The JSE ended a volatile week in which investors had to navigate soaring inflation, mounting geopolitical tensions and a hawkish US Federal Reserve flat after breaching the 74,000-point level only for the second time this week. The All Share index was down 0.07% at 73,454.96 points at the end of the trading session.

Mining stocks extended their losses as “the strong dollar and risk-off theme continued to take a toll on commodity prices”, remarks TreasuryONE. Gold dulled a further 0.7% to last trade at $1,784.70/oz as a more hawkish-than-expected US Federal Reserve sent investors fleeing to dollars and wiping out all the yellow metal’s gains so far this year.

Palladium and platinum plunged 2.04% and 2.78% to last trade at $2,327.60 and $998.50 respectively.

Tin producer Alphamin extended its rout by another drop of 10.21%, while PGMs Angloplat (-5.01%), African Rainbow Minerals (-3.42%), Implats (-2.83%) and Northam (-2.78%) all bled.

Gold counters Sibanye-Stillwater (-4.59%), South32 (-4.43%) and Harmony (-3.69%) also weighed. BHP bucked the trend, gaining 0.22%.

Adding to the gloom, technology services group EOH Holdings tanked 17.41% after warning it may go to shareholders to raise cash.

On the upside, Brent Crude’s spurt above $91 a barrel boosted Sasol’s share price by 1.45%.

Steinhoff soared 8.52% after the embattled furniture retailer said in its annual report that higher sales, an expanded store footprint and the easing of Covid-19 restrictions contributed to a 14% increase in revenue across its operations for the year ending 30 September 2021. Shoprite was up 2.92% on its solid sales growth of 10% to R91bn.

Also supporting the JSE were mobile operators, with MTN gaining 3.65%, Vodacom 2.28% and Telkom 2.18%.On the forex front, the rand was firmly on the back foot, last trading at R15.63 against the US dollar after touching R15.10 earlier in the week. “With the Fed being the highlight of the week, the MPC took somewhat of a back seat,” says TreasuryONE, adding that the MPC’s slightly dovish commentary did leave the rand vulnerable.

“The reaction could not purely be attributed to the MPC but also a corrective pattern unfolding after the rand traded as strong as 6% versus the dollar since the start of the year. For now, we remain buyers of the dollar below R15.30, while exports should look to add towards their longer-term hedges above R15.75,” adds the forex trading house.

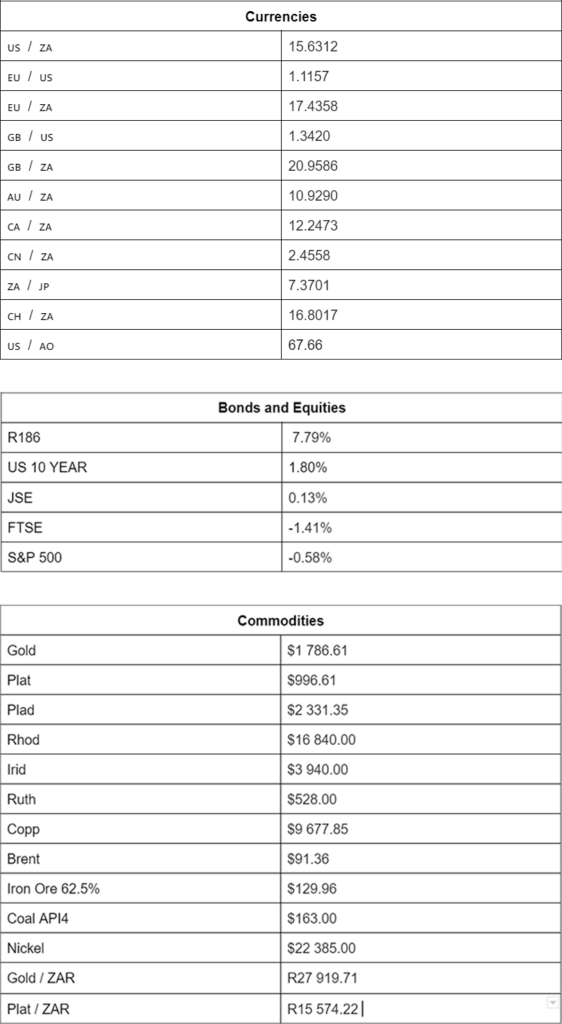

Indicators as at 17:00.

Source: TreasuryONE