(Bloomberg) — Bitcoin seesawed between gains and losses Thursday as it tested a key technical level that over the past two years has tended to act as a floor for the world’s largest cryptocurrency.

The digital asset rose as much as 1.1% and was trading around $47,350 as of 9:05 a.m. in New York. It’s down more than 15% this month amid a broader retreat in the crypto sector.

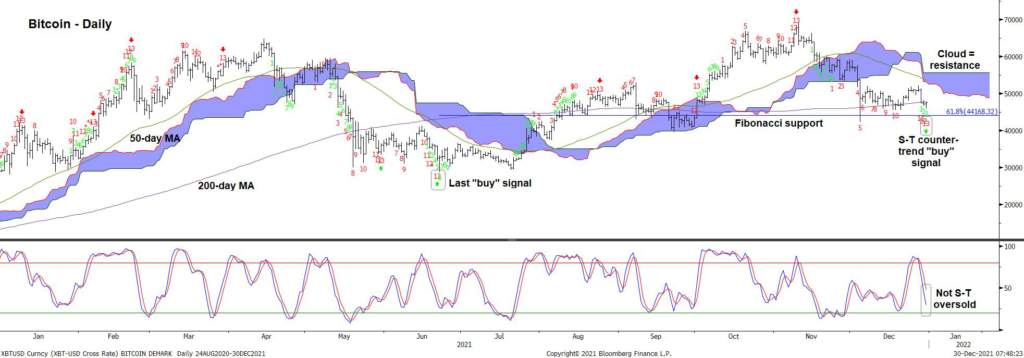

Bitcoin’s drop has taken the token to its 55-week moving average, a level it effectively held after a December flash crash and during the mid-year embers of a crypto rout. The technical study suggests a decisive break below the average would put a slide to $40,000 in play.

Katie Stockton, founder and managing partner of Fairlead Strategies, an independent research firm focused on technical analysis, points out that according to one model, Bitcoin has notched a new short-term buy signal. It suggests a two-week rebound, although it is “low-conviction” because by another measure, conditions do not appear to be oversold, she said.

Bitcoin is an emblem of volatility, and a major question heading into 2022 is whether all its gyrations will eventually leave it lower rather than higher as the tide of pandemic-era stimulus recedes.

Read more: Forget Bitcoin and Ether, the No. 3 Coin Gained 1,300% in 2021

Rosh Singh, CEO and founder of Quadency, says it’s possible that retail investors have been distracted by massive rallies in some alternative coins.

“That puts some pressure on Bitcoin as well,” Singh said in a phone interview. Still, he adds that “a lot of people in crypto are pretty optimistic about the next year and think we should see a rally with the way that things have been going.”

That Bitcoin will continue to run higher is a refrain heard frequently — crypto’s proponents remain undeterred, pointing to trends such as increased interest in the sector from a clutch of financial institutions.

This year “has seen crypto and blockchain mass adoption increase significantly with a large influx of institutional investments that has renewed confidence in this sector,” Walid Koudmani, an analyst at XTB Market, wrote in an email.

That “could ultimately lead to significant price gains and increased volatility as retail investors attempt to catch up,” he said.

Joe DiPasquale, CEO of BitBull Capital, agrees that prices can recover soon and that 2022 is likely to be a positive year for Bitcoin.

“We can expect relief moving into the new year and a possible recovery drive,” he said. “It would be surprising if we see a bear market like 2018 — $100,000 is definitely on the charts, but the timing can vary, especially as macro economic policy shifts and regulations start to emerge in the year.”

(Updates prices throughout, adds new commentary.)

More stories like this are available on bloomberg.com

©2021 Bloomberg L.P.