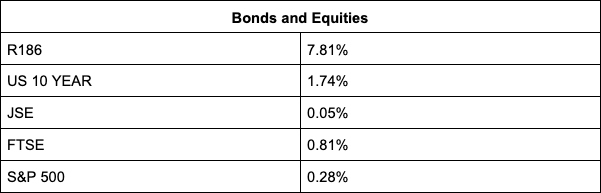

The JSE spent the entirety of the day in the red before a favourable late swing added 0.05% to the All Share Index to cap two consecutive days of positive trade where the bourse closed on 75,926 points.

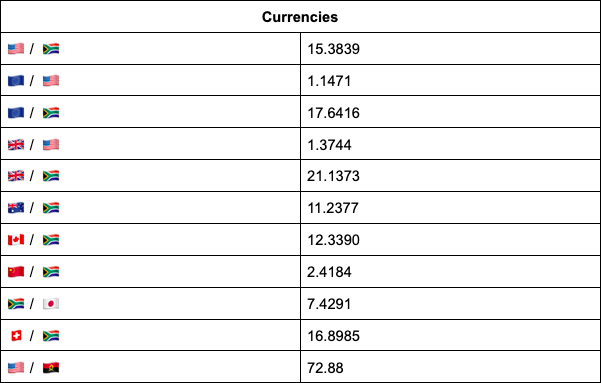

After a hive of activity overnight the rand was trading as low as R15.28/$ but has returned to the mid- R15.30’s level and is currently trading at R15.38 to the dollar.

“While there is little in the way of EM driven sentiment, we did see most of the EM currencies move along with the US dollar.

We have seen the US dollar on the back foot during the day, which helped EM currencies no end, but we get the feeling that the Rand is stretched, and we could see EM currencies correcting in the short term,” comments forex trading house TreasuryONE.

JSE heavyweights Naspers and Prosus saw a 1.34% and 1.08% drop respectively, while both face exposure to Chinese tech company Tencent, which was down 1.16% following share buy backs.

Meanwhile, Bloomberg reports that German food ordering and delivery marketplace Delivery Hero, which Prosus owns a stake in, clinched an eleventh-hour deal on New Year’s Eve for a majority stake in Spanish peer Glovo and it would sell down its holding of Latin-American company Rappi.

Then on Tuesday, Delivery Hero told investors its food-delivery business “would break even within months.”

Steinhoff jumped 7% in morning trade before returning some of its gains to end the day by adding 2.78%.

The retailer performed strongly thanks to a 12% rise in its December quarter sales report from its European subsidiary, Pepco.

Retail peers Pepkor and Lewis added 2.80% and 0.60% while Massmart and Home Choice lost 1.20% and 1.85% respectively.

Mining counter Tharisa lost 1.72% despite the release of their first-quarter production numbers for the 2022 financial year where the company reported its best production quarter to date, setting new records.

Peers South32 and Glencore added 1.55% and 2.57% with Kumba and Anglo American losing 0.02% and 1.10%

Tin producer Alphamin surged 17.69%, marking a second consecutive day of positive trade after its share price rose yesterday as well.

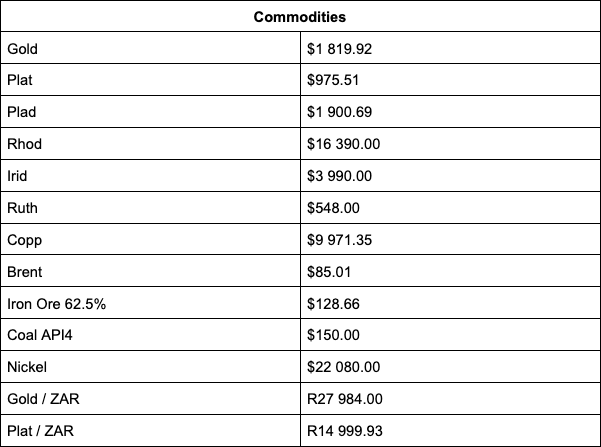

Commodities had a very flat day of trade with most of the metals ending the day slightly in the red.

Gold is trading at $1,819, platinum at $973 and palladium at $1,907. Brent Crude bucked the flat trade trend and traded higher today, currently at $84.84 a barrel.

Indicators as at 17:00

Source: TreasuryONE