(Bloomberg) — Retail investors who netted billions in the legendary pandemic bull market are getting schooled on stock volatility at long last, as the rates-fueled rout resumes.

When major major indexes were in free fall Monday, mom and pop offloaded a net $1.5 billion worth of stock by noon, according to data compiled by JPMorgan Chase & Co. strategist Peng Cheng. Yet conditioned by two years of nonstop rewards, these would-be dip buyers then poured $1.3 billion in the final hours as the megacap benchmarks wiped out steep losses.

Now the selloff has resumed with the S&P 500 falling as much as 2.8% in the Tuesday session before paring losses.

With the major indexes in correction territory all of a sudden, the new-year equity whiplash is giving small-time players an old-school lesson on the challenges of day-to-day stock investing.

“The current crop of retail investors came into the markets during a period of QE, zero percent interest rates, and there-is-no-alternative,” said Matthew Tuttle, chief executive officer at Tuttle Capital Management LLC. “In past times you buy the dips, so they keep doing it like Pavlov’s dog because they are trained to buy dips. In this new environment, dips keep dipping and rips are bull traps.”

With the Federal Reserve expected to signal an increase in interest rates after Wednesday’s policy meeting, markets from stocks to bonds are struggling to price the uncertain path of monetary policy going forward.

On Monday, the tech-heavy Nasdaq 100 erased a loss of nearly 5%, marking the biggest reversal since 2001 dot-com bubble burst. That followed two other recent sessions where the index reversed an intraday move of 2%, one on the upside and the other to the downside.

All these whipsawing moves have taken place over a matter of weeks, whereas historically such gyrations materialized over several months, if not years. That’s a challenge for many new investors who were born from the zero-commission trading boom in the depths of the pandemic boredom.

“My concern is that they are not prepared for the market volatility that I think will continue for many months,” said Matt Maley, chief market strategist for Miller Tabak + Co.

Up till late last week, confidence was running high among the retail crowd, who’ve fueled speculative excesses across markets from cryptocurrencies to meme stocks. They’d snapped up about $12 billion of equities in the two weeks through Tuesday, the most on record in JPMorgan data. For now, however, that faith has proved misplaced as both the S&P 500 Index and Nasdaq 100 have lost more than 10% from their recent peaks.

To Nicholas Colas, co-founder of DataTrek Research, the day-trading crowd still remains conspiciously bullish. He notes elevated buying interest Monday in stocks from Tesla Inc. to ProShares UltraPro QQQ (TQQQ), a fund that aims to treble the daily performance of the Nasdaq 100.

“We’ve seen too many times when a quick flush does not sufficiently reset either valuations or risk appetites during periods of rising uncertainty,” Colas wrote in a note. “We remain cautious near term on US/global stocks.”

Strategists like Morgan Stanley’s Mike Wilson warn the worst is not over, citing tighter monetary policy and decelerating growth. At the same time, JPMorgan Chase & Co. strategists led by Marko Kolanovic continued to urge investors to buy the dip. In a note published Monday, Kolanovic said market worries about rates and corporate margins are “overdone.”

While no one can be certain where the market is heading in the months ahead, most agree that heightened equity volatility is likely to stay. And that’s something many newbie traders will have to deal with.

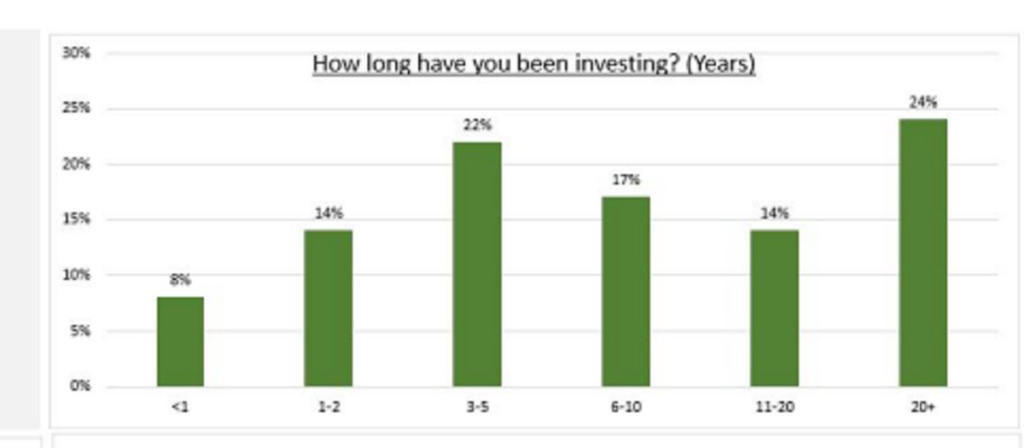

According to a recent survey of global retail investors from eToro, roughly a quarter of the respondents have been investing for two years or less.

“Investing is hard,” said Michael Wang, chief executive officer at Prometheus Alternative Investments. “This generation of retail traders is learning it.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.