The JSE started February off on a firm footing, adding to its 0.81% gain in January as risk-on sentiment returned following relaxed local Covid-19 regulations, US Federal Reserve officials playing down the prospects of aggressive interest rate hikes very soon and a slew of positive corporate news.

The gains were broad based, with Alphamin soaring 9.47% after the producer of 4% of the world’s mined tin from its high-grade operation in the Democratic Republic of Congo, announced positive drill results from its Bisie Tin Complex.

Combined Motor Holdings jumped 7.23% after announcing it expects headline earnings per share (HEPS), the main profit gauge in South Africa, to increase by between 70% and 90% for the year to end-February 2022 compared to the previous comparable period.

Aspen Pharmacare added 4.73% after the drugmaker said it expects interim profits for the half year to end-December 2021 to be up to 38% higher than the previous comparable period.

Anglogold Ashanti gained 1.80% despite a profit warning in which the group said earnings were hit by among others lower gold sales volumes, higher operating costs and unfavourable foreign exchange movements.

In turn, industrial equipment firm Hudaco said it expects HEPS for the year to end-November 2021 to be between 1600 cents and 1680c, representing an increase of between 52% and 60% on the previous year’s earnings.

Other top-value gainers propping up the bourse were Naspers (+1.91%), Prosus (+0.37%), Anglo American (+0.88%), Sasol (+2.24%) and Richemont (+3.04%).

All the banks were up bar Absa (-0.43%), with Capitec (+2.32%) leading the gains. FNB parent FirstRand added 0.52%, Standard Bank 0.39% and Nedbank 1.28%.

On the downside, Implats lost 2.99% after the platinum producer warned that several production issues including extended safety stoppages, intermittent industrial action and power supply interruptions, weighed on output in the six months to end-December.

Vodacom lost 1.26% despite the mobile operator increasing quarterly revenue by 6.4% to R26.7bn on solid growth in its financial and digital services across its markets.

Steinhoff slumped 5.36%.

On the forex front, the rand “broke below the low we saw overnight and has since tested R15.21 a couple of times”, comments TreasuryONE.

“The R15.36-level we saw overnight is smack bang on the 100-day moving average, and we saw a sharp move lower once it broke below this morning. The risk-on theme and a weaker dollar are the most probable causes for the sharp reaction we saw over the past two days, as we corrected 55cents from Friday’s high. Emerging Markets across the globe are all following a similar pattern as the dollar retraced back to levels seen before the FOMC last week.”

Commodities were mostly green, with gold trading back above $1,800 an ounce, while palladium and platinum both gained around 1% at the end of the local market session. Brent Crude continued its slide to close the local trading session at $88.45 a barrel.

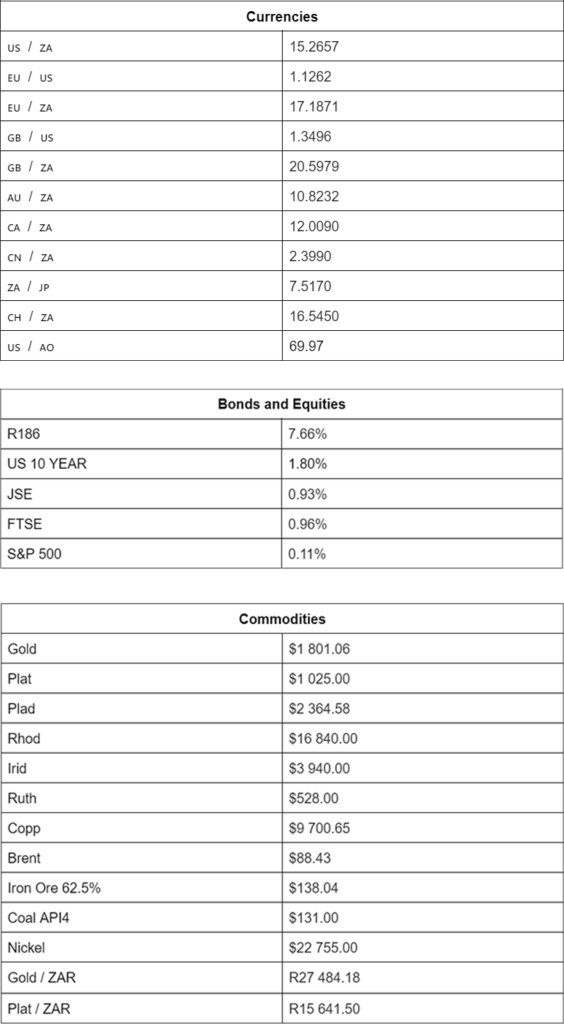

Indicators as at 17:00.

Source: TreasuryONE