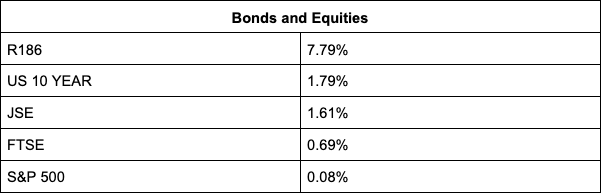

The JSE started the week on the front foot in the absence of trading in the US, with the All Share index adding 0.58% to 75,593.47 points on a strong performance from retail stocks.

Retailers Homechoice (+16.60%), Woolworths (+4.02%), Truworths (+3.77%) and Lewis (+3.01%) were among the top gainers ahead of retail sales data and as investors prepare for company sales updates from the festive period. Luxury goods conglomerate Richemont firmed 3.16%, while Foschini (+3.28%), Mr Price (+2.78%), Pick n Pay (+2.36%) and Massmart (+2.09%) added to the cheer.

Consumer goods and industrial heavyweights British American Tobacco (+4.16%),Bidvest (+1.16%) and Reunert (+2.85%) also added weight, while tech counters Karoooo (+6.67%) and Naspers (+0.47%) helped keep the JSE within reach of its all-time high of 75,925.55 points reached last Thursday.

On the losing end was Bytes Technology, which dipped 5.63% after the company announced CEO Neil Murphy sold half a million shares on the open market on Friday “for his own tax and estate planning purposes”.

Implats weakened 0.49% after the platinum producer issued an offer circular to shareholders of midtier PGMs miner Royal Bafokeng Platinum (-1.23%) proposing to buy all RBPlat shares it does not already hold. Rival Northam ended the day 0.31% firmer.

In other corporate news, Vivo Energy announced that the Financial Surveillance Department of the SA Reserve Bank has approved the buyout offer from Dutch energy giant Vitol and the subsequent cancellation of Vivo’s listing on the JSE. Other energy plays were mixed, with Renergen gaining 3.38% and Montauk losing 1.32%.

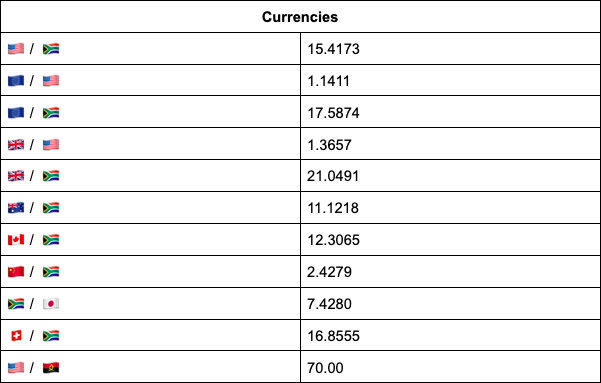

On the forex front, with the US being out of the market celebrating Martin Luther King Day, the rand traded in a narrow 10 cent range for most of the day.“We however saw the rand show a slight bias to the top side, which could be the first sign that the momentum from last week is slowly starting to dissipate. We have seen the rand being the best performing EM currency this year, and generally, after outperforming its peers, the rand reverts to them eventually,” comments TreasuryONE.

The forex trading house reckons we will only get a real sense of the market sentiment tomorrow when the US returns to the fray, with most market players expecting the dollar to make up some of the losses it suffered yesterday. “With little in the way of data or events out this week, sentiment will be the most significant factor in market movements and should be monitored closely,” says TreasuryONE.

The local unit was last trading at R15.39 against the greenback.

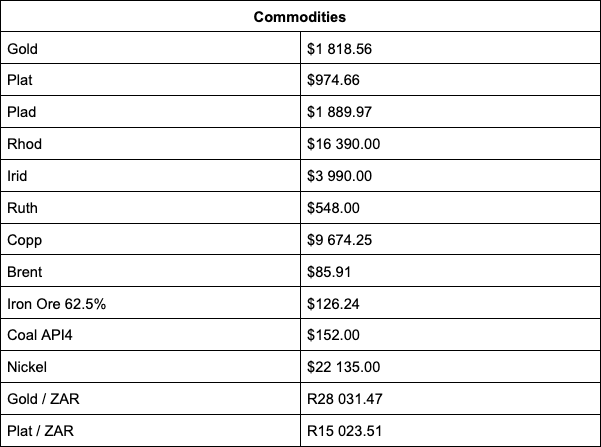

Among commodities, most of the metals ended the day slightly in the green. Gold ended local trade at $1,820, platinum at $977 and palladium at $1,890/oz. Brent crude was flat, last trading at $85.99 a barrel.

Indicators as at 17:00

Source: TreasuryONE