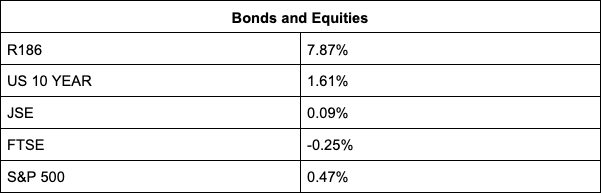

The JSE ended the first trading day of the new year on a positive note, with the All Share index closing a marginal 0.02% higher on 73,722.60 points after breaching 74,000 points in intraday-trading and advancing more than 20% in 2021 despite inflation fears and new COVID-19 variants.

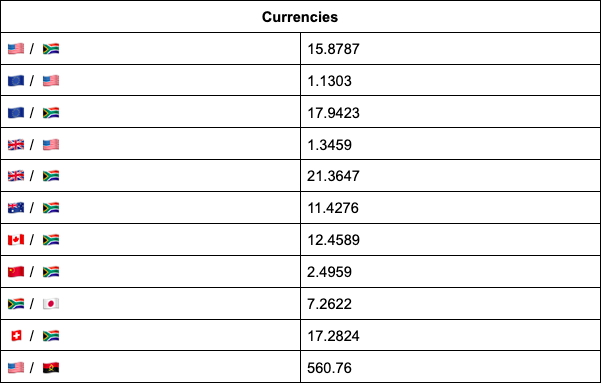

The rand also started the new year trading stronger against the US dollar, touching R15.76 at one stage, but “it was more a case of the US dollar being a little bit weaker than any EM movement”, reports TreasuryONE. The local unit, however, gave up some gains in the afternoon session as US markets came online and was last changing hands at R15.88/$.

“On the EM front, we have seen most currencies following the US dollar with little in the way of market-moving news at the start of the new trading year. We expect the dollar to be the primary market mover this week, with the FOMC minutes out on Wednesday and the US non-farm numbers on Friday,” says the forex trading house.

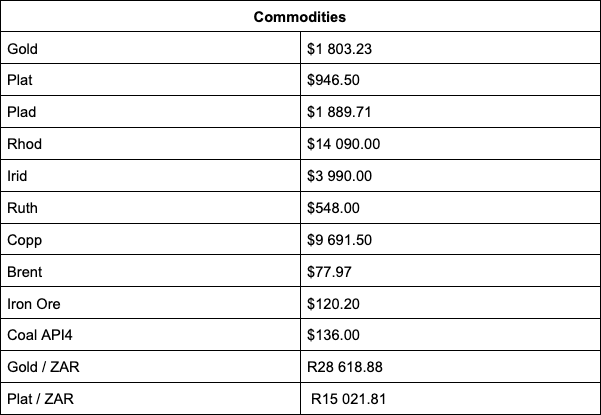

On the commodity front, precious metals lost their lustre as the day progressed, with all commodities except oil ending the local session in the red. Gold was last trading at $1,806/oz, platinum at $950 and palladium at $1,889. Brent was selling for $78.15 a barrel.

Sasol gained 2.60%.

Karoo, which provides real-time mobility data analytics solutions for smart transportation globally, was the top gainer, adding 7.48%, while gains in Naspers (1.06%), Prosus (0.46%), Standard Bank (2.65%) and First Rand (1.02%) also buoyed the bourse.

Sibanye-Stillwater, one of the four JSE mining firms that took major bets in preparation for expanding supply deficits in 2022 gained 0.04% after placing the winning bid for Brazil’s Atlantic Nickel mine. The other three had mixed fortunes, with Exxaro adding 1.59%, Implats losing 2.91% and South32 ending flat.

Other metals among the biggest losers were Harmony (-4.50%), Gold Fields (-1.69%), Anglogold (-1.55%) and African Rainbow Minerals (-1.50%).

Health counters Aspen Pharmacare (-2.06%) and Life Healthcare (-1.62%) also shed blood.

Indicators as at 17:00

Source: TreasuryONE