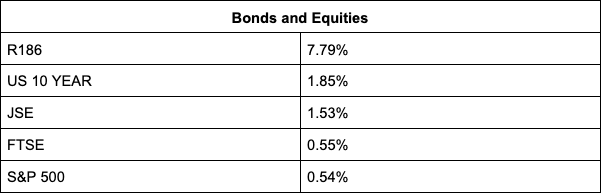

The JSE has set yet another record, the third one since the start of the year, with the All Share Index surging 1.63% to 76,176.15 points as commodities rallied.

Coal counters lead the charge, with Kumba gaining 8.95% as China’s thermal coal futures soared more than 6% amid supply jitters ahead of a national holiday when coal mines typically slow operations or shut down. Thungela Resources, which holds Anglo American’s thermal coal assets in South Africa, gained 1.13%. Anglo American jumped 4.50%.

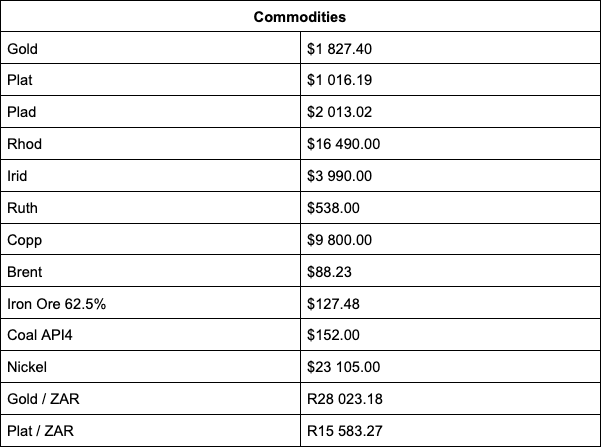

Platinum and palladium also rallied hard, both closing local trade up 5% at $1,015/oz and $2,020/oz respectively. Gold gained 1.35% to last trade at $1,838.31/oz as the US dollar weakened and risk sentiment improved across global equities markets. Bloomberg reports the greenback fell amid an increasingly positive mood, causing gold to edge higher. But bullion remains under pressure from a surge in Treasury yields that’s stirring expectations that the US 10-year value will top 2%.

A March rate hike is expected and will be the first of many increases this year, according to Bloomberg Economics. Locally, a surge in consumer inflation data for December 2021 to 5.9% compared with 5.5% in November and an expected 5.7%, reinforced the case for a hike in interest rates next week.

According to Statistics South Africa, this is the highest annual increase since March 2017, when the rate was 6.1%. On a month-on-month basis, the CPI increased by 0.6% in December.

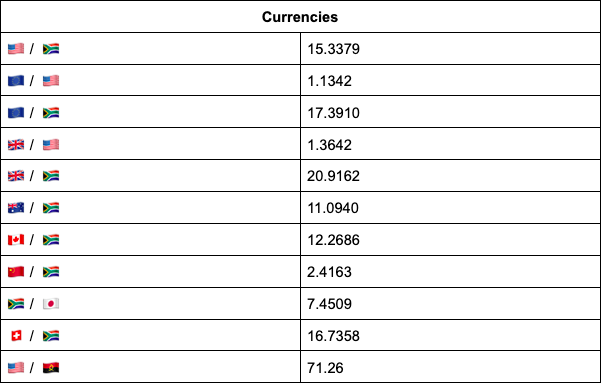

The rand, which opened trade at R15.50 against the US dollar, gained 1.46% to last trade at R15.29 against the greenback on the expectation of a local interest rate increase.

On the international front, “the US dollar has seen quite the surge from the 1.1400 levels of a few days ago and was trading close to 1.1300 earlier this morning. The US dollar is currently trading at 1.1350 against the euro. With the rand under pressure last night when the US dollar started its charge, we have seen the local momentum trump any US dollar moves today,” reports TreasuryONE.

Brent crude gained more than 1% as it headed for $90 a barrel. It was last trading at $88.48. Chemical and energy giant Sasol surged 2.02%. Bloomberg reports that traders are betting now that oil at $100 is no longer a question of when, but if amid surging demand, fading omicron fears and OPEC+’s inability to ramp up output. Since the end of November Brent crude has gained 25%.

Mining companies rallied, with Implats adding 5.84%, Sibanye-stillwater 5.83% and African Rainbow Minerals 5.56%. Glencore gained another 0.88% after the commodities giant hit the highest in almost a decade, driven by rallies in everything from metals to coal and optimism for a years-long supercycle.

Richemont added to the jolly mood, jumping 5.09% after the luxury goods group reported its fastest holiday-season sales growth in at least a decade as consumers splurged on Cartier jewels and Chloe fashion, the latest sign that the luxury-goods market is thriving again.

Among the losers was Old Mutual, losing 2.91% as the financial services company prepares for the continued court battle with former CEO Peter Moyo. He has abandoned his bid to be reinstated but still wants R250m from Old Mutual for contractual “damages”.

Capitec gave up 3.99% on news that a BEE deal may dilute earnings.

Other notable losers were Steinhoff (-5.86%), Aspen Pharmacare (-5.72%), Bytes Technology (-3.88%) and Montauk (-3.79%).

Indicators as at 17:00

Source: TreasuryONE