(Bloomberg) — Wall Street favorite Amazon.com Inc. could be the next technology giant to flag that pandemic-era growth is fading, but the stock’s sideway travel for many months is likely to lessen any post-earnings blow.

PayPal Holdings Inc. and Netflix Inc. are among the online companies warning in recent days that their businesses are cooling off because economies have reopened. The slowdown sent their shares plunging, denting hopes for a recovery in high-growth stocks after the Federal Reserve tightening shocks.

Amazon also saw a boom in business from people who were cooped up during lockdowns, a trend that’s taken a U-turn as less-severe Covid-19 infections led to people going back to in-store shopping. There’s one other headache: being one the largest U.S. employers, it has been facing pressures from wage inflation and shortage of labor.

Still, analysts haven’t budged. All 59 of them covering the stock stamp a buy on it, making it one of the most highly rated in the S&P 500. With Amazon shares down about 5% on Thursday after Meta Platforms’ earnings flop, the average price target implies a 44% gain from current levels. While the shares have bounced around as the market has swung, they’re trading now at about the same level as mid-July 2020.

For some, like Ross Sandler, an analyst at Barclays Plc, the underperformance is part of the attraction.

“With most of the street braced for another guide-down, we think Amazon shares are poised for a bounce,” he wrote in a research note. “We expect the tone to turn more upbeat and aggressive.”

Indeed, Amazon shares have fallen 14% in the past year compared to an 18% gain in the S&P 500 Index. The stock has become cheaper too, at 42 times estimated earnings versus the 2020 high of 70 times.

Given rising labor costs, Wall Street is projecting earnings per share to contract 73% for the December quarter. Concerns about higher costs have crept into 2022 profit estimates, too, with analysts steadily cutting projections for the first three months of the year. The average estimate has slipped to $9.09 a share from about $10.50 over the past month, according to data compiled by Bloomberg.

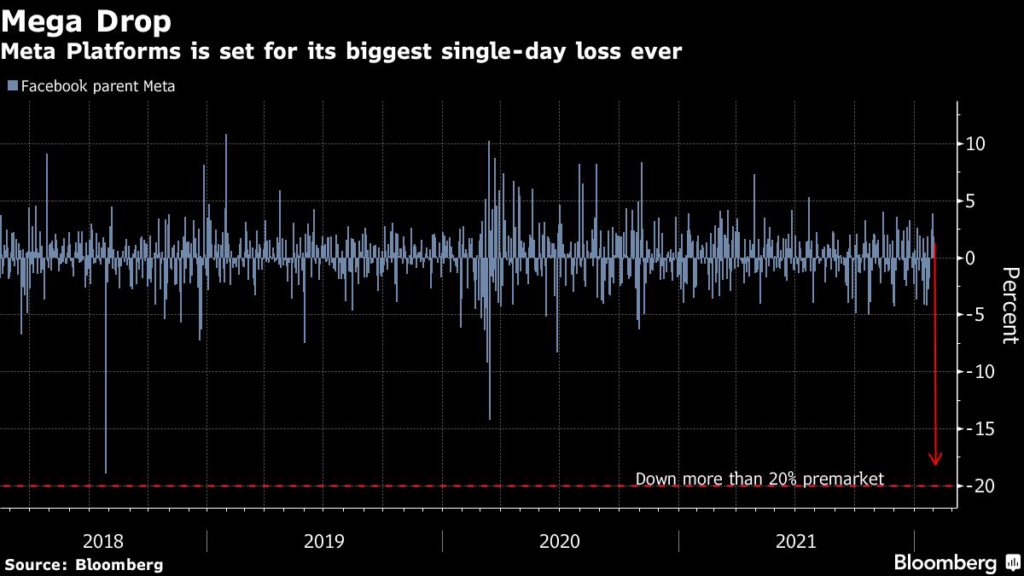

Tech Chart of the Day

Facebook parent Meta Platforms Inc. is set to shed about $200 billion in market value, in what would be one of the biggest one-day wipeouts in market value for any company on record. The stock is taking a hit after the company’s forecast for the first quarter missed estimates amid stagnating user growth and increasing competition from TikTok.

Top Tech Stories

- Spotify slumped after disclosing a slowdown in its growth to start the year. The company said it would end the first quarter with 418 million total users and 183 million paid subscribers, shy of Wall Street forecasts

- Nintendo cut its Switch sales outlook for the second quarter in a row as console makers grapple with a chronic chip shortage that is likely to continue this year

- Qualcomm, the biggest maker of chips that run smartphones, slipped after efforts to expand beyond its main business were hampered by shortages in the latest quarter

- Sony fell 6.1% Thursday in Tokyo after cutting its PlayStation 5 sales forecast and announcing weaker-than-expected results from its gaming division over the holiday period

- Apple had its strongest quarter for iPhone sales in India yet, a sign the Cupertino, Calif.-based company is finally making progress in the world’s fastest-growing smartphone market

(Updates share performance throughout.)

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.