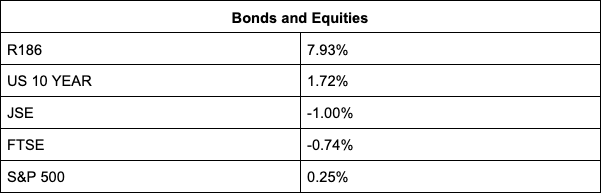

It was bound to give. The JSE ended its three-day winning streak with a 1.19% dip to end the day on 74,165.25 points as investors mulled over the hawkish minutes of the US Federal Reserve’s December meeting that signalled tighter monetary policy will be here sooner rather than later. Precious metals took a beating.

Bloomberg reports the Fed is now at the core of the investment outlook for 2022, overriding continuing concerns over slowing global growth, China’s regulatory crackdown and supply bottleneck, with its minutes showing officials’ increasing preference for a faster path of rate hikes and a shrinking of the bank’s $8.8 trillion balance sheet simultaneously.

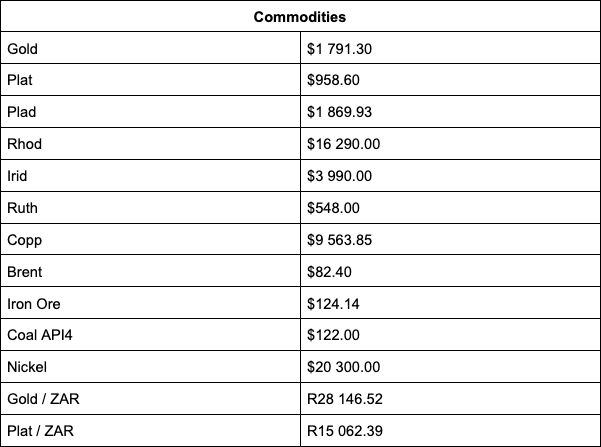

Mining stocks tracked weaker precious metals, which traded under pressure on the hawkish FED minutes, with gold pummeled down 1.14% to end local market trade at $1,788/oz. Platinum and palladium also took a beating, trading 2.85% lower at $962/oz and 1% weaker at $1,846/oz respectively. Gold counters Harmony (-8.48%), Gold Fields (-7.34%) and Anglogold (-5.96%) all bled. Sibanye-Stillwater (-4.21%) suffered a double blow of a softer gold price and a looming wage strike.

Implats led the losses among PGMs, giving up 4.19%, with Jubilee (-2.03%), RBPlats (-1.67%), Northam (-0.89%) and Angloplat (-0.86%) following suit.

Sasol ended the day 0.08% lower despite an almost 2% surge in Brent crude to $81.90 a barrel.

Bucking the trend were ArcelorMittal (+6.08%) and Kumba Iron Ore (+2.30%).

Local tech counters tracked the global tech rout, with Naspers losing 3.56%, Bytes Technology 4.76% and Prosus 3.58%.

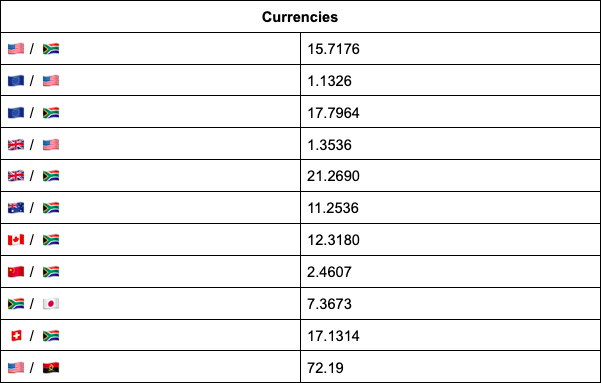

In the currency market, the rand had a one-way ticket stronger against the US dollar, hitting R15.66 in intraday trade before settling at R15.71 at last count from opening at R15.98 – “a wide range of more than 30c”, comments TreasuryONE. “This is significant, and it seems the ZAR’s move is decoupling from the other emerging markets. This appears to be a good opportunity for importers to hedge some of their exposure as we may see some pullback after a hard run by the ZAR today,” says the forex trading house.

Rand hedge Richemont retreated 2.02%.

Among the winners were consumer goods stocks Steinhoff (+9.67%), Spur (+6.15%), PPC (+5.02%) and Foschini (+2.52%).

Indicators as at 17:00

Source: TreasuryONE