(Bloomberg) — Samsung Electronics Co. reported profit for the fourth quarter that missed analysts’ estimates as memory prices remained sluggish due to a cyclical downturn and the company distributed special bonuses to employees.

South Korea’s biggest company posted operating income of 13.8 trillion won ($11.5 billion) for the three months ended December, below the average analyst forecast of 15.2 trillion won. Sales in the period were 76 trillion won. Samsung reported a one-time expense for bonuses it distributed in December and will provide net income and divisional performance when it reports its full earnings later this month.

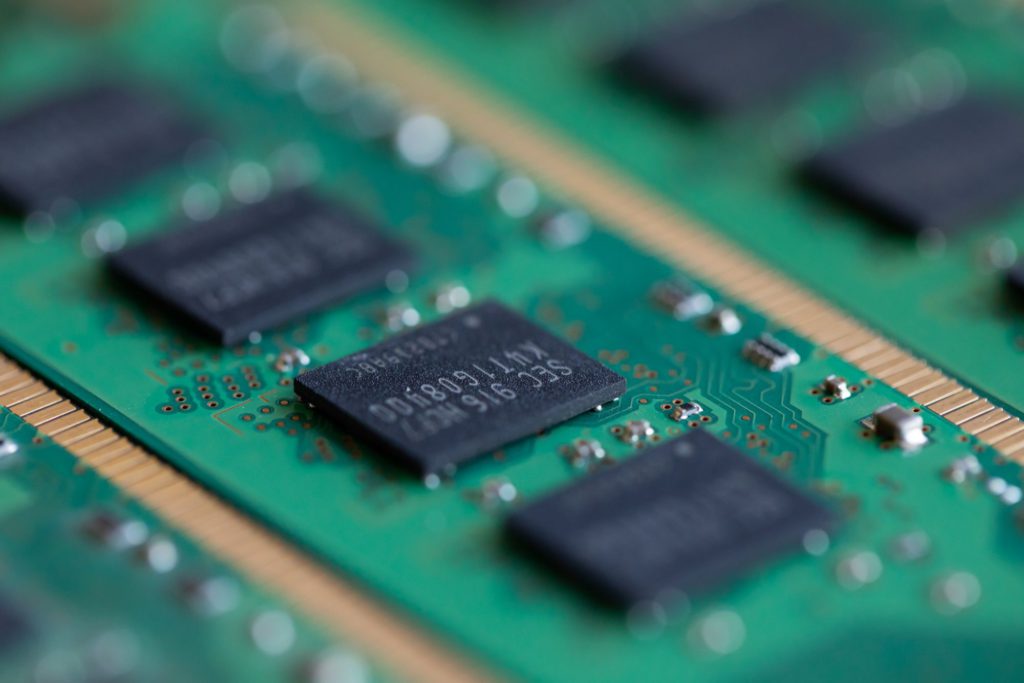

Chipmakers Seek Steady Growth to End Boom-Bust Era

Prices of memory chips started to fall in the latter half of 2021 due to oversupply following a period of inventory stockpiling among Samsung’s customers. DRAM was down about 5% and NAND dropped 3% in the quarter, according to Hanwha Investment & Securities. The downturn, smaller than initially feared, has been ameliorated by a widening array of products needing memory to function. Samsung’s foundry business, fabricating semiconductors for the likes of Nvidia Corp., is also making a growing contribution to its bottom line and was helped by the global chip shortage boosting prices for system chips.

What Bloomberg Intelligence Says

“Operating profit for memory chips may slightly decline sequentially due to weakening chip prices as Micron’s earnings results suggest, yet could rise strongly from a year earlier. Operating profit for the foundry business may increase in 4Q amid chip shortages. Sales of consumer electronics, including its premium TVs, may be strong in the quarter due to the year-end shopping season.”

– Masahiro Wakasugi, BI analyst

Click here for the full research

Analysts had projected the downturn to continue until the first half of this year with double-digit drops for both memory classes. Sentiment changed after China imposed a pandemic lockdown on the city of Xi’an, affecting production for Samsung’s local facility as well as rival Micron Technology Inc. Samsung’s Xi’an plant capacity accounts for approximately 15% of global NAND flash output, according to Hana Financial Investment. The company hasn’t completely shut down the fab but has adjusted operations.

“If NAND flash shipments fall 6% in 1Q and 2% in 2Q due to adjustment in operation rates at the Samsung Xi’an fab, the NAND flash market may not enter an oversupply situation and is likely to keep the supply-demand balance for six months,” Claire Kim, analyst at Hana Financial Investment said in a note.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.