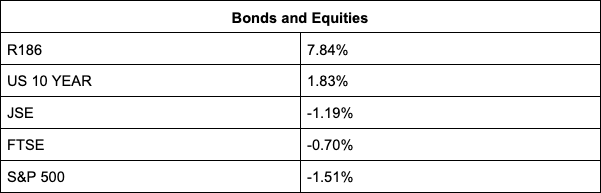

The JSE stumbled 0.84% to 74,955.66 points amid a global tech rout in which heavyweights Naspers and subsidiary Prosus both gave up almost 3.5%, tracking losses in Tencent as investors continue to fret over imminent interest rate hikes and their impact on high-flying tech stocks. The pair has a 29% exposure to the Chinese tech giant.

Losses in Karooo (-0.02%), Datatec (-0.96%) and Allied Electronics added to the gloom, with Bytes Technology (+0.94) bucking the trend.

Banks were all down, with Nedbank (-1.77%), Capitec (-1.31%), Absa (-0.92%), Standard Bank (-0.73%) and FirstRand (-0.20%) all losing ground. Investec gave up 2.90% as it plans to offer its private banking clients funding to install solar panels and battery storage systems in homes, bolstering its own green credentials and providing an alternative power solution to load-shedding prone Eskom.

On the commodity front, Northam (-3.79%), Royal Bafokeng (-2.99%) and Impala Platinum (-2.75%) all took a hit after the midtier takeover target said the only offer it is considering at the moment is Implats’.

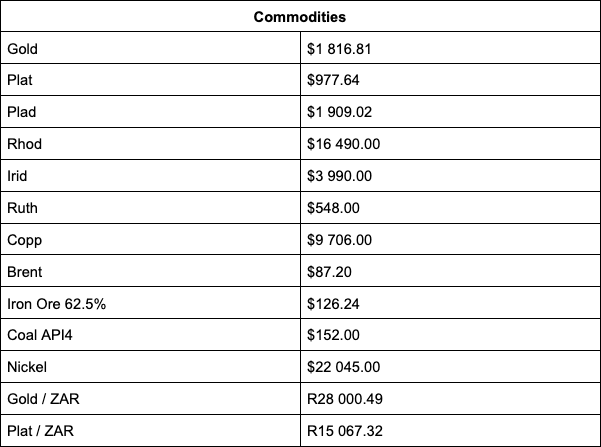

Other mining counters also dipped despite higher precious metal – platinum was last trading 1.13% higher at $987.50 and palladium 1.46% at $1,905.50/oz, while gold (-0.37% at $1,812.80) lost shine amid US rate hike jitters – with Anglogold Ashanti giving up 2.77%, Angloplat 2.75%, DRDGold 2.59% and African Rainbow Minerals 2.47%. Anglogold and Canada’s Corvus Gold announced today that they concluded the deal in which Anglogold acquired the remaining 80.5% of the shares of Corvus it didn’t already own in a deal valued at about $370m.

BHP, which is showing renewed appetite for deals with its biggest rivals in sight, ended the day 0.33% weaker. Bloomberg reports that after sitting dormant for more than a decade, the world’s biggest miner and once mining’s most aggressive dealmaker, is positioning itself for a return to large-scale M&A with its expanded dealmaking team evaluating rivals Freeport-McMoRan and Glencore among others.

Tongaat Hulett weakened 3.47% after the embattled sugar producer and property owner secured enough shareholder support for a controversial multi-billion-rand rights offer, which will involve Zimbabwe’s billionaire Rudland family.

Sappi slumped 3.11%.

On the upside, integrated chemical and energy company Sasol spurted 6.65% as oil boiled over $87 a barrel. Energy peers were mixed, with Montauk gaining 4.67% and Renergen losing 0.48%.

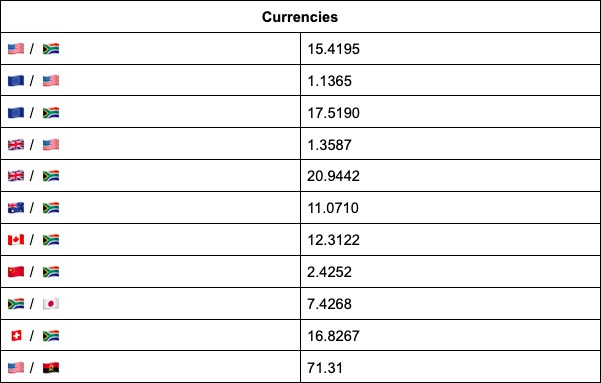

On the forex front, the rand breached the R15.50-level against the US dollar to last trade at R15.52 as the dollar gained ground on the expected increase in inflation and a faster hiking cycle by the Fed. “We still remain the strongest EM since the beginning of the year, with the ruble being the weakest. The focus remains on central bank policy and whether the SARB will hike rates during the January meeting,” comments TreasuryONE.

Indicators as at 17:00

Source: TreasuryONE