizing loan structure with more loans to small companies and green or tech firms; and steadily lowering financing costs.

Optimism for further liquidity support from the central bank helped push 10-year bond yields below 2.8% Tuesday afternoon China time, touching the lowest since June 2020.

That drop came after the PBOC injected the most short-term cash into the banking system in two months as demand for liquidity climbed before year-end.

Fiscal Policy

Tax and fee cuts next year will exceed the estimated 1 trillion yuan ($157 billion) in reductions in 2021, according to a Ministry of Finance statement after its annual planning conference.

China has already allowed local governments to sell 1.46 trillion yuan of special bonds from 2022’s quota to speed up spending early next year.

The central government recently told local authorities to use money raised from those sales in a timely manner and to accelerate project preparation, the 21st Century Business Herald reported Tuesday.

Similarly, China’s commerce minister said the ministry will “do everything possible to stabilize the momentum of the consumption recovery, and also stabilize foreign trade and foreign investment.” We should “promptly introduce new policies and measures that meet the requirements of cross-cyclical and counter-cyclical adjustments,” Wang Wentao said it in an interview with Xinhua Monday.

However, rising raw material prices and surging labor and freight costs will make it hard for China to keep its foreign trade growth stable next year, he said.

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.