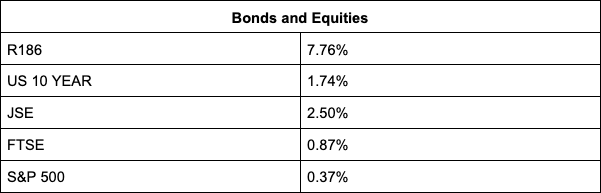

The JSE reached an all-time high of 75,885 points today, up 2.59%, lifted by commodity-linked sectors and tech stocks. The stock exchange took a leap in the early morning trading, following the rise of markets in the US on Tuesday and Asia on Wednesday. This comes after Federal Reserve Chair Jerome Powell’s renomination hearing before the Senate Banking Committee yesterday, where he said the Fed would step in and use required policy tools to bring down inflation.

Early morning EST the Bureau of Labor Statistics’ December Consumer Price Index (CPI) showed prices in the US rose at a 7.0% year-over-year rate at the end of 2021, the fastest increase since 1982 and marked an eighteenth consecutive month of price increases. This was higher than November’s figure of 6.8% but was in line with consensus estimates. Both the S&P 500 and Dow Jones were well in the green in early morning trade, bringing the JSE further upwards.

In general, markets are trembling a bit, afraid the Fed might be too aggressive but were calmed by Jerome Powell’s comment that it will be a process with respect to how long it is going to take.

Today’s winners were Alphamin, a mining company, the share price rising 6.02% following the record production volumes and increase in EBITDA presented yesterday. Heavyweights Naspers and Prosus rose 9.30% and 6.49% respectively following an update of its share repurchase programme.

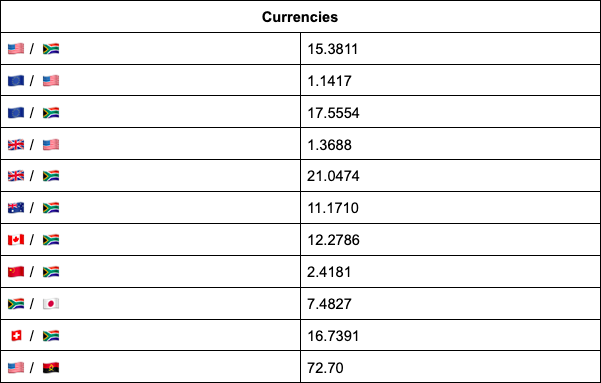

The US dollar weakened as a result of the US inflation figures, with emerging market currencies the big winners of that weakness. The rand is now trading at the R15.40 level after previously having traded as low as R15,37 to the dollar.

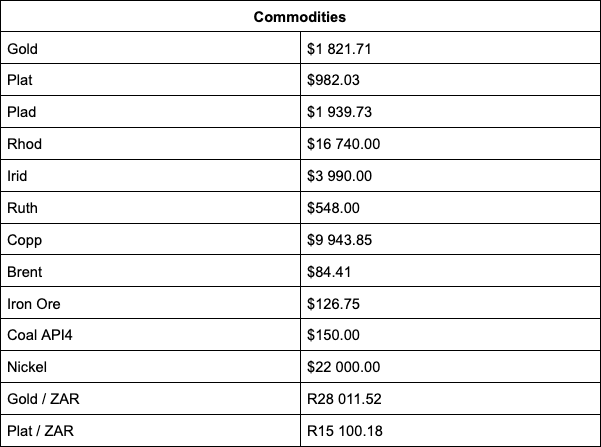

For the same reason, metal prices are trading in the green. Gold is trading at $1,821, platinum at $983 and palladium at $1,931. Brent Crude is currently trading at $84,36 per barrel.

Indicators as at 17:00

Source: TreasuryONE