(Bloomberg) — Global fund managers expect inflation — not economic growth — to decline this year, and are placing record bets on a boom in both commodities and stocks, a Bank of America Corp. survey showed.

Net overweight positions in commodities rose to a historical high in January, according to the monthly poll, which surveyed 329 panelists with $1.1 trillion in assets under management. Meanwhile, the spread between overweight positions on stocks and bonds increased to peaks last seen in January 2011, as underweight positions on equities fell to an all-time-low.

The survey results highlight that optimism continues to abound for stocks, despite the Federal Reserve signaling a more aggressive policy tightening to tame surging prices. Instead of luring investors into bonds, the prospect of higher rates has instead triggered a rotation within equity markets from more expensive sectors, such as technology, to cheaper shares that are bound to benefit from a booming economy.

“Global reopening hopes trump Fed hike fears,” BofA strategists led by Michael Hartnett wrote in a note. Market participants are shifting from credit to commodities, from growth to value, and from tech to banks, they said.

The responses are at odds with BofA’s own strategists, who have long argued that a sharp correction in equity markets looms as rates rise and economic growth slows. “We remain stagflationary bears,” the strategists said.

Other highlights of the BofA survey, which took place between Jan. 7 and 13, include:

- Net overweight positions on technology stocks fell to 1%, lowest level since December 2008

- Among the survey’s respondents, only 36% think inflation is permanent, while 56% think it is transitory

- Net allocations to bank stocks rose to 41%, near the record highs reached in October 2017

- Only 7 out of 100 investors believe there will be a recession in the next 12 months

- A net 50% believe value stocks will outperform growth peers

- Investors predict three Fed hikes in 2022, and the highest number since December 2018 expect a flatter yield curve

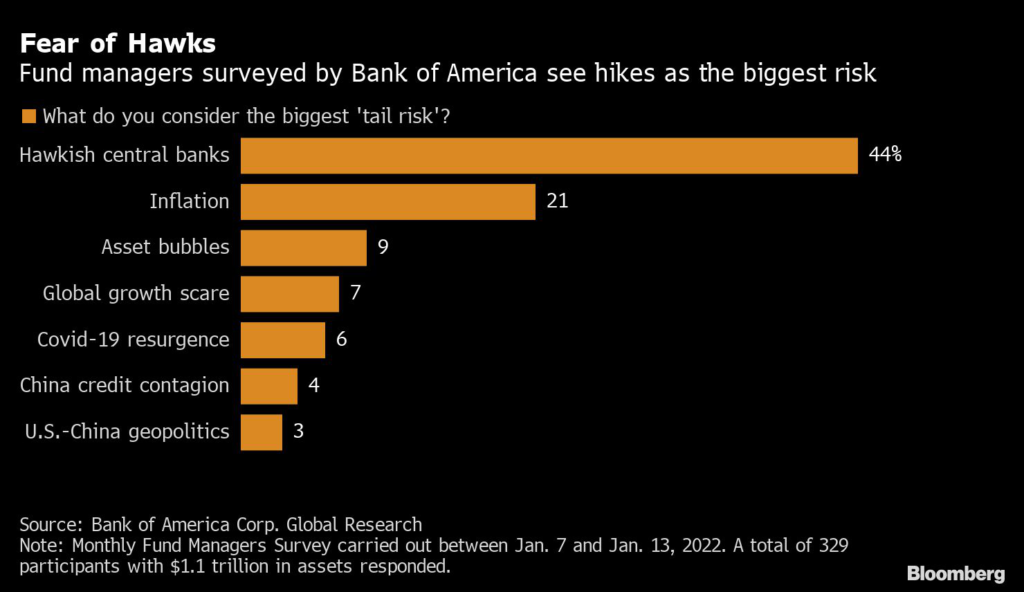

- Biggest tail risks include hawkish central bank rate hikes, followed by inflation, asset bubbles, global growth scare and Covid resurgence

- Most crowded trades include long tech stocks, short U.S. Treasuries, short China stocks, long ESG and long Bitcoin

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.