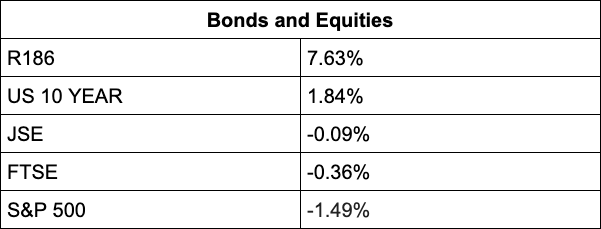

The JSE failed to add to its three consecutive day streak of gains and closed 0.22% down with the All Share Index at 75,022 points.

Pepkor gained 2.07% on the back of news that the retailer would purchase an 87% stake in Brazilian-based clothing retailer Grupo Avenida. The deal comes after a two-year due diligence process and is expected to be concluded tomorrow. Avenida’s preliminary turnover for the financial year ending December 31, 2021 amounted to R2.2 billion while Pepkor’s performance for the year ended September 30, 2021 surpassed its pre-Covid-19 levels.

Pepkor’s parent company Steinhoff cheered the announcement adding 0.22% to its share price.

Retail peers Truworths (1.71%), Foschini (1.69%), and Massart (0.09%) added to the cheer while Woolworths (-1.11%), Lewis (-0.64%) and Mr Price (-0.87%) all lost.

Datatec lost 0.18% with Tiger Brands chief financial officer, Deepa Sita announced as a new board member set to join the IT firm’s board on March 1.

DRDGold lost 1.06% after it said in an update on Thursday that company revenue fell 16% to R2.5 billion for the six months to the end of December 2021 (for subscribers).

Gold counting peers Gold Fields (-2.25%) and AngloGold Ashanti (-1.91%) also ended the day in the red with Sibanye Stillwater (0.29%) bucking the trend.

Anglo American added 0.09%.

On the back of news that Glencore will build a new plant to recycle lithium-ion batteries in the UK, the mining counter added 0.94%

Mining counters Kumba and Alphamin added 1.47% and 0.56% respectively.

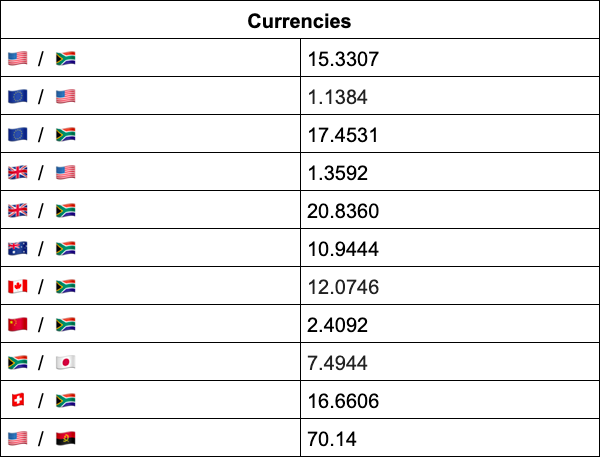

On the currency front, the Rand failed to break the R15.40/$ level in morning trade and is currently trading at R15.33 to the Dollar. “We do feel that the current situation with load shedding and SOE’s have hamstrung the Rand in gaining further on the US dollar. Most of the Rand’s EM peers have strengthened against the US dollar today,” comments forex trading house TreasuryONE.

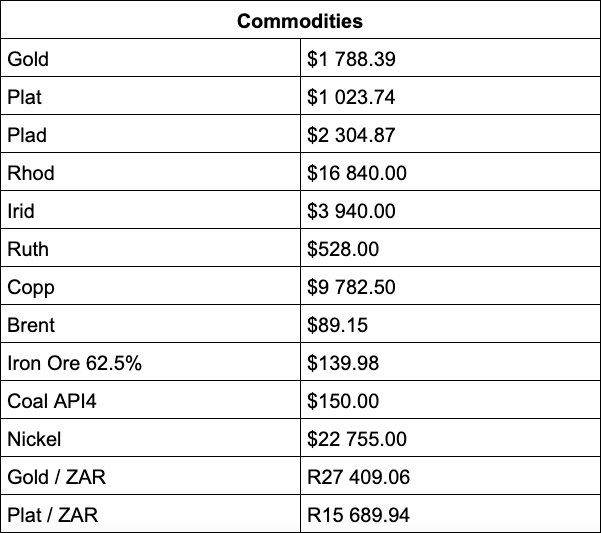

In commodities, Gold is trading at $ 1,801, while Platinum is trading at $ 1,029 and Palladium at $ 2,374. Brent Crude has held below $ 90 per barrel and is currently trading at $ 88.90.

Indicators as at 17:00

Source: TreasuryONE