As global markets paused for breath, the JSE powered ahead to a new record over 73,000 points on strong gains in heavyweight industrial and rand-hedge stocks.

The rand was trading under pressure along with other emerging market units, with the Turkish lira giving up over 6% against the dollar and 5% against the rand even as the country’s central bank said it will take steps to make the lira more attractive than foreign currency. The lira has suffered a nearly 40% loss this year as the central bank pushed ahead with interest-rate cuts at the behest of President Recep Tayyip Erdogan. The Russian ruble and the Brazilian real have also been on the back foot today.

“There could be a couple of reasons contributing to the weaker rand, namely closing of positions ahead of the year end, Turkish lira weakness spilling over into our local market, and the lack of liquidity during this time of the year. However, looking across the board it seems like the market remains slightly risk-averse, with commodities and equities also under pressure today,” comments TreasuryONE.

The local unit was last trading at R15.95 against the US currency.

Rand-hedges Naspers (1.22%), BHP (1.63%), Richemont (2.12%) and Anglo American (1.24%), which together account for about half of the value of the entire stock market all gained.

Financial services counters Ninety One Plc and Ninety One Ltd, up 5.38% and 4.44% respectively, and Investec (+2.67%) also added to the 1.10% rally in the All Share index.

Grindrod Shipping (+8.45%) led the industrial gainers following an upbeat analyst report on its performance, specifically the company’s reinvesting a huge chunk of its profits at a high rate of return, which caused the global shipping services provider to see substantial growth in its earnings. Multinational packaging and paper company Mondi gained 3.47%, with peers Mpact (+3.39%) and Transpaco (+1.52%) also lending support. Nampak bucked the trend, losing 0.27%.

Building counters also stacked up the gains, with Cashbuild adding 3.53%, Italtile 3.13% and Murray & Roberts 3.00%.

Hotel and gaming stocks saw an uptick on suspended travel bans and as omicron jitters calmed down, with City Lodge surging 9.02%, Sun International 3.24% and Tsogo Sun 2.62%.

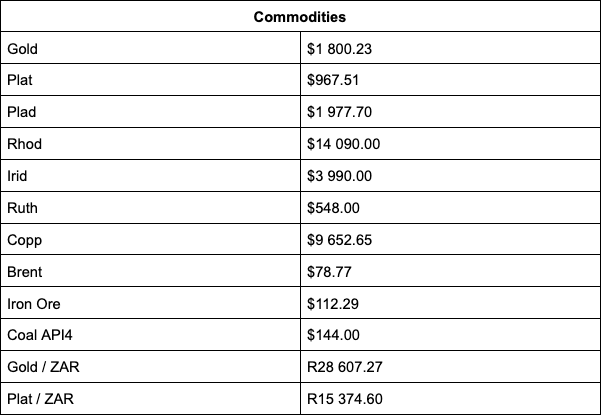

On the commodities front, a dip in precious metal prices weighed on mining counters, with DRDGold (-2.40%), Anglogold (-2.26%), Harmony (-1.37%), Gold FIelds (-1.04%) and African Rainbow Minerals (-0.71%) all ending the day in the red. At last count gold was quoted 0.11% down at $1,803.79/oz, palladium -0.21% at $1,989.89 and platinum -0.68% at $975.86/oz.

Sasol gained 0.35% despite Brent crude giving up 1.04% of its gains to last trade at $78.28 a barrel.

Steinhoff succumbed to profit taking after a strong run in the last two sessions, ending the day 4.62% weaker.

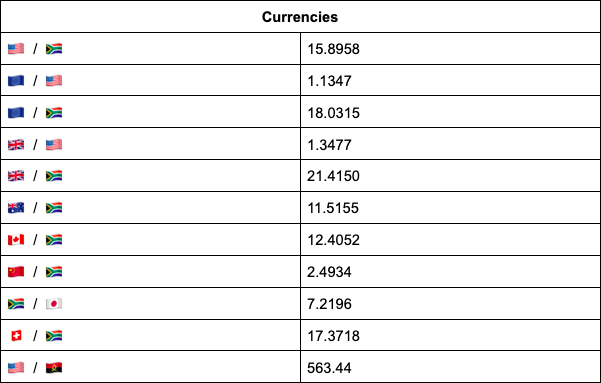

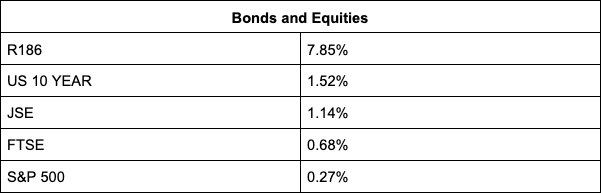

Indicators as at 17:00

Source: TreasuryONE