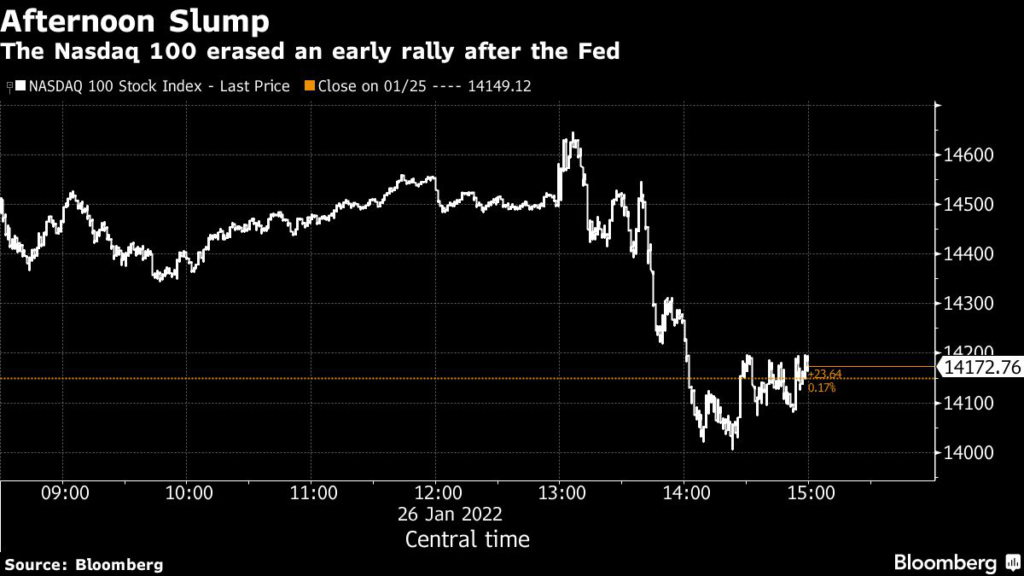

(Bloomberg) — Signals of more rate hikes from Federal Reserve Chairman Jerome Powell derailed a rally in technology stocks on Wednesday — dashing hopes of a reprieve from the worst ever start to the year for the Nasdaq 100 Index.

Powell didn’t rule out moving at every meeting this year to rein in the highest inflation in a generation, a more hawkish stance than what markets were pricing in. The comments wiped out almost all of the 3.5% gain the tech-heavy Nasdaq 100 scaled ahead of his speech. The index ended just 0.2% higher on Wednesday.

Early gains across indexes were driven by strong results by industry bellwethers such as Microsoft Corp. and Texas Instruments Inc. Those moves were seen as a sigh of relief after trillions of dollars got wiped out in January alone.

“The Fed overrules fundamentals, and raising rates is not something that’s market friendly,” said Mark Grant, managing director and chief global strategist at B Riley Securities. He pointed out how some companies may outperform this season solely on earnings, but believes Fed sets the stage for the overall market.

Indeed, more than half of the gains seen in Microsoft and Texas Instruments evaporated in the reversal. Microsoft gained as much as 6.9% before closing up 2.9%, while Texas Instruments closed 2.5% higher. Software bellwether Microsoft’s blowout forecast for its cloud-computing business was seen as strong read-across for the software sector until the market turned post-Fed.

For Matthew Maley, chief market strategist at Miller Tabak + Co., earnings still could be a catalyst for any bounce. Microsoft’s report “was just what the doctor ordered,” providing support to major tech names that were “quite oversold”, he wrote in a note. Apple Inc. is scheduled to report earnings on Thursday.

Microsoft results did support the worst-hit software names that lost more than 50% from their top in the recent rout: Datadog Inc. gained 1.8% and Crowdstrike Holdings Inc. rose 1.1%. Texas Instruments meanwhile boosted chipmakers, with Nvidia Corp. and Broadcom Inc., rising more than 2%.

What’s more, a technical indicator is flashing a a sign of excessive selling and a potential contrarian buy signal. Nasdaq 100’s measure of momentum, called relative strength, registered its lowest reading since October 2018 — a sign of intense bearishness.

(Updates throughout, adds detail from Fed comments)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.