(Bloomberg) — Skeptics who have long fretted about a speculative bubble in shares of hyper-expensive, unprofitable companies are pointing to this week’s blowup in Rivian Automotive Inc. as the latest sign that the air is leaking out fast.

Rivian, a maker of electric pickup trucks, briefly surpassed Volkswagen AG’s market value after its November initial public offering even before registering any meaningful revenue. As of Friday morning in New York, it’s lost 52% from its peak, wiping out about $75 billion in value. Many technology companies that trade at high multiples of expected sales have endured a similar fate: E-commerce company ContextLogic Inc., data analytics company Palantir Technologies Inc. and software maker Appian Corp. have plunged 70% to 80% from their highs.

As the selling has picked up this week on concern that the Federal Reserve will raise interest rates faster than previously expected, profitable mega companies Apple Inc., Google owner Alphabet Inc. and Microsoft Corp. have held up relatively well. They’re down about 5% to 10%, suggesting investors still prefer businesses with steady growth and margins.

“Technology exposures across portfolios are likely being changed to a little less of the most speculative and more of the high-quality technology companies with high stable operating margins,” said Peter Garnry, head of equity strategy at Saxo Bank. While megacaps can pass on rising input costs, bubble stocks that are priced for very high growth and margin improvements are unlikely to deliver on those expectations, he said.

What’s more, two-thirds of the Nasdaq’s 3,600-plus stocks trade below their average price for the past 200 days, an indicator that signals to chart watchers that the index is in a long-term downtrend. High-growth technology stocks make up more than half of the benchmark.

The problem for these high flyers: Higher rates reduce the present value of future earnings. That’s especially a problem for companies like Rivian, where any profits are off in the distance. And expectations were high. Analysts predict that the company will go from effectively no revenue in 2020 to $63 million in 2021, $3.5 billion this year, $8.5 billion in 2023 and $17.2 billion in 2024.

Analysts have been slow to adjust to the quickfire selloff. For instance, two-thirds of those covering Rivian have buy ratings on the stock with price targets north of $130. The company, which went public at $78 a share, dipped below that level Thursday before recovering a bit to close at $87.33. It traded 3.5% lower on Friday to $84.93.

For some, it’s not all downhill from here. Morgan Stanley strategists say the rate-induced selloff in hyper-expensive technology shares has almost run its course, pointing to past episodes where rising Treasury yields sparked similar routs.

Tech Chart of the Day

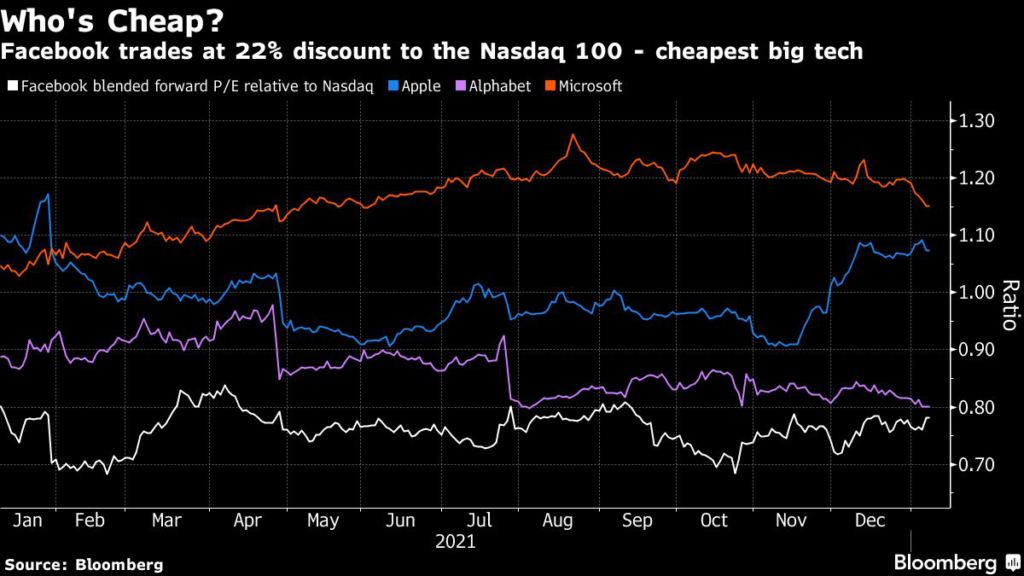

Facebook parent Meta Platforms Inc. has been relatively unscathed in this week’s technology selloff, thanks to its cheap valuation among big tech. While the Nasdaq 100 Index has seen $1 trillion in market value zapped, Meta has fallen about 1%. Facebook is projected to have one of the fastest revenue growth rates among large-cap tech companies in 2022, with an expansion of 19%, according to data compiled by Bloomberg.

Top Tech Stories

- Tech conglomerate SoftBank plans to issue its biggest-ever yen bond in a test of whether individual investors will continue to lap up notes of one of the world’s most indebted firms

- Samsung Electronics’ quarterly profit climbed more than 50% after chip prices stabilized and sales of smartphones surged

- GameStop said it is getting into the business of non-fungible tokens, sending its shares higher in U.S. premarket trading

- Sanofi formed a deal to develop 15 experimental oncology and immunology drugs with “pharmatech” company Exscientia that uses artificial intelligence to make new medicines

- Starling Bank says Meta Platforms needs to get rid of fraudsters from its platform if it wants to win advertising dollars from the bank, which is backed by Goldman Sachs

- STMicroelectronics NV reported fourth-quarter revenue that exceeded the company’s projections as it benefited from robust demand for semiconductors amid short supply

(Updates stock prices throughout)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.