(Bloomberg) — While investors focus on the recent rebound in big tech stocks like Apple Inc. and Amazon.com Inc., shares of smaller technology companies remain in a deep hole.

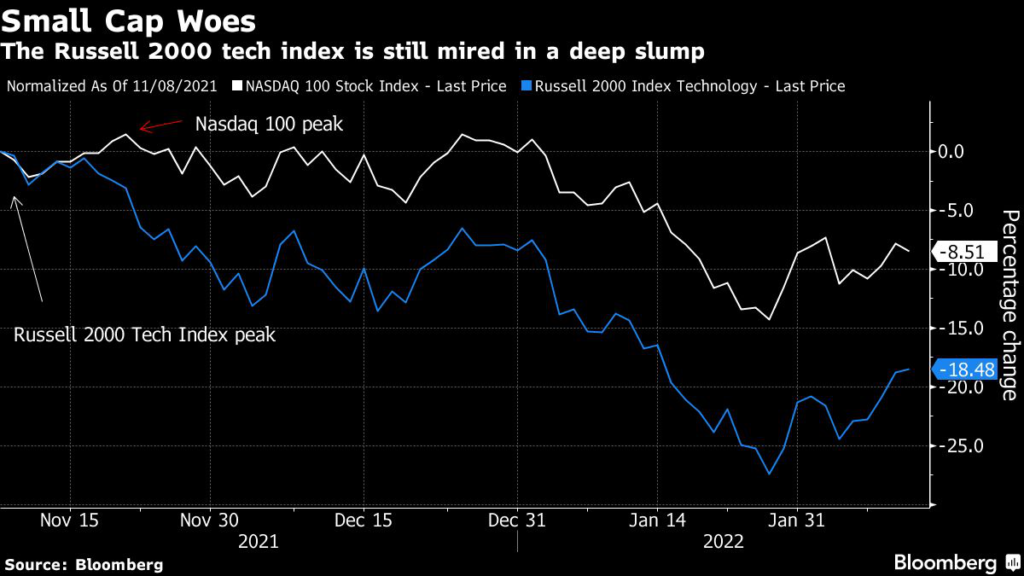

The Russell 2000 Technology Index is down 19% from a November record, compared with a drop of almost 11% for the Nasdaq 100 Stock Index from its own peak 11 days later.

Some software makers, like Asana Inc., run by Facebook co-founder Dustin Moskovitz, are down more than 50% from their all-time highs.

The threat of higher interest rates is taking a huge toll on smaller companies, many of which are barely profitable, because it reduces the current value of cash flows anticipated down the road.

And then there’s the prospect of higher borrowing costs. With the Federal Reserve expected to raise interest rates next month for the first time in more than three years, investment professionals see plenty of reasons to avoid the group.

“Some of these newer companies that don’t have much profits, we don’t know if they’re going to make it through the storm,” said Daniel Morgan, senior portfolio manager with Synovus Trust Co.

“I’m putting money on companies that have proven results.”

Despite the selloff, valuations in the Russell 2000 Tech Index remain elevated. At 2.3 times sales projected over the next 12 months, the benchmark is priced nearly 50% above its average over the past 10 years, according to data compiled by Bloomberg.

Meanwhile, some of the biggest technology companies are headed in the opposite direction as they recover much of the losses from last month. Apple has rallied to within 5% of a record after delivering quarterly profits and revenues that beat Wall Street estimates.

And Google-parent Alphabet Inc. is down just 6.4% from a November record.

The tech sector’s flight to quality is creating an increasingly narrow group of winners, according to Steve Sosnick, chief strategist at Interactive Brokers.

“Investors are becoming more discerning in terms of wanting actual earnings and cash flow, they’re less willing to invest in hype alone,” he said in an interview.

“This is why you’re seeing people clamor into Apple, Alphabet and Amazon. You can actually point to big numbers on their income statements.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.